The SUI Trade Will Shake You, but This One Signal Is Impossible To Ignore.

It sets up a compelling opportunity.

This blog was originally sent to paying members who support Carrot Lane for a small fee. Their support is what fuels the content produced here and allows the community to keep growing. If you’ve found value in this, please consider upgrading.

The gut punch of a 60 per cent drawdown is a sobering feeling many just cannot handle, and I say it often, but it’s the reason why folks don’t make money in the space.

In any other world, whether that is a trad-fi investment in the stock market, your investment is dead and buried. But this is no normal world. These are network adoption models, and while there are people still in the network who have been battle-tested over time, this creates a Lindy effect that keeps it surviving into the future.

The price you pay for crazy upside is the volatility, which means you need to stomach it on the downside too.

Another way to contextualise it yourself is to bring up a chart and compare it with a few base assets. What you start to see almost immediately is that the best-performing assets are just correlated with Bitcoin.

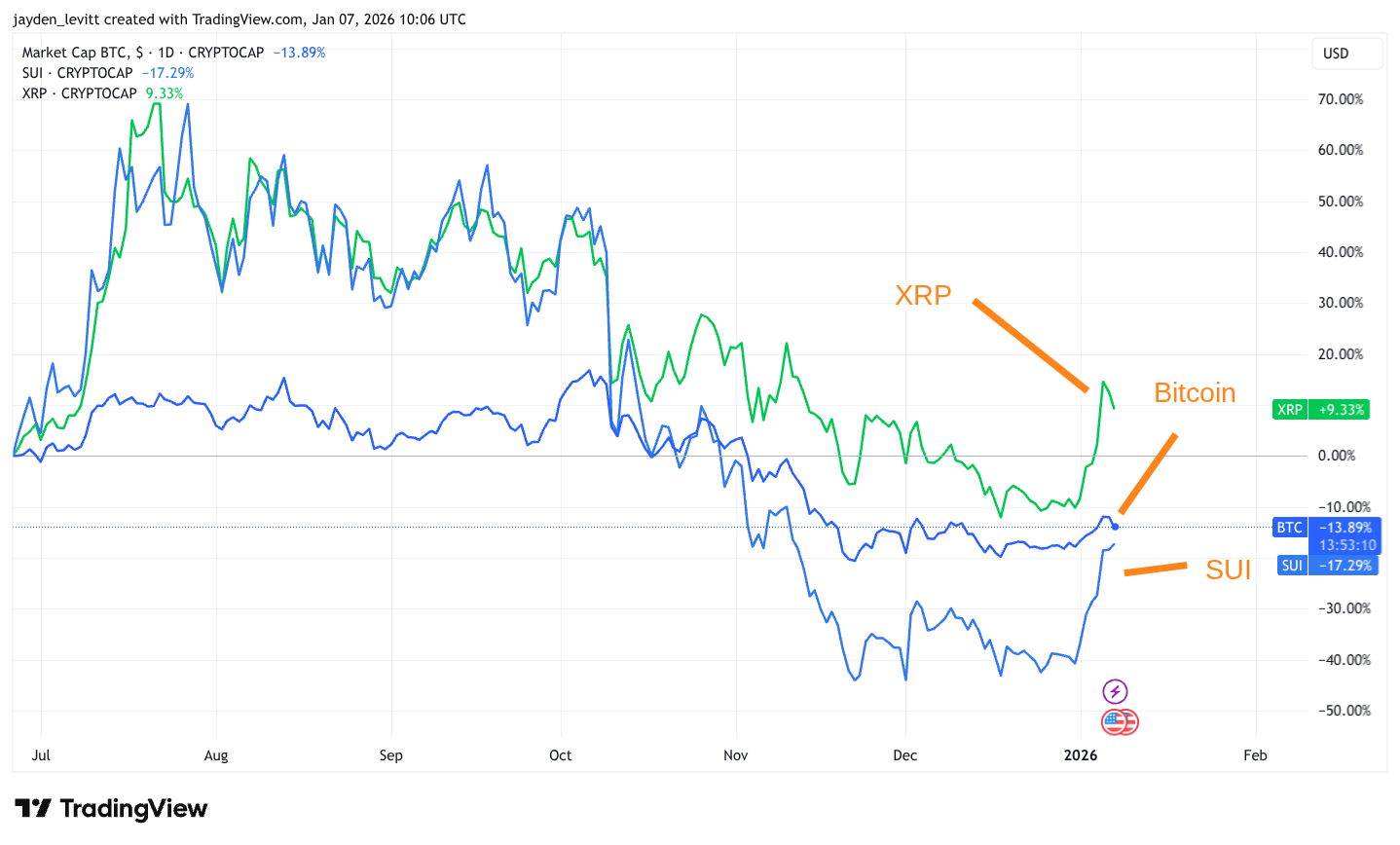

Below, I have added the best performers over 2024 and 2025, XRP and SUI. As you can see from the chart, whenever Bitcoin goes up, both XRP and SUI are very sensitive to those upswings and experience parabolic rises.

