The Cryptocurrency Market Is About To Hit a Sweet Spot Where Increased Liquidity and Adoption Collide (Raoul Pal)

Your Crypto will propel like a beach ball held underwater. It’s the most significant opportunity you’ll ever get.

Ahoy there, you magnificent bunch.

I thought I’d post my usual Thursday blog today to test the open rate. We’re enjoying our last few summer days in the UK; I'm just about to head off for my usual morning stroll and coffee.

I loved writing this piece and hope it brings value to your Cryptocurrency journey.

Can you imagine how utterly boring it would have been to discuss the economy 15 years ago?

If that were your topic of bar conversation, it would’ve been enough to put your friends into a coma.

Now, the Crypto revolution is tokenising culture. People are learning more about liquidity cycles, monetary policies like interest rate increases and general issues like inflation impacting the economy. Folks have some skin in the game, and they’ve cottoned on that it pays to know what’s happening.

Heck, ordinary people online have become full-blown economists ready to take down the Fed with a pitchfork.

Cryptocurrency bull Raoul Pal is making one big bet and an enormous claim. He says you have a unique opportunity to front-run professional investors with deep pockets for the first time. You can sense they’re coming and trying to get in like a horde of zombies beating down the door.

If you’re an ambitious person seeking to amass significant wealth, this is the ultimate opportunity you can’t afford to miss.

Pal, a boundary-pushing macroeconomic expert, believes this is the first time in investing history that everyday investors like you and me can front-run institutions by riding the crypto wave and making enormous gains.

He says blockchain offers a superior financial system destined to attract institutions. Now, with BlackRock, Fidelity, and Charles Schwab entering the cryptocurrency arena with their ETF applications, Raul’s instincts have proven 100% correct.

For everyday investors, it’ll come down to who can hold their breath the longest.

Who can block out the noise of regulation

Who can get in before the institutions

Who can stomach the volatility

Raoul Pal — Source

“Institutions can not invest yet, so you get the first chance to front-run them because you know they’re coming, but they’re not in yet.

If you’re young, this is going to be the biggest opportunity you’ve got, and it’s going to suck in millions of people, and it has.

Coinbase’s monthly active users are nine million people, far larger than Interactive Brokers, Schwab, and Fidelity, because people can buy a fractionalised part of a Bitcoin. They can’t do that with Berkshire Hathaway.

Bitcoin also has higher returns, making up for the lost time and the inability to gain other assets (house buying).

It’s been extraordinary. I read a paper yesterday about what’s happened with crypto wealth in America and how for these younger people, it’s been the thing that’s allowed them to get on the property ladder.

Younger people, through Crypto, have found a way to buy houses and venture into the stock market after, by diversifying.

The Bitcoin life raft not only saves the future financial system but also preserves your purchasing power from debasement, providing a chance to generate real wealth on a scale that was once only possible for our parents.”

When Liquidity Changes, Everything Changes

The Federal Reserve has increased interest rates faster than ever to tackle inflation, and Pal believes “higher rates are a bullsh*t story that the Fed has sold. It’s a massive red herring and a false narrative.”

The Fed increases interest rates to control the economy. They try to slow down borrowing and spending by raising interest rates, which can help keep inflation in check.

The increase in interest rates directly impacts the crypto market. When interest rates increase, people revert to investing in traditional assets like bonds or savings accounts that offer higher returns and are more attractive. It diverts money away from the crypto market, which impacts prices. In addition, higher interest rates make borrowing money more expensive, reducing speculative investing in cryptocurrencies.

Pal says what counts is the rate of change in rates, not just their actual level. So, even if rates stay at 5%-6%, it’s inaccurate to believe that growth stocks or Crypto will suffer endlessly “because life doesn’t work that way”.

Companies like Google, which have very little debt, aren’t bothered about the capital cost, and people investing in these companies don’t either, so they’ll continue to grow.

Pal makes an insightful claim when he says it’s a clear sign Cryptocurrency prices will increase because they mirror the business and the liquidity cycle. As soon as liquidity returns to the market, we’ll likely see a Cryptocurrency rally.

