The Most Important Bitcoin Signal Came From a Billionaire No One Talks About.

He quietly revealed the only way to protect wealth from what’s coming.

Today’s newsletter is free for everyone, thanks to the legends who support with a paid subscription.

If you’re enjoying the content and want access to everything I share, consider upgrading. It keeps this whole thing going, and I’d genuinely appreciate it.

Traditional finance heavyweights are quietly making their way into crypto.

These aren’t TikTok traders.

They’re billionaires with battle scars, names like Paul Tudor Jones. He’s one of the most consistently profitable traders ever to live.

He was once quoted as saying:

“At the end of the day, the best profit-maximising strategy is to own the fastest horse. Just own the best performer and not get wed to an intellectual side that might leave you weeping in the performance dust because you thought you were smarter than the market. If I am forced to forecast, my bet is it will be Bitcoin.”

When smart money starts front-running these assets, I often ask myself what they see that most folks still don’t?

Jones, a contrarian investor, typically takes the opposing position to the crowd. He famously established a short position the week before the infamous Black Monday, when the stock market lost nearly $2 trillion in a single day.

He said, “We had been studying 1929, and the parallels were uncanny. The market was extended, and we were waiting for a catalyst.” The stock market experienced the most significant single-day percentage drop in its history.

In Jack Schwager’s Market Wizards, Jones is quoted as saying his fund achieved a 201% return for 1987. Given Tudor managed approximately $125 million in assets at the time, a 201% return would equate to roughly $251 million in total profits for the year, with Black Monday being the primary driver.

The Wall Street heavyweight who built an $8 billion fortune using a mix of technical charts and fundamental analysis is now urging investors to put at least 5% of their portfolio into Bitcoin as an inflation hedge because all roads lead there.

All roads lead to inflation. The playbook to get out of this, which you see in Japan right now, is that they have 2% inflation but don't want to raise rates. The playbook to get out of this is that you inflate your way out, and you have a small tax on the consumer. You run interest rates below the inflation rate and a nominal growth rate above the inflation rate. That's how you reduce your debt-to-GDP ratio. Every 100 basis points (approximately 1% interest) adds about $90 billion to the national deficit. So interest rates need to come down; that's exactly how civilisation has always inflated away its debt.

What PTJ is saying is that this is the age-old trick governments use to shrink debt.

Keep rates below inflation, let the economy grow on paper, and quietly tax the public who take the hit through higher prices, with the hope that cheaper borrowing frees up spending, so more money flows into the economy and into risk assets.

That’s when people start stacking Bitcoin.

Bitcoin isn’t the wild gamble most think.

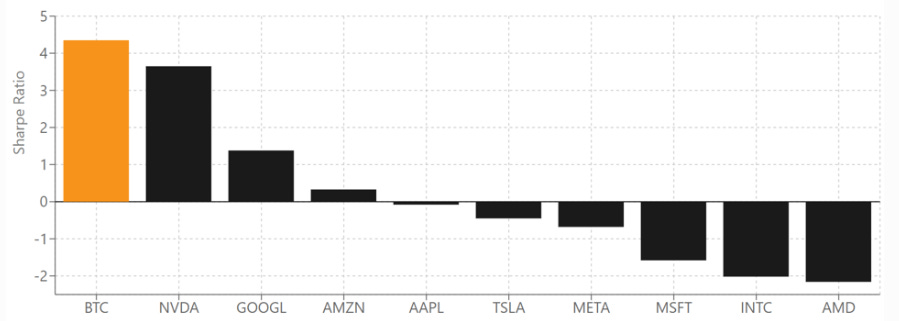

The most revealing reason is the Bitcoin Sharpe Ratio.

It’s a straightforward tool that measures whether an investment’s returns are worth the associated risk.

Nobel Prize-winning creator William Sharpe explained it like this:

“The idea of the Sharpe ratio is to at least take two things into account: an average return, and a standard deviation (volatility). It gives you credit for higher average returns — and it gives you discredit or it demotes your number or lowers your number for more risk, more variation.”

It helps you figure out if an investment’s returns are worth the risk. It answers the question: “Am I getting enough extra return for the risk I’m taking?”

It’s calculated by using the following:

The asset’s average return: How much Bitcoin’s value grew (or shrank) on average over the year.

The risk-free rate: The return you’d get from a super-safe investment, like a U.S. Treasury bill, which has almost no risk.

The asset’s volatility: How much Bitcoin’s price bounced around during the year, measured by its standard deviation.

If the Sharpe Ratio is high, it means you’re getting good returns while accounting for volatility. If it’s low, you’re taking a lot of risk but not getting much reward for it.

So basically: Higher = better risk-adjusted return.

Bitcoin delivered the highest risk-adjusted returns among significant tech assets with a Sharpe ratio of 4.35, surpassing NVIDIA (3.65), Google (1.38), and Amazon (0.33).

The results challenge the traditional view of Bitcoin as a purely speculative and so-called “risky” asset.

Bitcoin’s price quietly follows this one economic metric.

It’s the global M2 money supply.

We now know, on a risk-adjusted basis, that Bitcoin is probably a perfect bet.

Suppose Jones is correct about the reduction in interest rates—we’ll likely see continued inflationary pressure on the money supply and an optical rise in asset values as more debt is rolled over.

"That's probably your best portfolio to fight inflation: volatility-adjusted Bitcoin, gold, and stocks. We're in a debt trap. You're going to have to run negative real rates to get out of it. That's what we did in the fifties. We had five and six per cent inflation for a period of time. If I was presdient I'd run really low real rates, I'd have inflation running hot, and I'd tax the American consumer to get out of my debt trap.”

The global M2 money supply chart shows asset prices follow money supply when you add a lag of 84 days (12 weeks), and the match is striking.

When you use this method, Bitcoin has a 92% correlation with M2, backing up Paul Tudor Jones’s thesis that it’s ultimately the best hedge against inflation.

Final Thoughts.

I don’t own any Bitcoin.

It does act as an index to the other assets I own, and I’m happy taking that risk. I’ve also become attuned to stomach-aching the volatility. It’s not like I have a choice in the matter lol.

Paul Tudor Jones is simply saying this: to grow the economy and reduce the burden of debt, interest rates need to come below inflation. When the cost of borrowing plummets, it lends itself to a significant amount of cash being printed.

He says it’s the only outcome here, and it’s “dovish” for Bitcoin.

Using traditional measures, such as the Sharpe Ratio, shows that many people are likely to get caught offside because it’s no longer the risky or speculative play people once labelled it.

Top crypto researcher Jamie Coutts commented on the M2 money supply correlation and pointed out a caveat that everyone is missing.

“While this simple model accounts for the continuation of the hoovering of capital from all corners of the globe into Bitcoin, it doesn’t account for the inevitable “oh shit” moment of panic buying that is going to happen.”

Bitcoin might be the surfboard that protects us against inflation.

But…the real wave hits when the panic buying starts.

It’s the most important Bitcoin signal—and it came from a billionaire you probably weren’t watching.

If you got any value from my blog, please feel free to share it with a friend or family member—it’s how Carrot Lane grows and would mean a lot.

His name even sounds wealthy. Would you move some SUI into BTC if it goes?

Great article. Most people don’t understand the debt problem we have. I need to buy some more bitcoin.