The One Mistake That Will Cost Most Crypto Investors Their Profits.

It's a silently destructive behaviour that happens to almost everyone.

Today’s newsletter is thanks to paying subscribers. Upgrading is easy and comes with a bunch of perks, like a 1-2-1 call with me. Hope you enjoy!

Crypto investors keep falling into the same trap.

It’s living in a constant state of hunt mode.

I’ve spoken to hundreds of people in the comments section, on Zoom calls and in the DM's, and one thing is plainly obvious.

Everyone is looking for the next trade.

The conversation goes something like 'Jay, I've got my SOL and SUI position, what's next?'

What begins as innocent enthusiasm becomes silently destructive behaviour.

Back in 2021, I built a thesis very early that historical NFT projects gave me a protective moat because there was no human execution risk. So, I bought into projects like Crypto Skulls, Curio Cards, and a number of other vintage pieces in the ecosystem.

This was a solid outlook, and the early consensus and price movements around the assets proved it right. However, over time, my confidence morphed into delusion.

Slowly, as I began to be blinded by parabolic profits in basically anything I invested in—like a glacier slowly moving off course—I ended up in some bizarre tokens. One was called 420 from a company called Looks Lab, where I was farming virtual weed.

I don't smoke weed, I have very little interest in play-to-earn gaming, and I did not in any way relate to any of the community members.

This is an extreme example of where looking for the next trade can get you: a virtual f*cking weed farm.

Those tokens went to zero, and the company is no longer trading.

Instead of doubling down on my winning bet, or as Uncle Buffet famously said, “Sticking to your circle of competence”, I started chasing the next trade—or worse, sold off some of my winning positions for that next dopamine shot in the arm.

If you’re reading this — there is a good chance this will happen to you on some level.

I’m here to tell you to recognise it and stomp it out like a dirty cigarette butt. Excuse yet another unintended smoking reference.

Hear me out. When crypto prices start to pump like they are now, you'll feel like an absolute genius, and part of that illusion will push you to be 'proactive.'

You'll start trading in and out of assets, feeling underexposed and over-leveraging yourself by adding more.

As you keep chasing the next shiny object, like a puppy running after every bicycle tyre on the street, you unknowingly dilute your capital that could be used for your core bets—the very ones that brought you success in the first place.

The only real power move against this kind of silent, destructive behaviour is to do nothing.

I know it’s boring.

But it’s like Nobel Prize-winning economist Paul Samuelson once said:

"Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas."

Get yourself some ignorance insurance.

Noise and attention amplify FOMO. It’s your one job to not to get sucked into it.

Top Crypto researcher Chris Burniske said recently:

“The painful reality is as crypto prices go up, that draws more attention, and that attention converts into buying flows. Therefore, the more things go up, the more attention hits the space, but generally, the later we are in that "attention cycle," the worse the entry”.

So, the best entries come when very few are paying attention, and hopefully, you reading this now means you’re in a strong core position.

If you already have exposure in the space and are making trades later in the cycle—the later and later you are, the worse the trade becomes—you’ll also face a profit-related tax bill and the left-tail risk of everything drawing down.

Having a mental 'set-it-and-forget-it' framework for at least one core asset, ideally Bitcoin, Ethereum, or Solana, gives you a psychological safety net.

I have 25% of my liquid tokens in Solana, and I will never sell these—ever. I’ve staked them on Coinbase to lock them up because there’s a 5-day withdrawal period, which creates just enough friction for me not to even be tempted.

I know hardcore crypto purists will scoff and give me the 'centralisation is evil' speech. But let’s be real—more people lose their seed phrases than get scammed, and 90%+ of crypto owners who pass away have no succession plan. That means their tokens die with them.

Author’s note: I split my holdings between self-custody and centralised exchange.

My Solana position isn’t about profit or maximising capital allocation—it’s about psychology. Knowing I hold a globally adopted asset means that no matter what happens with my other trades, I won’t hit zero. Even in a major drawdown, I’m confident holding SOL.

This is my giant ignorance insurance hedge.

Ring fence core assets, but keep your mind wide open.

This is the part where we dive into the nuance.

While I’ve given the big speech about setting and forgetting your core positions, that doesn’t mean you should set and forget your learning—especially as you explore further down the risk curve.

There are early signs of something significant happening in crypto. As people move up the crypto wealth ladder, they’re looking for scarce assets to preserve economic value.

They’re not rotating out of the echo system.

In the old world, we rotated wealth into watches, cars, property, and physical artwork. But people are waking up to the fact that NFTs, which initially made their mark in art, do a heck of a lot more.

They’re far more liquid than physical assets, and since the underlying technology is a contract, NFTs can also serve as financial instruments. You can borrow against them while holding them at zero cost.

(And yes, John from LinkedIn, I know “zero cost” technically requires paying for Wi-Fi. You get my point.)

