The Hidden Crypto Flywheel That Could Power 2025’s Best Trade.

Very few are spotting this play.

This is something I never do.

I just released a paid post to my members…and now I’m immediately unlocking it for all subscribers.

Why? Because the opportunity is too big not to share.

Whether you upgrade or not is up to you. But make sure you read this blog, this one is shaping up to be a serious play.

In Carrot Lane’s Founders group, we spotted it early and that early edge has already been valuable.

There are many more of these opportunities coming.

Enjoy the blog!

Today’s piece is on a new token called Punk Strategy (PNKSTR).

I don’t usually share early-stage assets, primarily due to my own PTSD from the previous cycles, but my goodness, this looks like an interesting play.

I’m also making a more concerted effort to appeal to my broader reader base, who are less passive and more engaged in the space, to help them explore opportunities like this.

Yes, I still love NFTs. And yes, I still think SUI is going to the moon.

Before we get into the meat and potatoes of this, I want to be clear: I’m viewing this as a fun play and a learning opportunity. I’m not rotating anything out of my core positions.

In the short term, it could have an astronomical upside due to its close ties to the iconic CryptoPunks NFT project. PNKSTR is gaining early momentum, and the buy—sell—burn mechanism appears to be sustaining attention.

You’ve heard me say many times that sustained attention usually leads to buying flows, and right now, that’s exactly what’s happening.

PNKSTR is deflationary, a real crowd-pleaser in the Crypto Space, all while tying performance to a high-status NFT asset.

That said, there are risks here.

I’ve allocated $3,000 to this. That’s well over my fixed rule of $250 for guesswork plays, but this feels a little less like guessing. There are some clear signals that this could be incredible—but also things worth considering.

Adam Lizek, in his early 20s and a software developer (better known on X as @Rhynotic), is the founder of Punk Strategy (PNKSTR).

He describes it as a “bet” on renting appreciating assets:

“It’s like renting a car. These punks aren’t going to be in the protocol forever, but it’s like you’re renting it and it’s appreciating. That’s the bet.”

Launched a month ago via TokenWorks, a platform for on-chain financial experiments, PNKSTR utilises trading fees to purchase floor CryptoPunks NFTs, relist them at a premium, and burn tokens with the proceeds, in an attempt to create long-term value for holders.

The idea is simple:

10% of every $PNKSTR trade goes into the protocol (minus a 2% rake).

Once the pool is large enough, the machine buys a floor punk.

That Punk is listed at 1.2x the purchase price.

When it sells, the ETH is used to buy and burn $PNKSTR (Initiating another fee).

Read that twice if you need to—or watch this explainer video to help it sink in.

The mission is straightforward: flip punks for a profit, use the proceeds to buy and continually burn PNKSTR tokens, which fuels the deflationary flywheel.

So far, the protocol has purchased 12 CryptoPunks and has become the fastest-growing CryptoPunk NFT wallet. The PNKSTR market cap is now at $47 million, up from $12 million just over a week ago, when I first shared it in my Founders group.

It’s early. It’s experimental. But it’s damn interesting, especially if you’ve been watching the NFT space.

Or as one notable collector commented:

NFTStrategy by @token_works makes NFTs more investable while also respecting the collector and the founding team. I think this will be the largest liquidity onboarding event for NFTs since 22, and there couldn’t be a better team behind it.

Buckle up and let’s dive in.

The added element that feeds PNKSTR.

It’s other NFT projects, not just Crypto Punks.

PNKSTR was built to democratise access to high-value NFTs. Running on a self-sustaining flywheel that uses trading fees to buy, flip, and burn tokens. Again, the idea is simple: push the CryptoPunks floor higher while giving holders long-term value.

It tackles the big pain points in NFTs: illiquidity, high entry costs, and the lack of passive exposure for everyday investors.

A fork was inevitable, so instead of waiting for that mess, the team built a way for anyone to launch their own version, which remains permissionless and safe for buyers.

The best part? Every new launch pumps strength back into $PNKSTR while giving value to project creators and artists who’ve been squeezed out of royalties.

How it works:

Every ERC721 NFT collection can have a single NFTStrategy token deployed for it (1:1).

Fees from trades accumulate, buy NFTs from that collection, and relist them at 1.2 times the original price.

When the NFT sells, all the ETH is used to buy and burn that NFTStrategy token.

Rinse and repeat—forever.

