The “Market Too Hot” Lie That’s Keeping You Poor in Crypto.

The usual red flags of an overheated economy just aren’t here.

Today’s blog is made possible by paying subscribers who support Carrot Lane for a small fee. If my writing has brought you value, consider showing your support by upgrading—so I can keep creating more of it. Enjoy today’s post.

I read a blog today that nearly made me gag.

The headline read: “The Crash I See Coming: Why I’ve Liquidated My Portfolio.”

One of the perks of being a writer is that it forces you to see the gap between people’s perceptions and what is reality.

Whenever I read one of these not-so-hot takes, I always stop and ask: Why does this person think this way? What’s driving their conclusion before I even bother to digest the content?

A lot of it is political theatre. But the main culprit of this doomsday porn being peddled right now is nothing more than PTSD from the last cycle.

People are terrified of “round-tripping” or being caught “holding the bag”. So they end up doing weird stuff, like panic selling with the idea of buying back in when “prices are much lower”.

Hello, knock, knock. Did you miss it? We just crawled out of the most savage bear market in crypto history.

After being mistreated worse than a homeless veteran, cryptocurrency is rapidly gaining social acceptance as a store of value in our digital-first world.

So I say quit trying to out-trade what could be the most significant opportunity of our lifetime.

As Peter Lynch said best:

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

The worse it looks, the better it usually is.

The logic is upside down.

Weak data, like a softening job market, doesn’t always mean disaster. It’s because it often leads to the Fed rushing in with the fire hose (money printer) before the economy catches fire.

Fed chair Jerome Powell has acknowledged that the US economy is struggling with rising prices and slowing job growth.

He said recently:

"Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated."

So instead of waiting for the economy to get nuked, the Fed tend to step in much earlier with the band-aid of lowering interest rates.

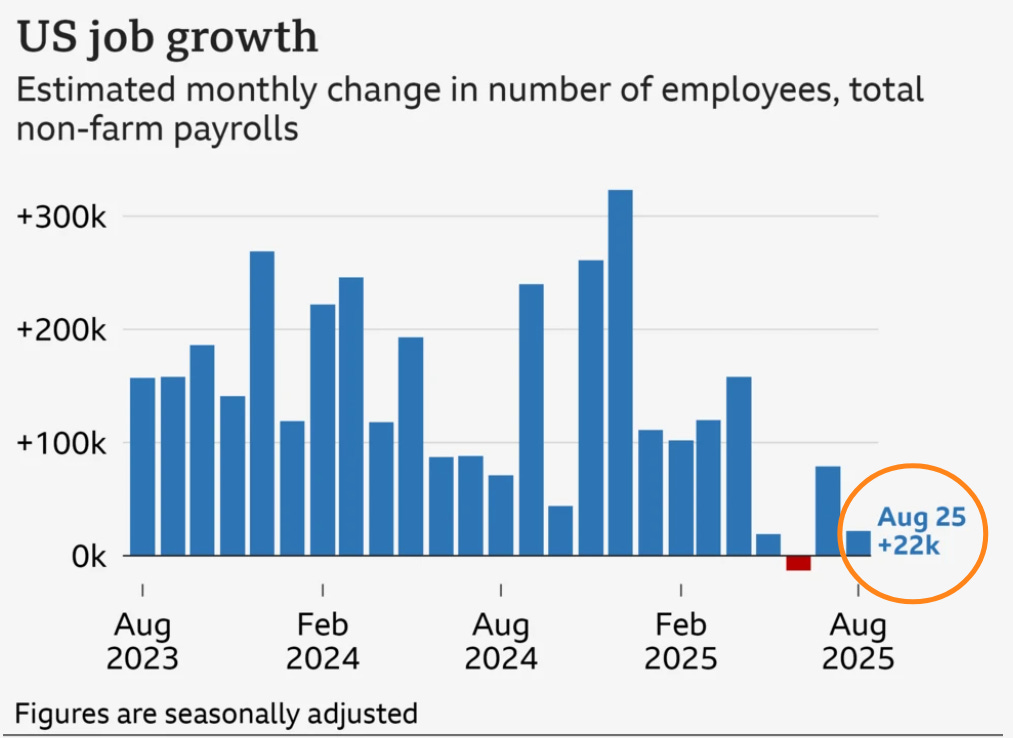

Recently, rates were cut by 25 basis points in light of the softening job numbers, which showed that employers added only 22,000 jobs last month, down from 73,000 in July.

At the same time, the unemployment rate ticked up from 4.2% to 4.3%, according to the Labour Department.

But the jobs data, which is dominating headlines, is like a decoy duck in a shooting range because it’s a lagging indicator.

Labour intelligence firm Jobspikr concluded that traditional labour statistics fall short in modern markets.

Particularly when making investment decisions.

“Think about the timeline. If someone loses out on a job in early May, that information is stuck in a queue to be processed for a while, and only after the May figure is released can the rest of the data be worked on, meaning the lost job won’t be reflected until the end of July. In the technology sector, where hiring and layoffs can easily keep in pace with spontaneous market changes, shifts can render the numbers a year or two out of shape.”