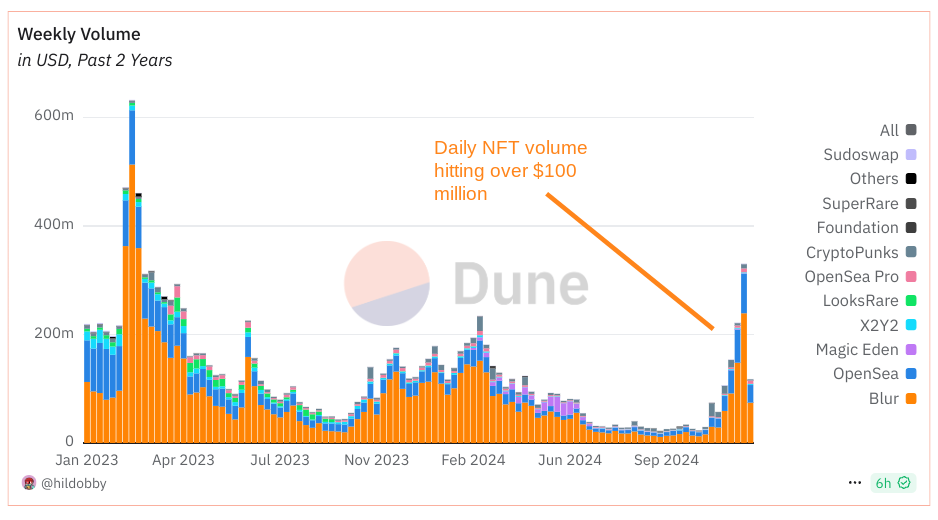

Recent NFT trading volumes show the space is growing at a rapid pace. What we’re seeing is capital rotating out of crypto coins into assets that solve scarcity—and NFTs are leading the charge.

I got the Bitcoin bottom right using the liquidity cycle.

I nailed Solana at $12.

People here will know I also did a full breakdown of SUI at $0.50—and I’m telling you, with every fibre of my being, NFTs are the next trade.

All the data shows trading activity is picking up, but there’s one thing it can’t quantify: the growing mindshare you sense from being in the trenches every day.

When I’ve shared this idea publicly, it’s been met with laughter—mostly on that dinosaur app LinkedIn. But the only way I know how to truly back this up is with signals from juggernauts in the space.

Here’s what Macro Investor Raoul Pal recently had to say:

“Massive crypto wealth creation, along with monetary debasement, will drive incredible demand for scarce desirable assets (digital real estate or, well, digital art). Younger generations are more attracted to digital assets than most physical assets.

If, as Saylor says, BTC is Manhattan real estate then the best crypto art or NFT's are the scarcest, most desirable block space of all. It is blindingly fucking obvious...

Also as people go up the crypto wealth-curve, you soon realise that physical property is expensive to hold as an investment and is better as a lifestyle asset. Art fills that gap and crypto art is ultra-cheap to custody for extended periods. Like property, it can be used as collateral too, if you so desire it.”

Final Thoughts.

There is no how-to guide for Crypto.

I’ve found selling crypto coins much easier than letting go of my prized NFT assets.

The most important reason not to trade between positions—and this might surprise you—is that it’s actually very hard to sell your NFTs.

For reasons you may not have considered.

I bought NFTs in 2021, watched their value soar into the millions, and then crash back down again. I’ve spent a lot of time thinking about why this happens, and the answer lies in social signalling, status, and the relationships you build around the token.

When you go to meetups and connect with people who hold the same NFTs, it feels almost like breaking a bond if you sell. I can’t fully describe it—it’s like a breach of trust. You might have been chatting with these people in Discord or on Twitter for years, and when you finally meet, that shared token becomes a symbol of your shared interest and connection.

To then say, 'Hey guys, I’m selling out,' creates a massive psychological barrier. This perfectly explains Bitcoin maximalism too.

My point is this: it’s much easier to sell crypto coins, which is why rotating those profits into NFTs is rarely a smart move if you’re hoping to cash out and enjoy the lifestyle gains.

While I love NFTs and encourage you to explore them, be wary of getting caught in a perpetual hunt for the next big thing. If you dive into this kind of activity late in the cycle and a drawdown hits, (I repeat) you’ll lose all your profits and still be stuck with a tax bill for every trade.

If you’ve got spare capital, deploy it separately. I’d recommend historical NFT projects. Their iron-clad supply will outpace most assets over time, making your coins look silly due to the hyperinflationary effects of coin value increases and the token's supply-and-demand dynamics.

If you’re already holding these assets, the smartest move is to do nothing with your core positions—let them anchor you. If you’re ignoring this and rotating into NFTs, at least hedge by not completely exiting the assets that built your foundation.

None of us can predict what’s coming—there’s no perfect play.

Just make sure you enjoy the ride.

If you found value in this, please feel free to share it. It’s how our newsletter grows.

thanks for the post, where should i look further into historical nfts?

Definitely informative.