The Most Slept-On Crypto Project With Real Upside (Almost No One Knows About).

Missed by many. About to explode for a few (NFTs).

Author note: Before we dive in, hit subscribe to get more content like this—it's free, and you can unsubscribe anytime. If you’re enjoying the blog and want to show your support consider upgrading to a paid membership. It unlocks my best work and helps fuel Carrot Lane.

The 'aha, apple bouncing off my cranium' moment in my NFT journey was understanding that a universal power law drives the entire space.

It’s supply and demand.

Attention (demand) leads to buying flows, which then move into these assets (supply), usually when financial conditions improve. Buying pressure kicks in because more people suddenly have a bit of extra cash to play with.

We want to show people our financial status through these expressive assets, and when that happens, as the successful simpletons in the crypto space like to say: “Number go up. By a lot.”

With NFT art and collectables, it’s beyond simple to see the value.

You don’t need an Einstein IQ or to be some investing wizard. The two major bets you’re making are either on historical projects with limited supply or founders with the ability to drive demand.

Today’s blog is about a little-known historical project I’ve yet to mention publicly, called CryptoStrikers, now viewable on OpenSea as “Wrapped Strikers” (note: they do not have a blue verification tick, I’ll explain why in a minute).

There is no other project that exemplifies the power of supply and demand more than Wrapped Strikers.

It's officially the first-ever sports NFT project based on the most popular sport in the world, commonly referred to as football here in the UK.

For the benefit of my American friends across the pond, I’ll reluctantly refer to it as soccer. Yuck.

Humans often perceive things that came first as more authentic, purer, or more original, and owning them is usually seen as a sign of status.

We romanticise about this stuff.

Just as people are fascinated by the first-ever car, the first iPhone, or the first tweet, a photo of us taking our first steps, passing our driving test or getting our first job, we give added weight to items or ideas that kick-started something new.

It provides us with a sense of being closer to the beginning of history, almost as if we own a piece of the timeline.

That’s why we collect first-edition comics, rookie sports cards, and genesis NFTs. There’s a belief, sometimes irrational, other times spot on, that what was first will always matter.

Provenance taps into status, history, and nostalgia. That’s why it’s so powerful and why people will pay a premium to say, I was here before you, laggards.

Author of "Against the Gods: The Remarkable Story of Risk," Peter Bernstein, a financial historian, broke down how we measure risk and why our obsession with scarce assets runs deeper than just money.

As he put it:

“The fundamental value of a scarce asset is not in its utility, but in the fear of not having it when everyone else wants it.”

Otherwise known as the FOMO freight train. Lol.

That’s how we think about Bitcoin.

That’s how we’ll think about NFTs, but on steroids. What NFTs have, over and above all other scarce assets, is how communities organise around them, driven home by the social signalling element, since the first use case is art.

And art is upstream of wealth.

Buckle up, and let’s get into it.

Very few understand why it matters.

CryptoStrikers is a bigger deal than most people think.

It wasn’t just another NFT drop. It was designed to be a gateway drug to pull the mainstream into digital collectables.

It’s a humungous idea that rewrites the rules.

The project was created by Benn Gurton and Gianni Settino in May 2018 and launched just before the 2018 World Cup on June 11th. It holds the title of being the first-ever sports NFT.

The idea was to recreate the feeling of collecting physical trading cards, but on the blockchain. And fix all the usual problems that come with traditional cards, such as unclear supply dynamics, counterfeits, and limited global access.

Both founders created the project as an experiment, intrigued by the concept of digital scarcity, inspired by the success of CryptoKitties.

Gianni Settino said:

"What was made possible with the ERC-721 tokens—like CryptoKitties—was the idea of digital scarcity. For the first time ever, a digital good can be rare.

Think back to mp3 files—when music first started getting ripped and shared, the file could be duplicated endlessly, and the music industry kind of collapsed under that.

But now, with the ERC-721 standard, we have digital scarcity. That’s a really interesting concept. And beyond that, you also get digital ownership.

You, as the user, hold the asset in your digital wallet—it’s not tied to a specific company’s servers. So, if something like CryptoStrikers were to shut down, you’d still own your cards.

These are powerful concepts that just weren’t possible before these innovations."

In a conversation I had with Benn Gurton, he said, “CryptoStrikers was one of the most fun things I’ve ever worked on”.