But by the same token, when Bitcoin draws down, you get huge downswings, and recently, after Bitcoin’s recovery, we've seen the two top movers back in action again: SUI and XRP.

So the punchline here is simple.

When those tokens go down, there is no fundamental floor for the token, the team, or anything else. It’s just that Bitcoin, which serves as an index of the entire space, has gone down, so alts crash faster.

And if you understand that, you stop panicking at the wrong time and start positioning at the right time.

The only question everyone is asking that actually matters.

Will Bitcoin go up or go down?

It’s because Bitcoin has this rotation effect. As it rises, capital rotates further down the risk curve into smaller, less liquid alts and eventually into NFTs (the last to gain liquidity). Yes, NFTs. And everything has this optical rising effect.

So the question then becomes what makes Bitcoin go up in price.

What people are realising is that it’s the most sensitive asset to financial conditions. It almost acts like an index itself. You can literally eyeball the price of BTC and get a read for how the economy is doing, probably better than most signals you’ll see.

When you consider the string of liquidity provisions in the system, which I have often shared here, like oil prices, which are a tax on the entire system because the cost of oil is passed on through goods and services. Interest rates, because every country in the G20 is reducing rates. And the dollar has been dropping, so all of a sudden, the world, which has dollar-denominated debt, now becomes easier to service. All these things have stimulative effects.

Think about it simply:

You have a mortgage that drops by a few hundred dollars a month because borrowing costs are lower. This has the same impact on businesses whose goods and services are also cheaper because of lower oil prices and on increased productivity because people are spending more, so new employment rises and so do pay increases (full-time workers swear they’ve never seen this in the wild).

These effects all result in people having more money in their pockets for discretionary spending, not less.

So the question then becomes, with the extra casholla people have, will it find its way into the assets I am holding? For me, it's simple: they will buy Bitcoin, and we have clearly seen from the chart that when they do, the SUI price goes parabolic.

Now, it is an early-stage asset with a lower float, and in the same way Solana popped off last cycle, there needs to be a use case. But for a first-cycle wonder child, it looks good.

But before you get high on my dopamine-fuelled buzzwords, please read the disclaimer at the footer of the email.

Price performance rules all.

Most here now know that finding value comes from using price as the ultimate indicator, as it reflects the average cost basis, network adoption, and underlying demand, and it tells you the clearest story about the network’s performance.

Particularly when you pair the assets up with any of the base assets.

The reason you do this is simple. Let’s say you want to invest in anything other than Bitcoin. Those assets need to outpace Bitcoin’s price performance, or you may as well just invest in Bitcoin as a safe play.

