The Costly Mistake Crypto Investors Keep Making (And How to Dodge It).

It starts by looking for actual signals.

The old truism goes: if everyone has the same idea, it’s probably not a great one.

Right now, a lot of folks in crypto are laser-focused on exit strategies.

I get it—many were burned last cycle. Who wouldn’t be cautious after buying high, selling low, and round-tripping NFTs? Been there, done that.

I once watched $1.4 million in NFTs shrink to a measly $20,000 as Ethereum dropped by 60% and NFTs tanked by 90%. Oh, and I was left with a nasty tax bill to rub salt in the wound. Good times.

So yeah, I see why people are positioning themselves for an early exit this time around. But here’s the thing: if you’re selling assets for money you don’t need, you might be prematurely cashing out of the fastest-growing asset class in the world.

The real risk isn’t being stuck with the proverbial “hot potato” that is crypto—it’s missing the entire trade.

This is why the age-old advice, “only invest what you can afford to lose,” is more than just a cliché. It’s genius. Not because it’s safe, but because it naturally extends your time horizon. Suddenly, you’re not sweating the daily volatility—you’re thinking big picture.

And right now, the big picture couldn’t be clearer. Financial conditions are improving. Interest rates are set to come down. Oh, and we’ll soon have the first-ever crypto-friendly president talking about buying up a ludicrous amount of Bitcoin.

So let’s zoom out for a moment.

The last thing you want is the double whammy of round-tripping the last cycle and selling too early this cycle—only to watch the “god candle” take off without you.

It’s a costly mistake.

One powerful lead indicator could reveal everything.

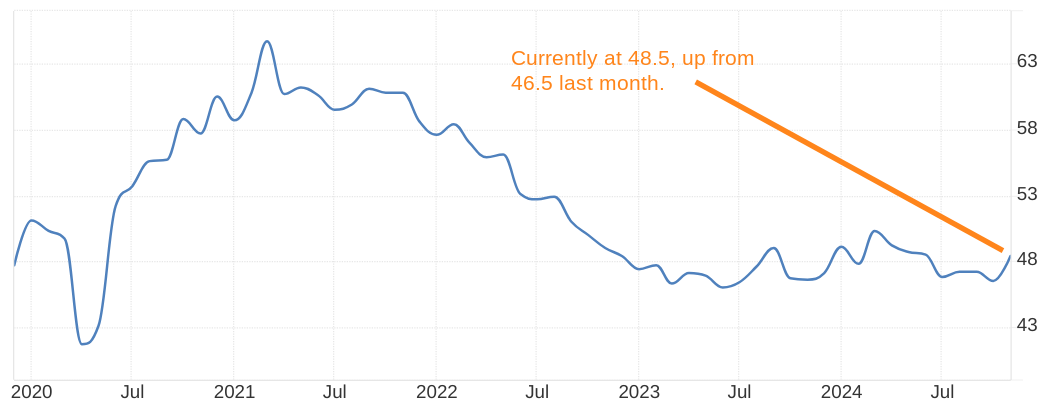

Here’s where it gets interesting: the lead economic indicator, the ISM, is starting to trend up.

If you’re not familiar, ISM stands for the Institute for Supply Management.

It’s basically a survey sent to 50,000 operations managers across the U.S., asking them about things like new orders, old stock, imports, exports, and hiring plans. In short, it gauges productivity, which impacts corporate profits, stock prices, and eventually spills into risk on assets like crypto.

The ISM has nailed the last 14 recessions whenever the score dipped below 43. It’s sharp, like a surgeon’s scalpel. But the real trick isn’t where the ISM is now—it’s where it’s headed.

This metric doesn’t do much sideways movement. It either trends down in a bear market or shoots straight up in a bull market.

Right now, it’s on the move—just under 50 but climbing upward and the highest it’s been in months. And when productivity ticks up, corporate profits follow, stock prices rise, and eventually, that liquidity trickles into speculative assets like crypto.

One meeting that could redefine everything.

Last month, Fed Chair Jerome Powell sounded optimistic about hitting the 2% inflation target.

At the same time, he admitted that high interest rates have been tough on the job market. Rates sat at 5.25% to 5.5% for over a year until the Fed finally began cutting them in September.

In November, Powell spoke to the Fed balancing act:

“We know that reducing policy restraint too quickly could hinder progress on inflation. At the same time, reducing policy restraint too slowly could unduly weaken economic activity and employment.”

So, what does this mean for crypto investors?

Financial conditions are improving. The Fed is likely to keep reducing rates, and business conditions, as signalled by the ISM, are on the upswing.