The partnership between him and Gianni worked perfectly because their skills complemented each other well.

Benn Gurton said:

"My brother had just been in Colombia and brought me back this Panini World Cup sticker book. I had no idea what it was—and I pride myself on being someone in the sports industry who knows every collectible out there.

So I actually went to a trading market in Queens to see what it was all about. That memory stuck with me—watching people trade physical goods—and the story behind the collection was fascinating.

No one really knew how many stickers there were, how they were printed, what the distribution looked like, or the actual scarcity.

After seeing CryptoKitties, that idea popped back into my head. We started talking about it, and it just felt like a really interesting direction to explore.”

And so, CryptoStrikers was born and launched without a license.

This means the project didn’t (and still doesn’t) have the image rights for the players. In fact, back in February 2022, OpenSea received a takedown notice from the representatives of Spanish midfielder Thiago Alcântara. But his card is still live on every other marketplace and weirdly, still visible on OpenSea too.

People in the ecosystem are divided about this particular aspect of the project, and if I’m honest, it kept me at bay for a long time. At any time, OpenSea or any other marketplace could receive a request to remove access to the items from their site based on the player's request.

Gianni says he and Benn made a conscious decision to keep it that way, wanting to prove the concept before seeking licensing rights, investors or expanding the business. They had early conversations with Panini at the time, but the capital outlay was far too high. The problem was that, back in 2018, no one was buying NFTs.

CryptoStrikers still managed to become the most successful NFT project that year, achieving a volume of 50 ETH ($25,000 at the time).

As of publishing, the project’s total volume is $8 million (2,500 ETH).

With each new cycle, a new and larger wave of buying pressure emerges, so the licensing element is clearly not a concern for people.

A truckload of historical examples demonstrates that the overriding factor is supply and demand, rather than licensing rights, especially when the item is already in circulation.

Think misprinted coins, rare bootleg albums that collectors pay insane amounts for, or one of the most famous cases in the collectables world: the 1952 Berk Ross baseball set. It was created by a rogue businessman who took his own photos, made baseball cards, and slipped them into boxes of popcorn and bubble gum he was selling.

Other examples include the Hekking Mona Lisa, a famous copy of the Mona Lisa. Painted in the early 1600s, the known replica sold at Christie’s in Paris for €2.9 million.

Berk Ross landed in legal trouble in 1952 after seven New York Giants players, among them Bobby Thomson and Sal Maglie, sued his two popcorn companies for using their images without their consent.

Gary Vaynerchuk, whom I frequently mention because he’s remarkably skilled at spotting trends, like being an early-stage investor in Facebook, Twitter, Tumblr, Uber, Coinbase, along with a greatest hits album of other early calls like foreseeing the rise is in soccer and baseball cards, shared his take on the licensing angle. In short saying that history rewards those who know how to read between the lines.

He says being the first gives CryptoStrikers an edge that almost makes the licensing element redundant, as they were covering new ground. It predates every official digital rights deal, which, in the counterculture world we live in, actually makes it more iconic.

In an interview with Gianni Settino, he said:

"I'm in love with a card set from 1951–52 called Berk Ross. This entrepreneur just made baseball cards and put them into his cookies and didn't talk to anybody about it—just did it. I think that was a little more ridiculous because cards had been around for 70 years and there was a, call it, acceptable protocol and a way to do things. I think what you and Benn did was such early frontier that... I don't see them the same. I think that entrepreneur in the '50s was a little bit more aggressive. Think about what you guys achieved—you had one of the most successful projects that did: 50 ETH when ETH was $500."

Billions are being spent on NFTs—folks don’t know it yet.

Soccer is the most popular sport on the planet, with an estimated 3.5 billion fans worldwide, roughly 10 times the audience of the Super Bowl.

That might not hit as hard across the pond, but over here, people treat their teams like religion.

Electronic Arts (EA) and its most popular game, FIFA, are a significant signal of where this is all headed.