Fee breakdown:

$PNKSTR currently has a 10% trading fee: 8% goes to the NFT accumulation pool, 1% to TokenWorks supporters, and 1% to the team.

NFTStrategy tokens stick to 10%, but the split is different: 8% to the NFT accumulation pool, 1% back to the collection owner as royalties, and 1% used to buy and burn $PNKSTR.

How to launch:

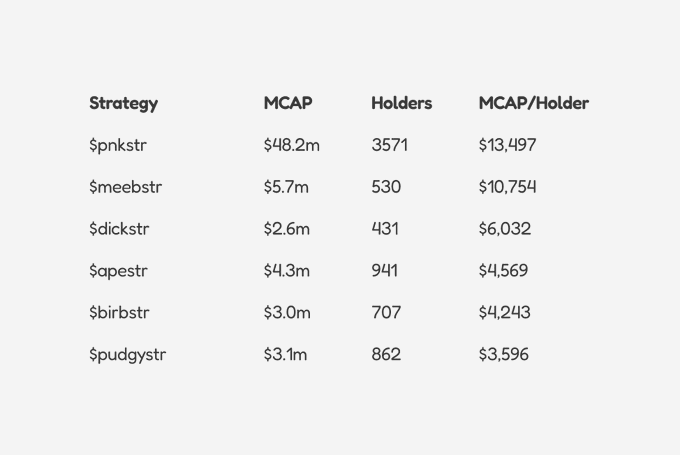

There will be three phases. First, TokenWorks is launching five NFTStrategy tokens on Day 1: $APESTR (Bored Apes), $PUDGYSTR (Pudgy Penguins), $DICKSTR (Dickbutts), $BIRBSTR (Moonbirds), and $MEEBSTR (Meebits).

After that, deployments are open to NFT collection owners.

Finally, deployments open to anyone, for a fee.

Fair launch:

Each token starts at a $50k market cap, with all tokens added to the initial LP.

For public launches, the deployer also gets 1% of the token supply included in the deploy fee.

To keep snipers away, buy fees start at 95% and drop by 1% per minute until they settle at 10%.

What could possibly go wrong?

The mechanism is clever, but the risks aren’t obvious at first glance.

The reliance on CryptoPunks as the core asset (which, by the way, I believe in) is both a strength and a weakness.

Punks are iconic, no doubt about it. They consistently outperform Bitcoin in certain periods and are seen as the reserve asset of the NFT space. But the market for Punks isn’t infinitely liquid.

Most non-Crypto folks don’t even know what they are. Let alone an NFT.

If the broader NFT market softens, or a large holder decides to offload a significant number of Punks, it could depress prices and disrupt the entire model, with Punks being listed and not selling well above the floor price.

Web 3 product designer and CryptoPunks NFT collector Foogy spoke to this:

“Imagine this scenario: the NFT floor keeps sliding for months, the token chops up and down, and the strategy reserve ends up sitting on 600+ NFTs. But no one wants to buy the token or the NFTs. The outcome? Either (a) the NFTs get so cheap that buyers jump back in and restart the flywheel 💥, or (b) people finally realise the collection never had any real cultural value—so the bot hoovers them all up 😂.”

He believes a floor price drop would reignite the flywheel by encouraging more Punks to be bought until it recovers.

The flip side is if PNKSTR’s market cap climbs high enough that people stop seeing upside, the whole thing could stall. The 4-D chess part? When people sell their PNKSTR, the fee kicks in. And that fee buys more NFTs. Lol.

So, about that 10% fee on trades.

On the one hand, it's exciting because it funds purchases, but the double-edged sword is the friction it creates for traders. (I’ll explain in the next section.)

We’ve already seen this play out with NFT collections. People refused to pay the 10% royalty imposed by projects until marketplaces removed trading fees altogether. Obviously, with PNKSTR, the fee is baked into the contract and not at the marketplace level, but you get my drift.

The friction can deter participation, especially when there are other ways to gain exposure to Punks, like fractional ownership platforms.

These “experiments” or perpetual buy-and-burn models only work if interest holds over time, which is why the novelty phase is the best time to get in and maybe take profits on the way up. Plenty of people on the timeline would disagree and say this is just the beginning. The recurring flywheel also means there’s no single news event or cliff that can crash the token.

One early investor commented:

“Never touched coins, but I bought $PNKSTR when it was at a 500k market cap, and now it’s at 37M. I’ve studied the fundamentals and believe in Rhynotic, who has created a completely new genius model. I believe we are still extremely early.”

