The Next Big Crypto Rotation Is Obvious: But Most Will Miss It.

As long as you have a rough sense of where we’re headed—and you’re willing to act on semi complete information—you’ll come out ahead.

I first shared this article with paying members — and it really struck a chord. Their support is what lets me keep doing this work.

As a one-off, I’m unlocking it for everyone to read.

If you get something out of it, feel free to pass it on.

The best advice I’ve heard in crypto is simple: there’s no such thing as a free lunch.

You either hold your position with incomplete information and deal with the discomfort of uncertainty, or you chase the crowd once the move is obvious, only to find there’s not much meat left on the bone.

Right now, the best risk-adjusted opportunity in crypto and investing is hiding in plain sight: art NFTS.

It will be the next big rotation, and the explanation is simple: They’re more scarce than coins, connect us with communities, and socially signal status to the world.

Or as Cozomo de' Medici, a pseudonymous collector, investor, and thought leader who has become one of the most popular and prominent names in the digital art community, puts it:

“Few see it yet — but when you look closer, it’s undeniable: Right now is the greatest risk-adjusted moment in history to acquire crypto art. And possibly the last window to do so before the market changes forever.”

He’s right.

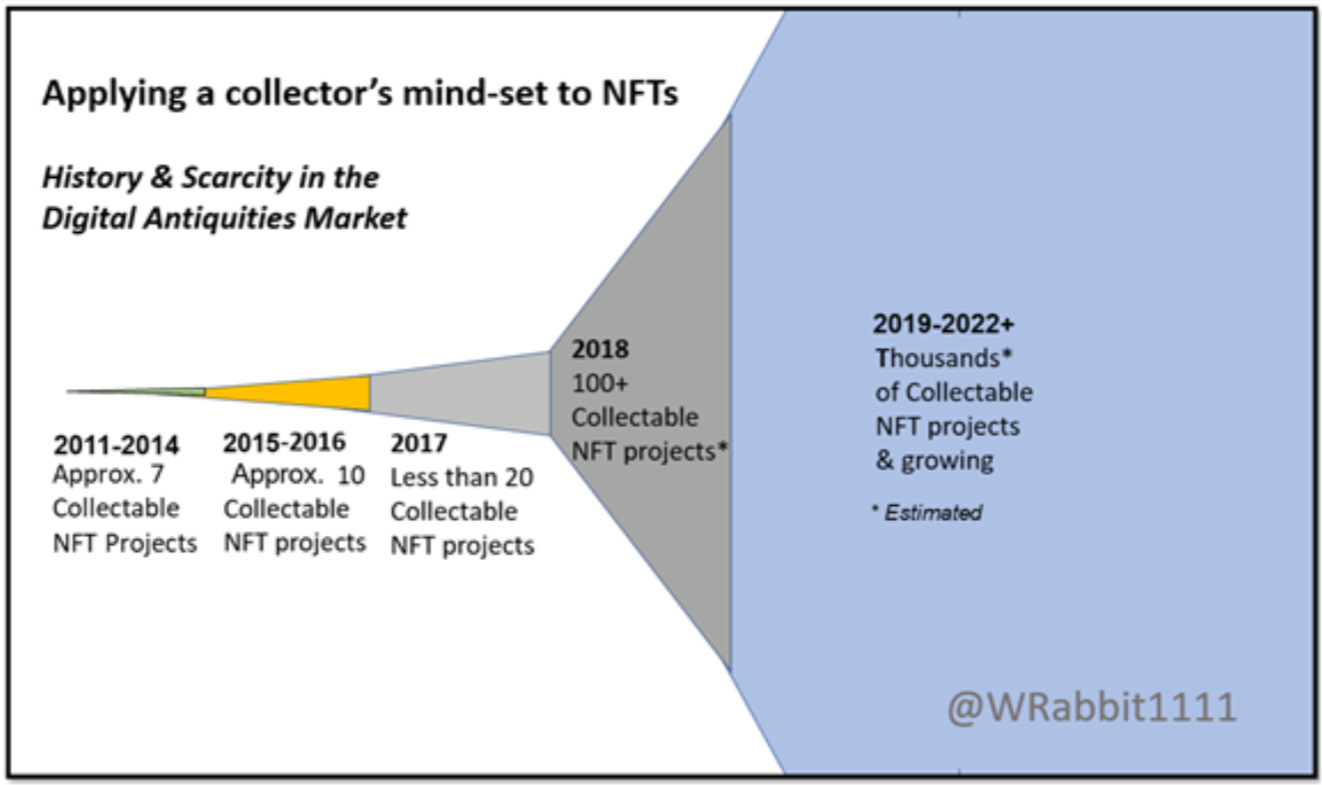

The beauty of NFTS is that they have built-in supply friction. You can’t just create/unlock more when demand increases. And if you’re picking some of the earliest projects—like the first in their category or some of the first pieces of art on the blockchain—there’s a strong chance that, as the world becomes more digitised, more money will flow into these kinds of alternative assets.