Productivity is ticking up—a clear sign that the broader economy is stabilising.

This is all fancy babble for ‘number go up’ much higher, and now is NOT the time to think about selling.

Crypto is hyper-sensitive to global liquidity.

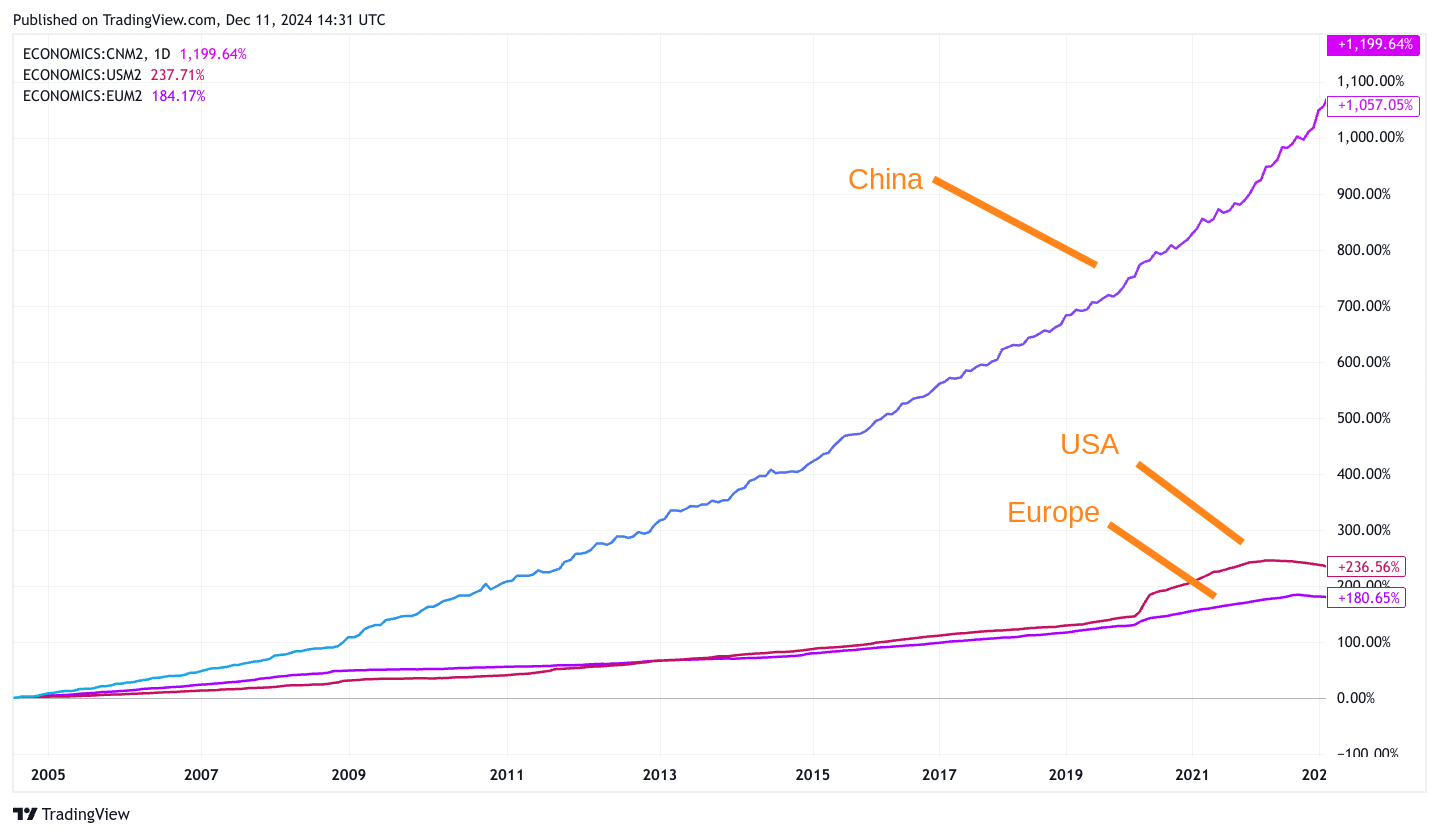

Something that was a significant “aha” moment for me: the entire crypto market moves with Bitcoin, which is 98% correlated with the global M2 money supply.

Here’s a chart of the M2 money supply with an 11-week lead on the price of Bitcoin which it almost mirrors.

So, the effects of the injection of capital are still to come.