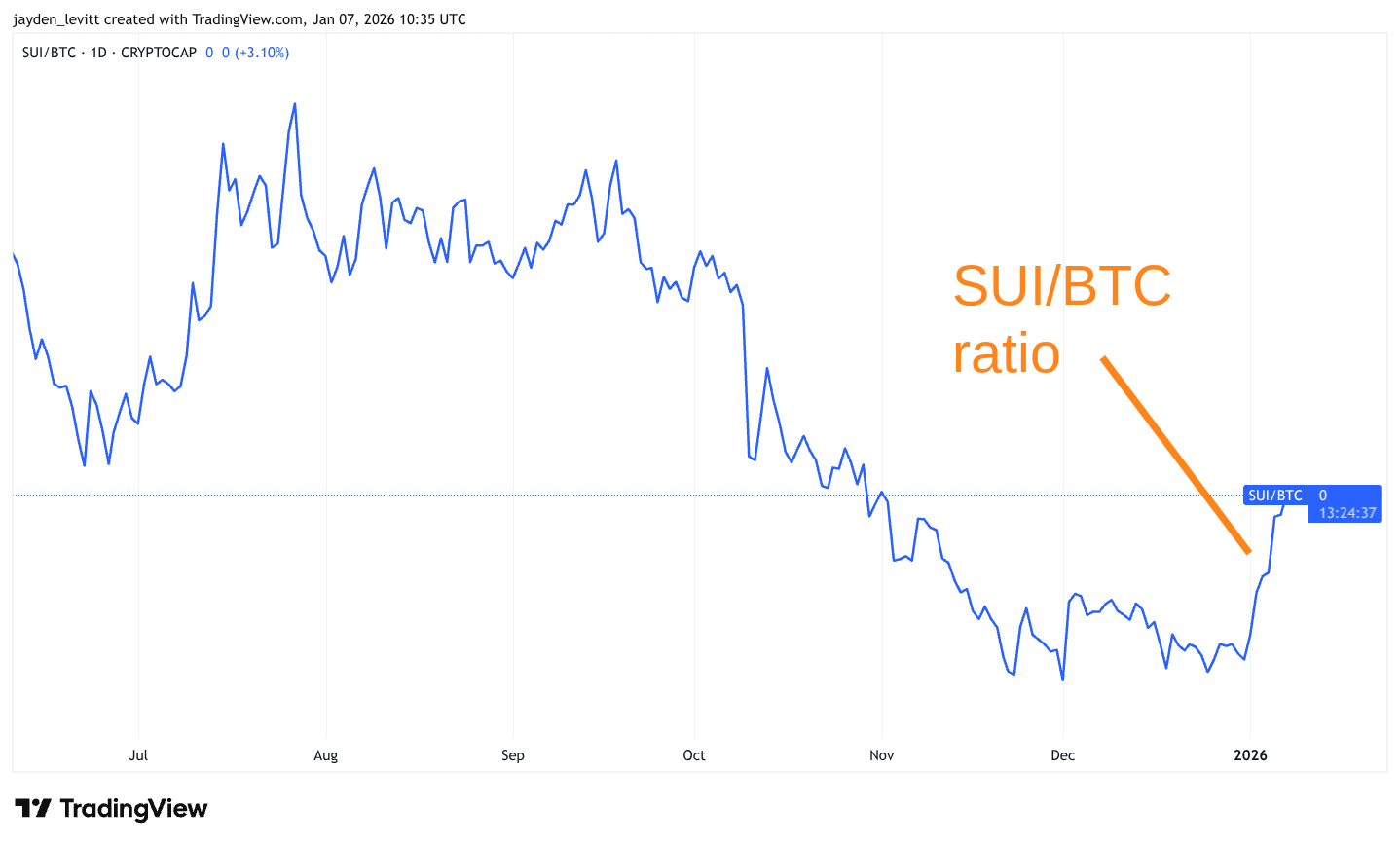

So I use this pair, or the cross method. Steal this for yourself. It’s beyond simple. It divides one token's price by another, so it gives you a ratio, and what you want to see is which coin outperforms which.

As this blog is themed around SUI, which is my biggest holding asset, I will pair SUI up against the top performers, starting with ground zero, the granddaddy, Bitcoin.

I’ll add commentary below on each.

As you can see on the six-month chart, when Bitcoin goes down in price, SUI underperforms because there are fewer spot positions and more leverage against these assets. My timeline was utter carnage. It’s smaller and less liquid, so the drawdowns are more aggressive.

This becomes a benefit and a feature when Bitcoin rises. We then observe crack-induced upswings that are much higher than those of other tokens.

It comes back to my point that this is just a game of stomaching volatility.