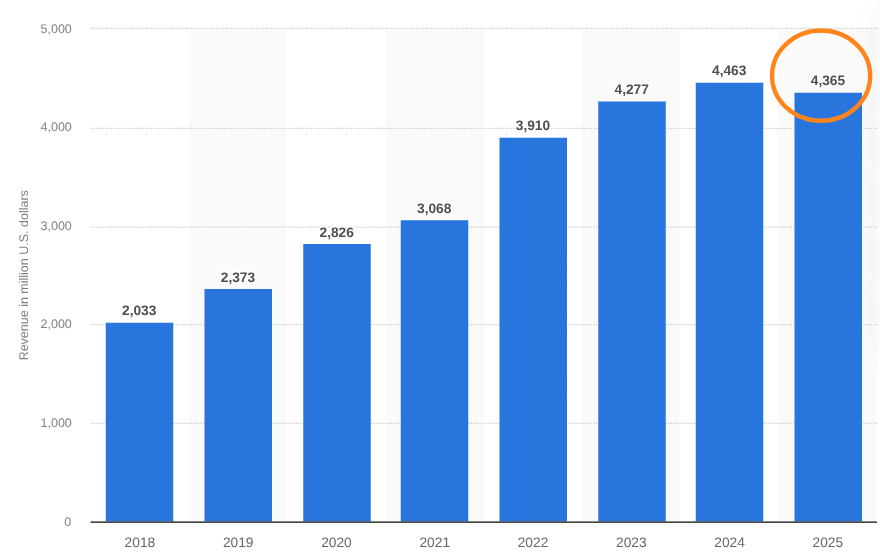

In the 2025 fiscal year (April 2024 to March 2025), EA generated approximately $4.3 billion in in-game purchases, with nearly half of that revenue tied to FIFA.

That’s $2 billion (with a B) in upgrades, packs, and team builds, just in the first half of this year alone. And none of those digital purchases belong to the people. The company hold the assets.

These are effectively NFTs, except users don’t have self-custody. People are spending real money for access, but not ownership.

As Steve Kaczynski puts it in The Everything Token (a book you’ll want on your radar), unlike centralised gaming companies, NFTs are more like our experiences with physical assets and says, “Your paper diploma doesn’t spontaneously combust if your university goes bankrupt”.

Kaczynski goes on to say:

“If Epic Games, the company that makes Fortnite, were to go bankrupt, you’d lose all of the skins, gliders, and emotes you’ve purchased in the game. And don’t even get me started about digital articles disappearing when an online media platform shuts down”.

The reason for mentioning this is that there’s already a massive, ready-to-go market of people buying digital assets based on soccer in games.

They don’t realise yet that NFTs offer the one thing FIFA doesn’t: actual ownership.

Artist Mau Toscano created the 100-player Original set, and Gilang Bogy, whom I have come to know through social media, was commissioned to design the 32-player Iconics set, which he completed in a now-made-famous WPAP-style art for the collection.

The project has a total supply of 10,261 cards that were issued, but only 4,437 are wrapped, with about 5,000 thought to be lost to the Crypto gods.

I’m not sure how to explain it. Maybe this is what they mean when they say you can’t bottle lightning. But CryptoStrikers has it. The art hits different. They feel like those Kaboom inserts from Panini.

It’s a pop-art style, once pioneered by Indonesian illustrator Wedha Rasyid in the 1990s, that looks incredible. WPAP (Wedha’s Pop Art Portrait) is known for using straight lines, sharp geometric shapes, and bold, contrasting colours to create stylised portraits.

Following the work on CryptoStrikers, Bogy has completed numerous commissioned projects for Coca-Cola and Veefriends in this style. In particular, he was the artist behind the Iconics in the Veefriends collection, which mimics the CryptoStrikers art.

Gary Vaynerchuk himself looks to be closely tying Veefriends to CryptoStrikers’ historical significance, which, as of the time of publication, has only 914 collectors.

NFTs featuring football icons like Messi, Ronaldo, and Mbappe have sold for substantial amounts because people in the CryptoStrikers echo system were treating them as their digital rookie cards.