China has sent their money printer into overdrive, and the US is yet to start their stimulus cycle because interest rates are still very high, so it’s unlikely they will refinance the national debt at 5%.

Europe, well, they copy and paste what happens in the US.

More stimulus will come into the system, and we know that crypto and asset prices will rise optically.

The critical reason why money printing is inevitable.

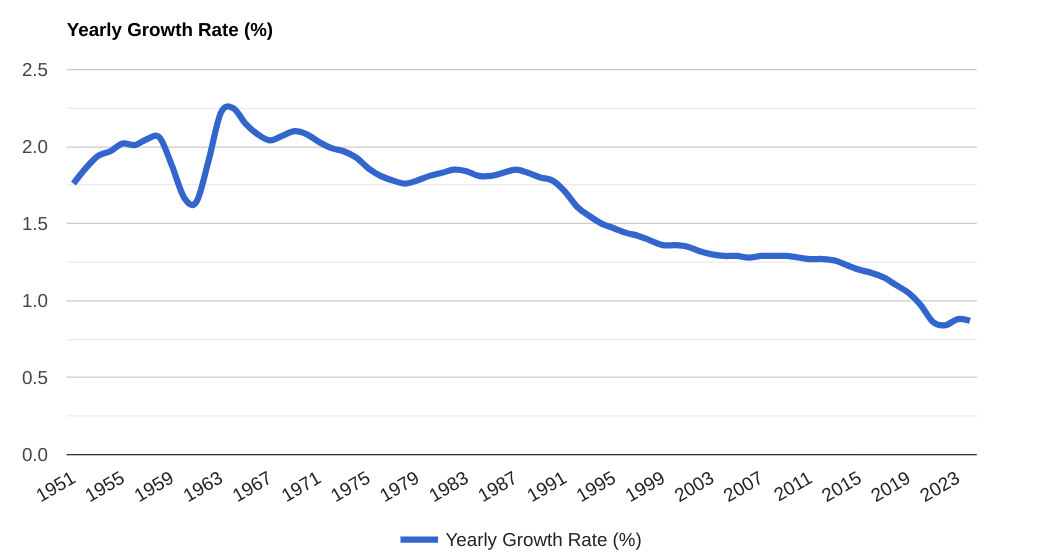

I’m not an economist, but it helps to understand why we’re stuck in a reinforced debt cycle.

A lot of people like to blame governments for reckless spending—and sure, there’s truth to that. But the bigger culprit? Demographics.

We’re living longer, becoming less productive, and seeing shrinking populations in many parts of the world. Combine that with overspending, and you’ve got a recipe for a debt cycle that’s tough to break. Governments are forced to compensate for GDP losses by piling on more debt.

Here’s the kicker: central banks will keep printing money to keep the system afloat. Why? Because they can’t afford for 85 million baby boomers to see their pensions wiped out. Imagine the fallout—it’s just not an option.

But this relentless money printing quietly debases currencies by about 8% a year. If you’re not paying attention, it’s easy to miss how quickly the value of your money is eroding.

The silver lining? If you’re holding assets, they’ll keep rising—at least optically—because of the flood of liquidity entering the system.

In a world of endless printing, the right assets become your lifeboat.

Final Thoughts.

My advice to anyone invested in crypto? Zoom out.

Seriously, stop obsessing over the daily price charts—it’s a surefire way to lose your mind and make costly mistakes.

Instead, look at the bigger picture.

If I may borrow some buzzwords: think macroeconomic trends. They’ll give you a much clearer sense of where things are headed. This is how you avoid making emotional, knee-jerk decisions that hurt you in the long run.

Crypto is wild—day-to-day volatility can mess with your emotions like a bad reality TV show. And honestly, I can spot the over-leveraged folks from a mile away. It’s mostly because I was one at one point.

The giveaway is the way they talk, the panic in their tone, or the desperation in their posts—it's like they're screaming, “Please, let me out!”

Don’t play that game. It’s a losing battle.

Instead, stick to a simple strategy: buy strong assets—any of the top four cryptos—and hold until the end of the cycle.

It starts with understanding the bigger framework. More money is about to pour into the system than we’ve ever seen before. What does that mean? Asset prices are set to climb to levels we can’t even imagine.

The signs are already here. The ISM is trending up, signalling improving business conditions. The Fed is gearing up to lower interest rates. And global liquidity? It’s on the rise.

Put it all together, and the path forward for crypto looks clear. The direction is up—not just a little, but much higher and maybe for even longer than most expect.

Yes, it will be volatile.

Scan out and enjoy the ride.