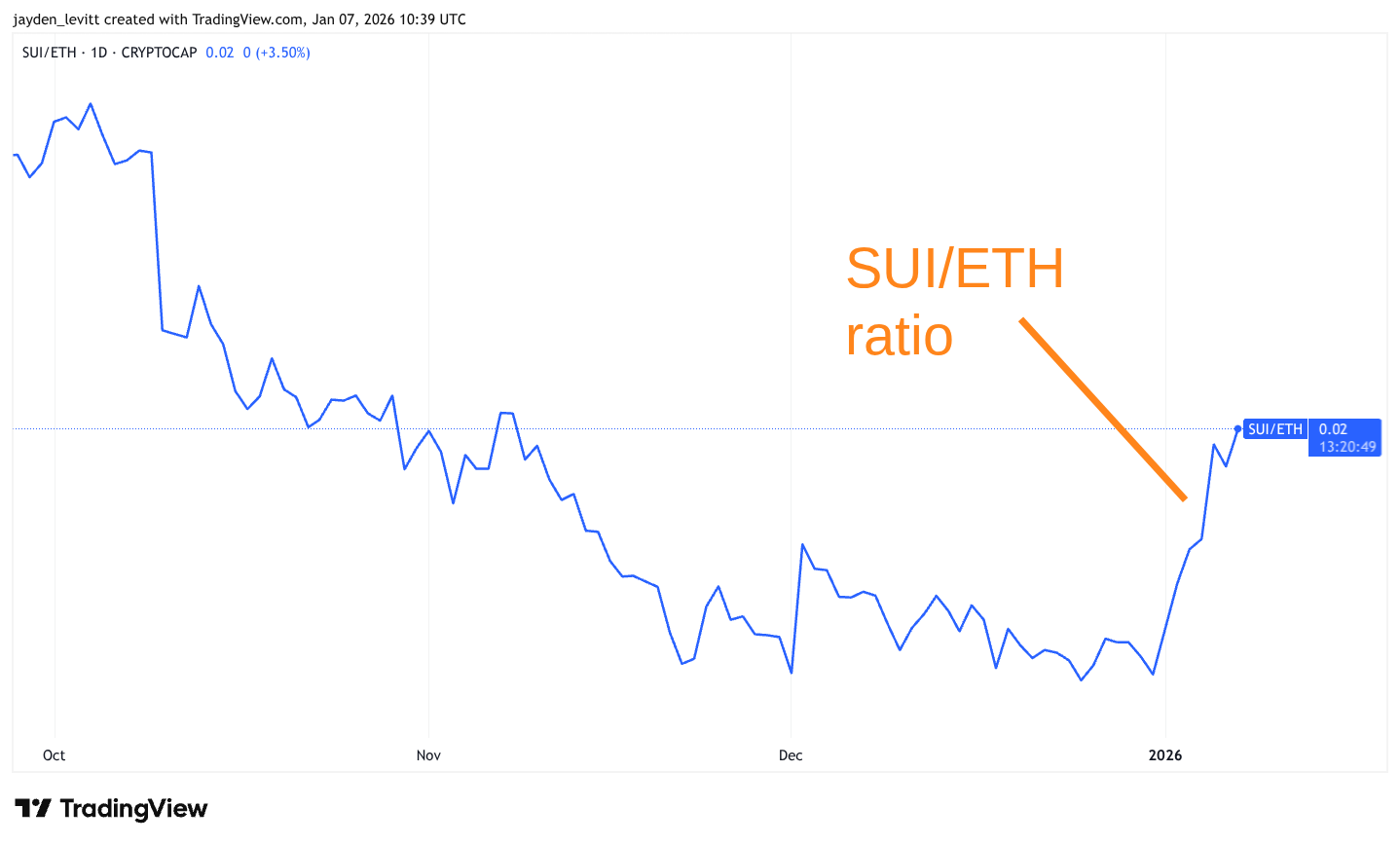

We have the same situation with Ethereum.

Because the market cap is so much larger than SUI's, it takes far more buying pressure to move its price. And when Bitcoin goes down, it drags Ethereum and the rest of the alts with it. No asset here is immune.

But as we headed into Q1 this year, Bitcoin’s price recovery to $90k lifted everything with it. Ethereum increased, and SUI increased as well. When you pair SUI with Ethereum, you can see the outperformance clearly. That’s simply because SUI is smaller. Ethereum sits at around $390 billion. SUI is around $7.5 billion (as of publishing).

I love Ethereum.

Ethereum NFTs are a huge function of how ETH performs, so I already have more exposure than a nudist. But as a coin, SUI looks set to outperform. Simply because it’s smaller (yes, I will repeat that point many times). For you to double your money, SUI only needs to reach $15 billion. Ethereum needs to go close to $800 billion. That is a completely different level of buy pressure.

Remember, this isn’t a religion, a cult, or something you over-philosophise about. It's just a numbers game.

And if you step away from tribalism for one second and just remember that everything is correlated with Bitcoin, and all these assets rise in tandem, it becomes obvious why SUI will outpace.