We’re already seeing the early signs.

People my age—pushing 40—have kids entering their teenage years (not me, by the way). And those kids are now collecting the same Pokémon cards, baseball memorabilia, and sneakers we once did.

A report from ThisGenGaming showed that the global trading card market was valued at $11.6 billion in 2023 and is projected to reach $23.9 billion by 2032, with nostalgia driving price appreciation.

“Beyond financial investments, nostalgia remains a powerful driver of the pokemon TCG market. Millennials and Gen Z collectors, many of whom grew up during pokemon’s early years, now have disposable income to reinvest in childhood favorites. Recent releases like New Pokémon Snap have reignited interest in classic pokemon, allowing fans to relive their favorite moments in new formats. This nostalgia-driven resurgence extends beyond video games, fueling demand for iconic pokemon cards such as Pikachu, Charizard, and Mewtwo, whose vintage and alternate-art editions continue to appreciate in value.”

That wave of nostalgia is leading to buying flows.

However, interestingly, these folks are now in their peak earning years, which is quietly driving prices up across these alternative assets.

NFTS are alternative assets but on steroids.

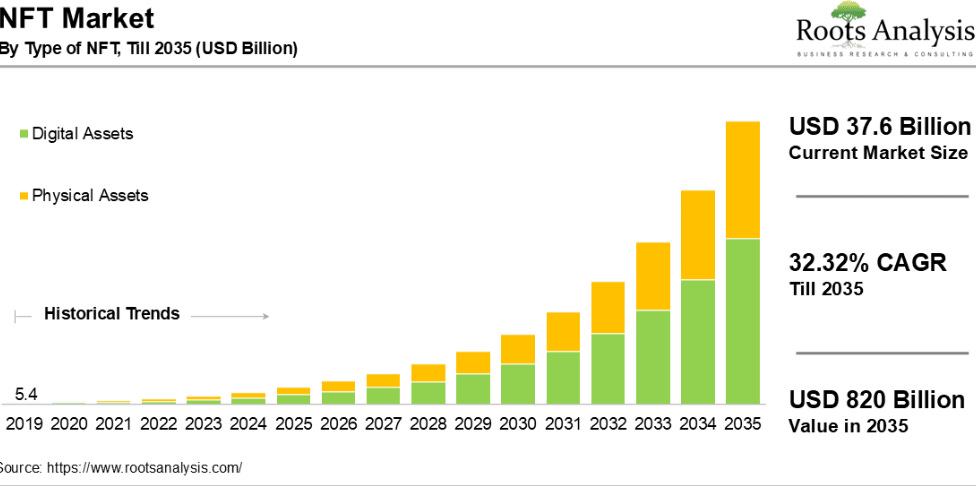

Research by Roots Analysis projects a compound annual growth rate of 32.32% for NFTS, taking the market from $37.6 billion (1% of the crypto market cap) today to $820 billion by 2035.

That’s a 25x move over the next decade (but I think it goes much higher). Either way, we’re looking at a race to the top for the scarcest assets.

RA say in their report:

“Based on the type of offering, the global market is segmented into arts, collectibles, gaming assets, music NFTs, real estate and others. It is worth highlighting that currently the collectibles occupies the highest share (45%) of the market. However, during the forecast period, the art segment is expected to have a relatively higher growth rate of 34.26%. This can be attributed to the increasing adoption of modern art, which is further fueling the NFT investment opportunities.”

The sweet spot moment very few will see.

There is no denying that sentiment around Ethereum has been horrendous.

The whole layer two cannibalising Ethereum narrative, high gas fees, slow speed, and general clunkiness have made Ethereum one of the worst-performing Cryptos this cycle.

But what it means is that it's a great entry point for NFT buyers and possibly signals a bottom for Ethereum.

The chain is by no means dead because institutions will continue to use ETH as the settlement layer for payments as the safe bet.