So the economy looks rough, and people instantly assume their assets are heading for the slaughterhouse.

However, the signals really are one of an early market recovery.

As global liquidity expert Mike Howell puts it, asset prices reflect central bank balance sheets—when they increase, so do asset prices.

“If you have an expanding Fed balance sheet and an expanding injection of capital, that’s a recipe for very strong global liquidity. The best time for asset prices is when economies are slow and sluggish, but policymakers are trying to stimulate them, and that’s what we’ve got.”

Pollymarket odds have already given an 85% chance of another rate cut at the end of October.

The tendency with cuts is that they scale downward or move meaningfully in one direction, like a super tanker. What this means is that borrowing costs will become increasingly more affordable, allowing the Fed to roll over its $700 billion that becomes due in the next 12 months. However, it’s unlikely that this will happen at the current interest rate level of 4.25%.

Or, as one of the world's best business cycle analysts describes.

“Liquidity drives markets. The Fed won’t hit the QE button until debts can be rolled over at sustainable levels. Meaning rates have to fall first. But it’s not just the Fed. Liquidity can come from the Public Bank of China, private credit creation, rate cuts, a weaker dollar, or lower bond yields. Back in 2017 the Fed was hiking and doing QT, yet Bitcoin still did a 23x. The playbook is simple: Phase One: rate cuts. Phase Two: debts get monetized.”

Signals that spit in the face of hot market sentiment.

Job data looks dirtier than a politician’s expense report.

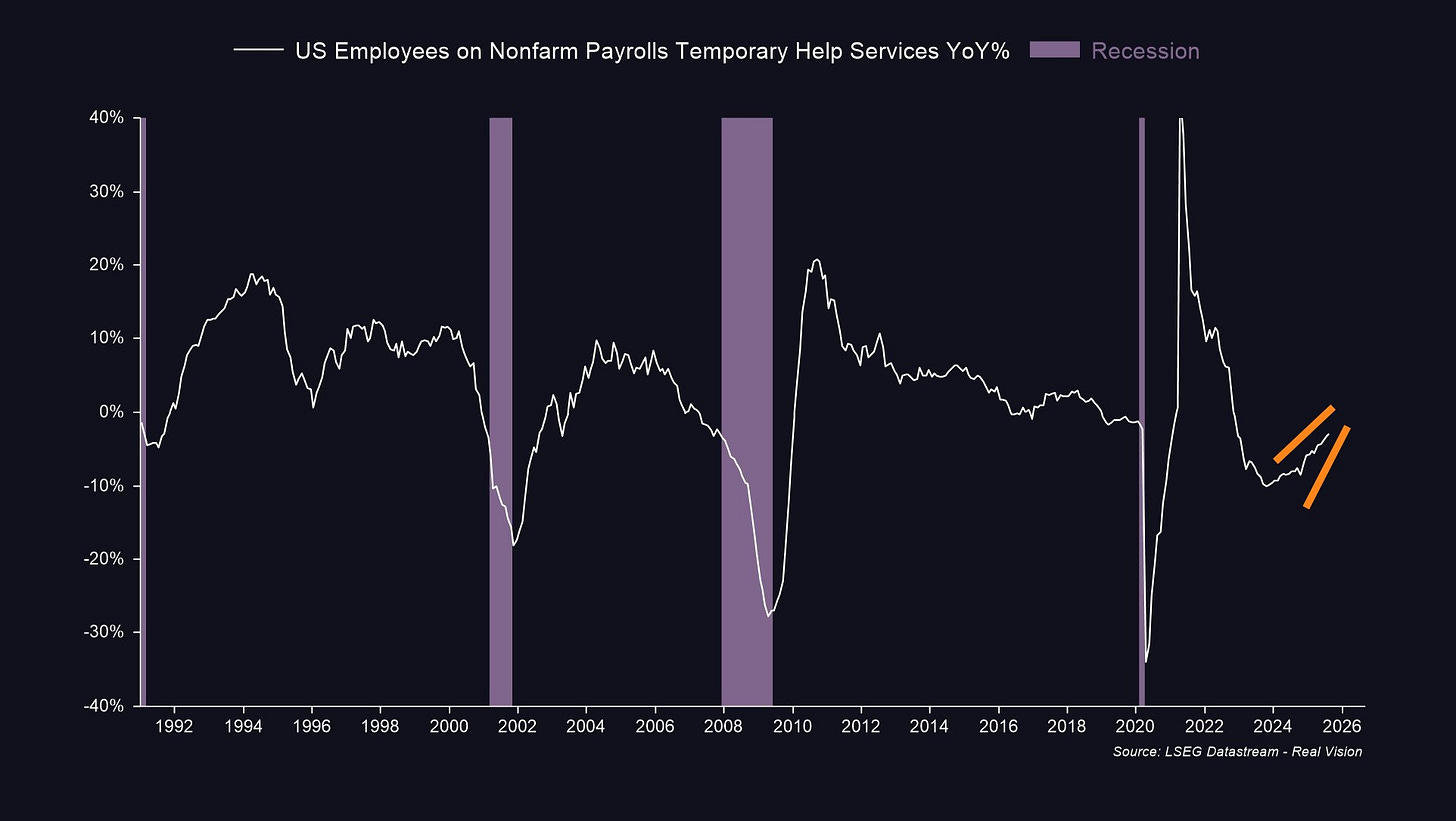

But the temp labour market is the canary in the coal mine. As a growth industry, its hiring trends often lead the way for the economy. When temp jobs rise, overall private employment usually follows, sometimes in lockstep.