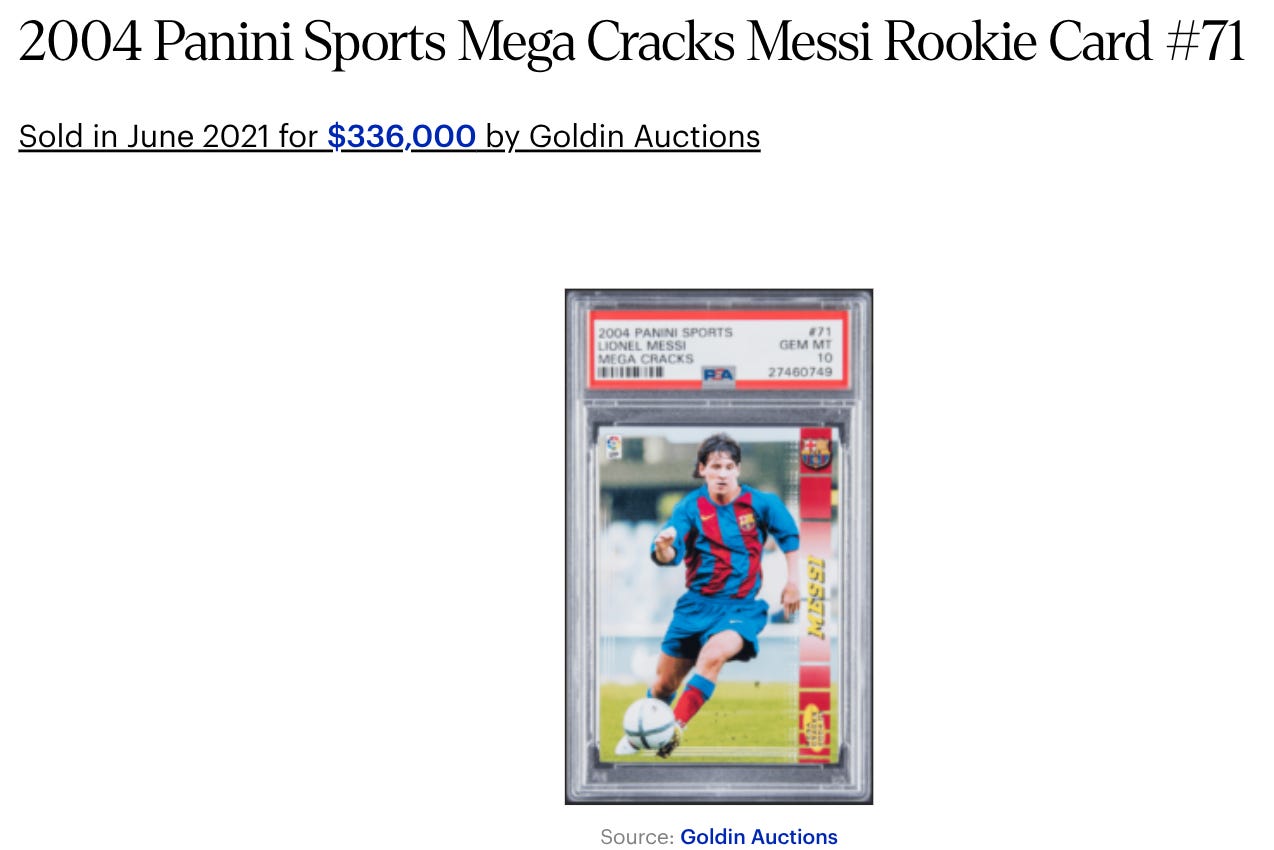

In August 2021, Bogy’s Messi piece sold for 39.96 ETH, equivalent to $130,000 at the time. It’s still small fry compared to the physical rookie card, which sold for $336,000 but was released in 2004, so it took much longer to accrue that value.

Messi’s rookie card has a PSA population of 376, with only 20 cards (roughly 5%) achieving a PSA 10 rating.

In comparison, the digital “Iconic” in CryptoStrikers below has a run of just 13. That’s it, which sets up a big contrast between supply and the potential flood of demand, especially with NFTs having global reach and near-zero friction on blockchain rails.

The beauty of digital cards is that they all come out PSA 10 by default.

The NFT collecting mistake everyone is making…

Steve Jobs once said:

“When we develop a new medium we generally tend to fall back into our old habits from our old medium. When the television first came, the first television shows were simply a camera pointed at a radio show.”

This is what we are currently doing with NFTs.

Soccer is not as widely supported in the US as it is, for example, in the UK and parts of Europe. The average viewership of a World Cup football game is 1.42 billion (with another B), whereas the average viewership of a Super Bowl is around 123 million.