As David Duong, head of research at Coinbase, says:

“It is no surprise to anyone that is active inside of the crypto community that Ethereum has not been a loved asset. A big part of that has to do with transition and activity. Even though there is a lot of total value locked through DeFi that takes place on Ethereum and a lot of real-world assets—a lot of speculative trading activity moved to other networks. A big one was the memecoin movement on Solana.

The transition happened for many reasons. Transaction numbers have been flat, there’s been liquidations of short positions, and there’s been a lot of selling pressure. But it looks like the capitulation phase was over in Q1, and we have reached a bottom. What we’re seeing is an opportunity to actually start picking up here.”

We’ve started to see a wave of bullish sentiment around Ethereum NFTS—still the go-to chain for serious NFT buyers.

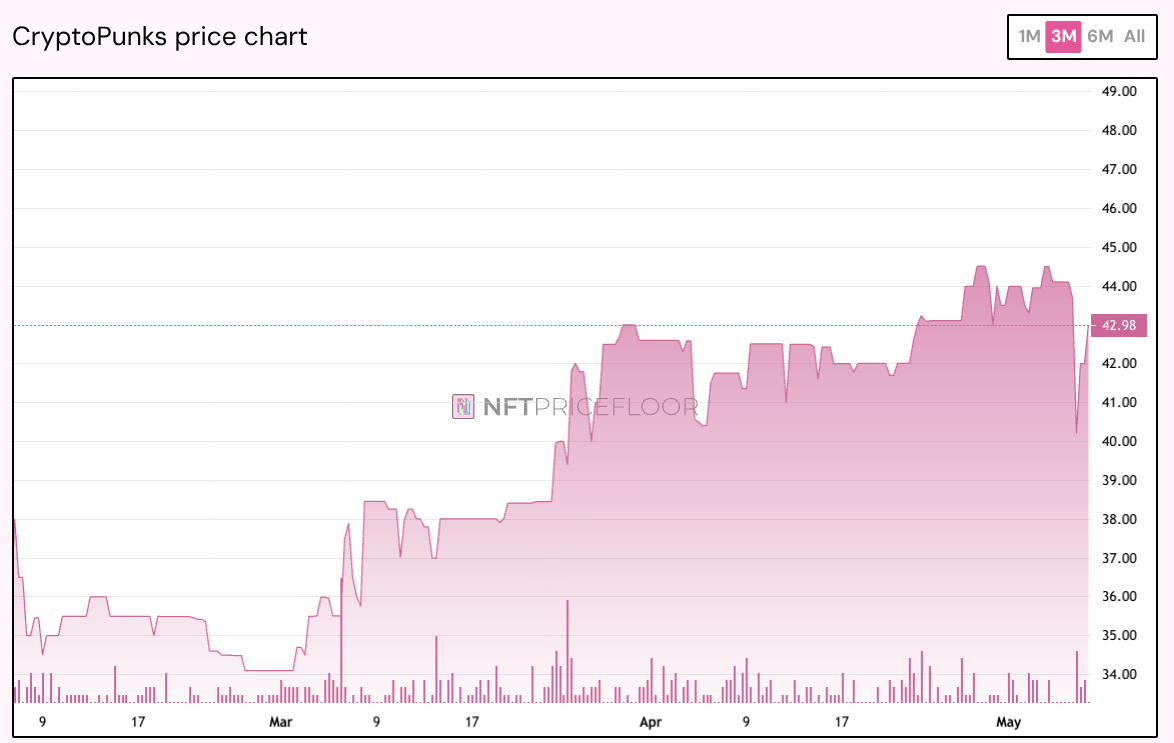

Just like Bitcoin leads the way for the broader crypto market, CryptoPunks act as the signal for NFTs. They give a clear read on market sentiment.

And right now, despite Ethereum’s recent capitulation, the signs from Punks are starting to turn.

Now imagine Ethereum and NFTS go on a rip-snorter of a run.

It’s like holding a beach ball underwater—when the pressure finally releases, it explodes upward.

What follows a soul-crushing downturn is often a complete reversal. Both the currency (Ethereum) and the asset built on top (NFTS) start climbing fast.

I come back to this example often:

Say you buy an NFT for 1 ETH when Ethereum is at $2,000. If you pick the right project—one with real demand and staying power—that NFT could realistically rise to 5 ETH (easily). There are 10x the participants coming into the space in the next 24 months, so I’ve discounted that by 50%.

But here’s where the silent multiplier kicks in: if Ethereum hits $10,000 this cycle (a number that’s not out of the question), then your NFT that cost you $2,000 is suddenly worth $50,000.