I have never seen anything like this, ever.

Team execution is critical here.

These models live and die by their smart contract design and governance. If there’s a bug, if the team isn’t competent, or if funds are lost through an exploit, trust erodes quickly.

The poker lesson that could predict what happens next.

The high 10% fee for buying, selling, and swapping PNKSTR is a double-edged sword.

On one hand, it feeds the perpetual machine. But as market cap grows, it could also choke off active trading.

Think of it like the rake in poker. The house takes a slice of every pot, which doesn’t change the cards you’re dealt but eats into the winnings. Over time, that grind makes certain hands unprofitable, even if the odds look good on paper.

Crypto plays out the same way. A 10% fee can make smaller, frequent trades less viable, slowly draining the incentive for active participation.

It brings me back to my earlier example, where NFT marketplaces had to slash project royalties to nearly zero because people stopped trading or moved to more lucrative platforms.

Higher costs reduce effective returns, and fewer winners mean fewer players at the table.

I might be wrong. I’m also willing to squeeze the juice out on the way up, so let’s watch it play out.

Final Thoughts.

I love this project.

It’s beyond fascinating. And I ask myself: if I find it interesting enough to check the website every day to see what Punk has been swept next or how much ETH has been accumulated on this recurring loop, then plenty of other people will too.

As founder, Adam Lizek says:

“It’s like everything is good news. If the price is up, that’s great. If the price is down, the percentage to buy the next punk is up. So it’s always tons of dopamine.”

That attention isn’t fleeting. It feels sustained, and most importantly, it’s goddamn fun.

There are only 3,800 PNKSTR holders, fewer than the number of people holding CryptoPunks NFTs. For context:

Pepe: 490,000 holders

SPX6900 (ETH): 47,218 holders

Giga (SOL): 82,456 holders

I know those are cheap shots at random meme coins, but they show just how far this could go. Or crash horrendously.

Currently, with the floor at 46 ETH and a relisting price of around 55 ETH (a 1.2x premium), whales and significant funds can still bulk sweep the floor tokens with that marginal markup. And without blinking an eye.

As one NFT collector explained:

“Can’t stop thinking about this… what happens if a fund sweeps $10M–$30M worth of CryptoPunks? 👀

• $10M clears ~50 floor punks → PunkStrategy sales fire → ~$1.2M ETH into $PNKSTR buys + burns → supply shock, maybe +30–50% move

• $20M sweep = $3–4M of ETH buying + burning → floor jumps into 55–60 ETH → token could double

• $30M sweep = all PunkStrategy punks in play → $5M+ ETH flows into burns → full reflexive loop unlockedIt’s not just token price—it’s the cascade: floor rises → PunkStrategy sells → ETH converts to $PNKSTR → tokens burned → more eyes → next cycle feeds itself. 🧹🧹🧹

Or maybe nothing happens. Idk. But it’s fun as hell to think about. Thanks @token_works.”

The real test comes if, for example, Punks hit 100 ETH.

Suddenly, the relist price is 120 ETH, and I can’t see many paying that premium for a floor Punk.

If people dump PNKSTR, though, it generates more fees, buys more Punks, and restarts the flywheel.

This takes me back to when I first got into crypto, and it was about the fun of the discovery. But let’s be real for a second, this isn’t core portfolio stuff. I’ve only put a small slice of my holdings into this “experiment”.

Over the next 12 months, I expect the value of CryptoPunks NFTs to climb, which makes the timing of this release particularly fascinating.

Scalability is another question.

Most people outside of the space couldn’t name an NFT project, let alone CryptoPunks. The new projects that TokenWorks has rolled out are seeing some intense price action. Those projects don’t carry the same cultural weight as Punks, even if their market caps are rising in the short term.

Here is a snapshot of the NFT strategies.

There’s a wild theory that this one protocol could kick off an entire NFT bull run.

Every NFT project dreams of a perpetual buyer, and if that happens, all eyes turn to PNKSTR as if it’s a deflationary Death Star money glitch.

I’m pumped—but fully aware this could also blow up spectacularly. Expect volatility. However, have fun with it and use it for learning purposes.

And only ever use money you can afford to lose entirely.

If this blog provided you with value, please feel free to share it with a family member or friend. It's how Carrot Lane grows. It would mean a lot.