The one caveat to all of this is that the physical collectables card market for soccer is more widely based in the US, with soccer being only the 5th most popular sport.

Zion Market Research said:

“North America dominates the global sports trading card market due to the deep cultural roots of card collecting, which date back to the early 20th century. The United States has the most developed ecosystem of card manufacturers, grading services, and specialised retailers supporting the hobby. Major card producers, such as Topps, Panini, and Upper Deck, are headquartered in the region, enabling quicker product distribution and market engagement.”

Proof’s in the behaviour.

Folks tend to collect the top players, such as Messi, Ronaldo, Mbappe, and Neymar, without the nuanced interest in the other world-class performers.

That, my friends, is the colossal mistake that people are making with CryptoStrikers.

They’re applying a traditional sports card mindset, focusing solely on collecting the top athletes with the most mindshare and disregarding the value of other superstars, as well as the project's allure of being the first-ever sports digital collectable.

Let’s return to our power law of supply and demand.

I believe this project has all the hallmarks of something that will be truly significant, given that even mid-tier players have around 50 million followers or more on Instagram (E.g. Paul Pogba, Sergio Ramos, James Rodriguez, Marcelo).

Put into context, Tom Brady, often regarded as the greatest quarterback of all time, only has 15.2 million.

One thing to consider about this project versus PFP projects like CryptoSkulls, Pudgy Penguins, CryptoPunks and even Veefriends is that those projects are character-led, so there’s no real-world measure to put value against apart from scarcity or your own subjective view.

In contrast, soccer players have a market value based on their skill and performance level. On that basis, some are more desirable than others. Now, obviously, the players from minnow countries are going to be worth much less, so you should gravitate towards the better players.

While I’m playing devil’s advocate, there is also a train of thought that, as this is the very first sports NFT project, the allure of the entire project will make ALL of the pieces valuable.

A buddy of mine, Jon Torrey, wrote about CryptoStrikers sometime ago, reflecting on the supply and demand mechanics and comparing it to card collectables, and why the digital version will do much better because it’s open to a global audience, not just the USA.

“There are only 248,131 total physical soccer cards graded by PSA compared to 17,482,908 graded baseball cards. The difference is significant and is likely due to the fact that soccer is just the 5th most popular sport in the United States, and most sports card collectors are based in the US.”

Final Thoughts.

I often say that writers can spot what other people aren’t noticing.

For CryptoStrikers, many are collecting GOATS, not realising that mid-tier players have huge followings and are actually more followed than most US sports stars.

They’re also unaware that soccer NFTs via FIFA are already amongst the most purchased digital assets.

People overlook the fact that mint day in 2018 generated $25,000, and no one had ever heard of an NFT. Then, in 2021, it generated $8 million, and still, no one has ever heard of this project.

I’ll be honest—I had some hesitation about sharing this one.

First, because the supply is tiny, I didn’t want people jumping in just for the dollar signs without really caring about the sport (which, to be fair, is fine).

There’s also the licensing consideration, which is why OpenSea haven’t given it a blue tick verification.

Yes, OpenSea could remove the assets. However, they can still be bought and sold on numerous other marketplaces. And because they’re now wrapped and already in circulation, almost like a physical collectable, there’s not much anyone can do to stop that.

I hate baiting folks with celeb dopamine NFT porn, but many well-known folks did get into this project, giving it the social consensus.

I often say take action with incomplete information for the significant upside.

This project, given its tiny supply and potential for outsized demand, looks like a major win. Big, big, big.

Given the very little trading activity, I suggest ensuring you’re not just buying the floor but also submitting WETH offers.

Educate yourself on the players.

A great yardstick is their online follower count, followed by a quick player ranking on Google search.

It’s the most slept on project with real upside that almost nobody knows about.

It’s being overlooked by many, but it will explode for a select few.

OPENSEA COLLECTION HERE. (Beware of fake collections—always check transaction volume.)

If today’s blog gave you value, pass it on to a friend or family member—word of mouth is how Carrot Lane grows. If you want to take it a step further, consider upgrading to a paid membership. It’s the best way to support my work and unlock even more value.

Fantastic content, this is why I subscribe to Jayden's articles. I purchased one Cryptostriker when I read this as a paid member a few weeks ago.

Already got a couple keep spreading the word , thanks for the heads up