$2k into $50k is a bet I take every day of the week. It can happen fast, but you’ve got to position yourself early.

If you’re patient enough to let time do the heavy lifting and are prepared to play for multiple cycles, your odds of serious upside go way up. That’s why I focus on NFT projects that have real historical significance. They offer the best risk-adjusted upside because you are just betting on us valuing digital assets more over time.

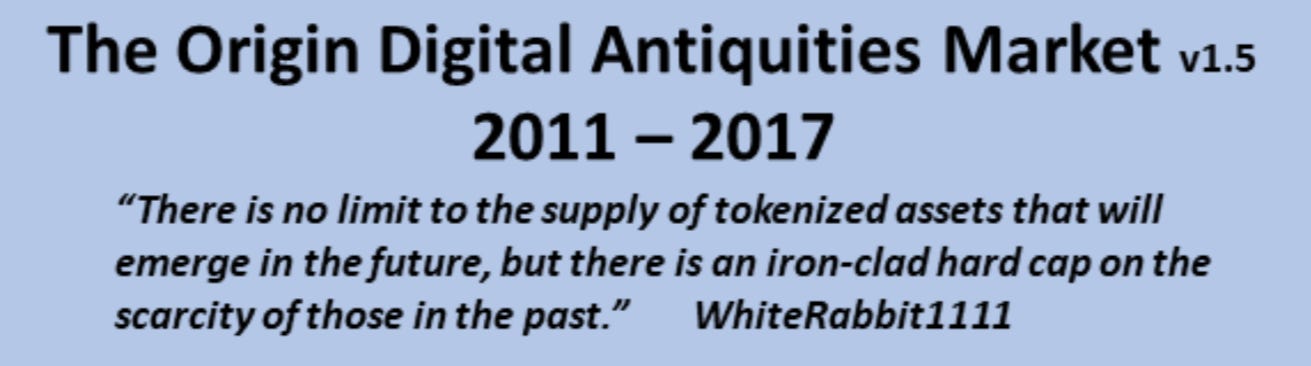

One of the best illustrations of this thesis comes from an infamous chart shared by NFT historian and rare asset collector, WhiteRabbit111:

Final Thoughts.

So this is the game.

Collect the rarest, most historically relevant assets with fixed supply—assets that can never be recreated. Right now, with Ethereum lagging and most people still not clued up on NFTS, we’re sitting in one of those rare sweet spot moments in time.

The rotation into these assets is obvious, but most won’t grab it. Just like they missed Bitcoin in the early days… just like they ignored the emergence of Ethereum, then Solana, now SUI—and even last year’s memecoin summer.

People keep missing the boat by staying in the “no” business.

What we need now is a shift in financial conditions—more money flowing into the system—to really light the fire under these assets.

As Cozomo De’ Medici says:

“For centuries, art has been used as a means to preserve wealth. For the last decade, crypto art has existed on the fringe, as a means of speculation. From now forward, crypto art shifts from speculation, to preservation. Get it while you still can.”

Once the opportunity is gone, there’s no putting the genie back in the bottle.

I’ve been accumulating crypto art for the last four years, and I still feel majorly underexposed.

Because once people feel a little wealthier—once there’s a bit more cash in their pockets—these assets move fast.

All that’s left is to take action.

If this blog gave you any value, I’d truly appreciate you passing it on to a friend or family member. Word of mouth is how Carrot Lane grows.

We’re currently sitting at #16 on the Best Sellers list—and with your help, I’m gunning for that #1 spot. Let’s get it there.

Thanks for the article, always good stuff 🔥

Any tips for NFT research? While I get your point of buying ETH NFT’s at the bottom, to me it still feels like the exception and not the norm for these assets to appreciate without utility function.

Most of these projects, people will lose money. The only NFT’s that have held their value for me have been ones tied to membership logins. (Example: using an NFT as login authentication to access AI crypto research and API’s.

If the NFT doesn’t have utility, then you’re trusting the project creators to maintain a community and keep people interested, which is hard to do in crypto. (Only a few blue chip NFT’s that have actually done this in the long term)

It hard for me to invest in NFT’s that are just art right now.. but.. I still get your point for the objective investment opportunity.

Thank you for freeing up this article. What do you think about being on the other side of the proverbial coin and being the creator of NFTs? I am a starving artist at this point in my life and in need of patronage if I am to get into this market. Do you think there is room for this in the new digital art frontier for artists? There are sooooo many artists that need CAPITAL to make their art for investors (sharks) to circle and take a bite of. Just my two cents from the other side of this coin.