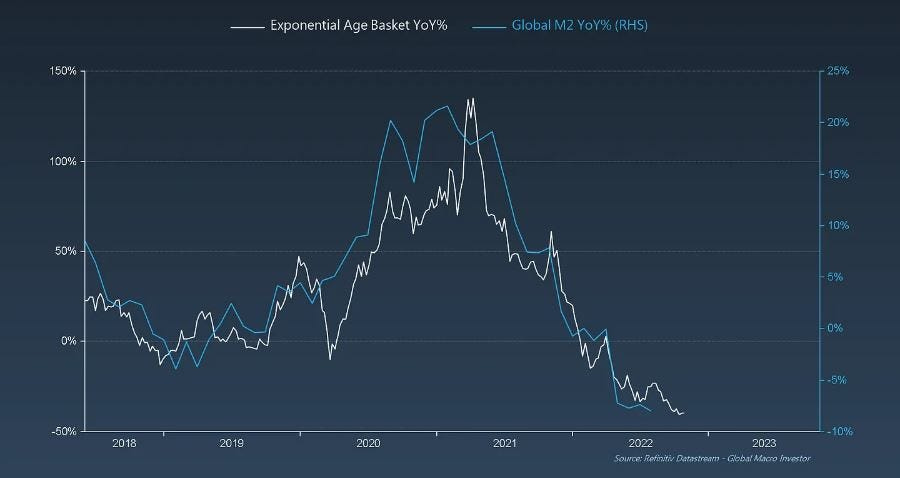

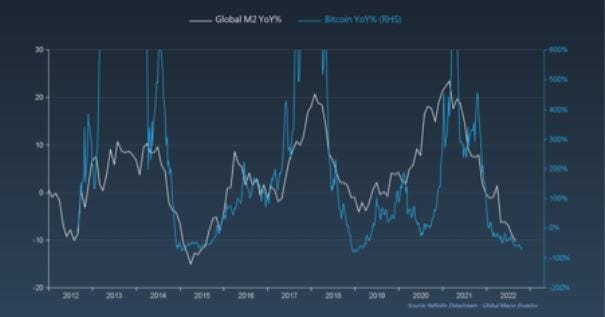

He says Crypto, liquidity and the stock market mirror each other and uses the chart below as an example.

The M2 money supply is used below as a broad indicator of money in circulation. It refers to all the money readily available for people and businesses to buy things and make transactions. It includes cash (like coins and paper money) and money in checking accounts, savings accounts, and other deposits you can easily access.

Raoul Pal measures money supply against the stock market, and it’s identical (first chart, on the left).

He also measures Bitcoin against the M2 money supply, and it’s also very similar, so it shows you how the market responds to liquidity and the business cycle.

You’re Squandering Capital if You’re Not Allocating It to Crypto

Pal says once you grasp this concept, your willingness to take risks may shift.

If you “re-base” all assets, i.e. adjust or recalculate the value of all investments like stocks based on removing the Fed’s borrowing, it makes clear what the best-performing assets are.

When you understand that assets have only increased optically because of borrowing, he says it challenges your views on risk and diversification.

For him, he’s irresponsibly long on his one big bet.

Raoul Pal — Source

“When I re-based all assets by the FED balance sheet, the only two assets that outperformed it were Crypto and tech. Crypto was soaring 10x faster than tech, making it the one big bet.

It’s the same thesis I had in 2012–13, but now is the real-time to get involved. So, I’m now ultra big picture, ultra-concentrated, without using leverage.

Typically, you want to build a diversified portfolio and be careful. But I have an income stream and a savings pool. Then, there’s this once-in-a-lifetime opportunity. So, I just stopped investing in almost anything else.

Monetary printing and debasing the currency meant, optically, assets rose.

My understanding of the risk I wanted to take changed because I realised this was a supermassive black hole, the best-performing asset the world had ever seen (Cryptocurrency).

Due to the unique properties of Metcalfe’s Law and adoption models, it was likely to remain so. Everything else looked inferior, and any other allocation would be sub-optimal.”

Final Thoughts.

We’re about to hit a sweet spot with Cryptocurrency once the Fed pivots on interest rate hikes. So you’d think.

We also have a potential recession ahead of us, which Crypto has never experienced. But we’ve seen positive early signs of a rally amidst the cascade of bank failures.

Pal believes the Cryptocurrency markets have already priced in a recession because they forward look by 6 to 9 months.

Data shows that people who have owned Bitcoin for over six months make up 71% of all the Bitcoin available to buy and sell.

Despite five significant drops in the value of more than 75% since it started in 2009, Bitcoin has still given positive average returns over three, four, and five years every time liquidity has returned to the market.

The adoption of Cryptocurrency is slowly grinding up.

Once liquidity returns, it’ll be like a beach ball no longer held underwater.