The data is real-time, providing a granular and more detailed view of the economy.

Put simply, businesses squeeze more overtime out of current staff, then lean on temp workers for flexibility, and only when they’re sure the ground is solid do they bite the bullet on full-time hires with all the baggage that comes with them.

Right now, temp jobs are climbing. So that’s not late-cycle weakness, but the spark of an early-cycle recovery.

So when it comes to our magical crypto coins, the top-line job data is BS.

It's the temporary labour market that is a far better litmus test for the economy.

The dominant force in financial markets is straightforward: It’s the M2 money supply, which represents liquidity.

By first principles thinking, more money in the system means more money chasing assets. And the master switch for that liquidity is interest rates. When they drop faster than a dictator’s statue on Revolution Day, suddenly folks have more cash in their pockets and easier access to capital. So bad job numbers push rates down to ease the pain—ironically driving asset prices higher instead of lower.

Ceveated with, expect short-term drawdowns.

The M2 money supply is at record highs of $95 billion and continues to climb. The Bitcoin implied pricing, when it decides to play catch-up with M2, is $209k, assuming M2 has a 12-week lead.

Now it feels more like a pressure cooker or a beach ball forced underwater, set to burst back up with force at any moment.

Behind all the “market too hot” noise, the truth is the opposite.

We’re in recovery mode.

Meanwhile, the media (and social media clout-chasers) are still pumping out firing-squad sentiment. Not 2022-level carnage, mind you, but grim enough to spook punters.

Renowned crypto researcher Jamie Coutts said this:

“Every time we exit a contraction, it kicks off what I call a super bullish liquidity regime. Global liquidity can’t stay flat or falling for long, the system’s too indebted. Eventually, the cost of debt gets too high, and there’s always an impulse to add liquidity. Like a beach ball held underwater, the pressure builds then bursts.

That’s exactly what started in early April. Global liquidity broke out, and Bitcoin ripped 40%. Historically, when liquidity rises 1%, Bitcoin climbs around 7%. But in these breakout regimes, that multiplier jumps to 20–30x. This isn’t theory, it’s happened before. And we’re seeing it again now.

Even with recent pullbacks, Bitcoin massively outperformed equities on a risk-adjusted basis. It’s not overheated, it’s doing exactly what it should.

Every new dollar added, even through a weakening dollar, makes financial conditions easier and injects more fuel into the system.

The breakout already started. Most people just haven’t noticed yet.”

Final Thoughts.

A weak economy doesn’t necessarily mean your crypto bags are about to drop like a busted elevator cable.

It's the lie that’s keeping you poor in Crypto because the logic is upside down. It forces the Fed to step in sooner.

As Mr Howell says, the best time for asset prices is when economies are slow and sluggish, but policymakers are trying to stimulate them.

History shows that when conditions soften, central bankers typically step in, usually at the beginning of a cycle. If the market were running hot—which it isn't—liquidity would be being sucked out of the system.

Yes, jobs data looks rough, and unemployment has ticked up, but the temp labour market is rising—a real-time recovery signal. And when the Fed cuts rates, which it is doing now, the M2 money supply expands, sending more liquidity sloshing through the system.

That’s fuel for asset prices to rise, not collapse.

As Jamie Coutts quite rightly says, every time we exit a contraction, it kicks off what I call a super bullish liquidity regime. Global liquidity can’t stay flat or falling for long because the system’s up to its eyeballs in debt.

These doom junkies, still playing from last cycle's rule book, can watch us from the sidelines.

I’m not selling a damn thing.

If today's blog brought you value, please consider sharing it with friends or family. It’s how Carrot Lane grows.

Good stuff. If you look at on chain analysis from Mardypardy and other's doing crypto forensics, it's crystal clear that the drop this week was orchestrated by offshore gigs like Wintergreen/binance. As soon as they've filled their bags cheaply from those they panicked, we'll be off to the races again.

Their time is short if the new bill gets passed extending oversight to these operators who can still legally play games that would enrage most investors.

Sol, sui, avax at this price are a gift IMHO

I love your last sentence, “I’m not selling a damn thing.” And nor am I. When I saw that story pop up, with its scare tactic headline, I thought “nope, not gonna read.” Curiosity got the better of me, though. As I thought, nothing this author said would ever change my mind about crypto. I’m a 5-year plus holder, and crypto went through more ups and downs than a roller coaster. I’m holding, I’m good :-) Taking some profits for the first time later this year, as I deserve (and as you’ve hit on many times.) I’m 100% in alignment with you, Jay 😌