Stop — If You’re Scrambling To Buy Bitcoin Now, You’re Making a Huge Mistake.

You’re excited about the price increase when we might not be out of the woods yet.

Photo by Niklas Hamann on Unsplash

Bitcoin is back in the news.

And those of you on the side-lines for the last year are jumping on the bandwagon again.

You’re probably looking at the recent increase in the price of Bitcoin and thinking about investing.

Who wouldn’t want to take advantage?

Before deciding to invest in Bitcoin, I want to share some thoughts about why it might not be the best idea to invest right now.

Unless you’re Dollar Cost Averaging into BTC without a care in the world, you should exercise extreme caution buying now.

First, there’s the potential for sticky inflation to come back.

You may have heard of this before, but if you haven’t, sticky inflation is when prices don’t immediately adjust to economic changes.

Like an increase in interest rates.

So, even though the economy may recover, prices may not adjust immediately. And when prices don’t change, it can lead to further inflation.

It could harm the value of Bitcoin and other cryptocurrencies.

Now, famous investor Michael Burry made nearly a Billion Dollars accurately predicting the 2008 mortgage crisis by shorting the stock market.

Investors thought he had lost his mind at the time, and many tried to pull their funds out because they thought his predictions were beyond ridiculous.

His decision to short the 2008 stock market proved correct and made a $700 million profit for investors who stuck with him.

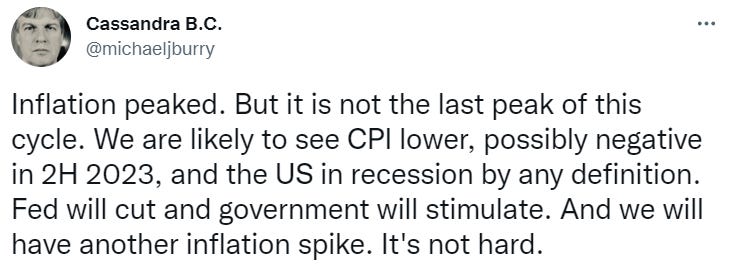

Burry now says that the positive report around inflation and the recent recovery in the market is here to trick us.

In simple terms, governments increase interest rates when there is high inflation to bring down the cost of everything. As a result, you see large sell-offs in speculative investments like tech stocks and cryptocurrencies.

Burry says we’re headed for a period of stagflation when the economy is stagnant and prices are rising. He says that inflation will come down, causing the government to stimulate the economy, but it will almost certainly come back.

Even though things may be improving on the surface, there’s a lot of underlying uncertainty and risk in the market.

Burry indicates that inflation can spike unexpectedly.

He believes it’s the nature of inflation to come and go, and when it comes back, it will catch people off guard, and neither the President nor the Federal Reserve will take credit.

Michael Burry — Source

“Inflation appears in spikes.

When the spike resolves, it won’t be because of Biden or Powell.It will be because that is the essence, the nature of inflation.

It resolves, fools people and then comes back.

When it comes back, neither the POTUS nor the Fed will take credit.”

Burry believes the recent recovery of hype and speculation is luring everyday retail investors.

He predicted that the value of cryptocurrency would fall by trillions of dollars, which was probably an easy prediction to make given its volatility.

He says all the hype and speculation are just drawing in retail investors before a big crash happens. He also warns that when cryptocurrency falls from its trillion market cap or other stocks fall from tens of billions; the losses will affect the size of countries.

He also mentions that history repeats itself.

Michael Burry — Source

“All hype/speculation is doing is drawing in retail before the mother of all crashes.

When crypto falls from trillions, or meme stocks fall from tens of billions, #MainStreet losses will affect countries’ size.

History ain’t changed.”

Raoul Pal

Pal, a macro investor who uses clever historical references to predict future events, has a slightly different view from Burry and believes that according to his forward-looking indicators, you can expect to see the bottom of this economic growth cycle soon, around March 2023.

He predicts that there will be a recovery period of around 18 months to 2 years if the bottom comes, but we’re already a year into a recession which started at the beginning of 2022.

He also states that the economy is in a mess globally, which everyone can see.

Raoul Pal — Source

“My forward-looking indicator suggests that the bottom of this growth shot comes pretty soon, like March 2023, so if the bottom comes, you get the recovery side.

So it ends up being about 18 months or two years because we probably started some recession at the beginning of this year. The economy is in a mess on a global scale.”

Final Thoughts.

Many opinions are floating around the internet about Bitcoin and its value.

It’s important to note that not all opinions hold the same weight.

Michael Burry and Raoul Pal are both well-respected figures in the financial world, but they have different perspectives on cryptocurrency.

Burry, a famous short seller, is sceptical about Bitcoin’s value. On the other hand, Pal is a proponent of emerging technologies and is fully invested in the cryptocurrency market.

Michael Burry believes success comes from thinking independently rather than getting caught up in the hype.

He’s chosen not to invest in cryptocurrencies like Bitcoin based on these views.

How you invest is up to you.

If you believe in Bitcoin’s long-term potential, short-term news and price changes should not affect your investment decision.

A smart strategy would be to use dollar cost averaging, which means investing a fixed amount of money at regular intervals regardless of the price.

It can help to smooth out the impact of price fluctuations over time and help you focus on the long-term potential of your investment.