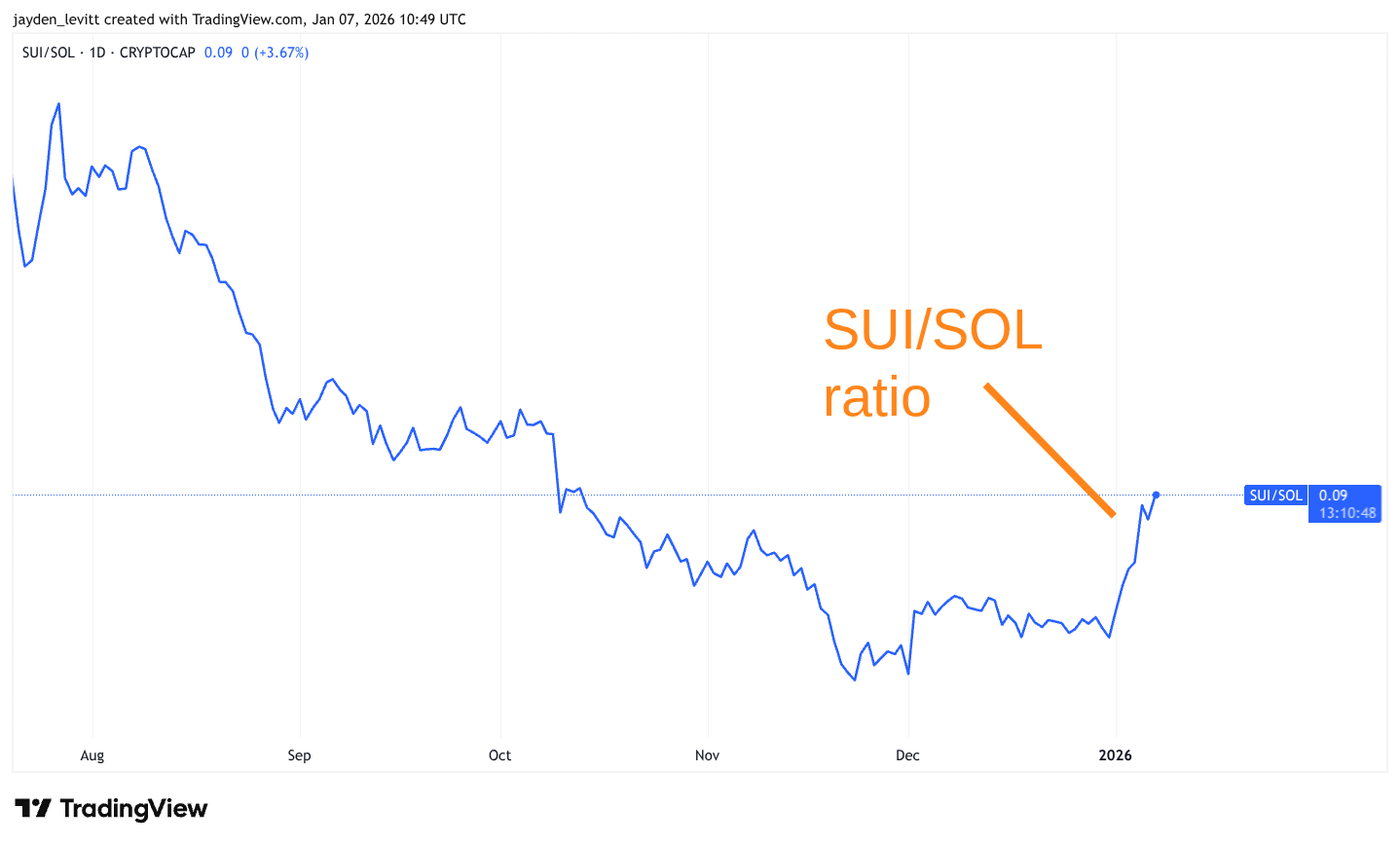

The next on the purge list is Solana.

Sol was the darling of the last cycle, and just to put gut punches into context, I held my Solana from $247 all the way down to $8. So these recent drawdowns are complete rookie numbers.

But I always remember to bank these 90%+ drawdown experiences, and the pebble in the shoe is the possibility that SUI could face the same in a bear market. (More on this at the end.)

Again, it’s the same story. SUI in a drawdown, because everything is correlated with Bitcoin, bleeds the most. And in the upswing, it beats the most. Solana has a $77 billion market cap, which is ten times that of SUI.

When money comes into Bitcoin, the smaller caps outpace by a higher percentage.

Put another way, if both assets receive the same rate of inflows, Solana would need roughly 10 times as much buy pressure as SUI just to break even, given the size difference in their market caps.

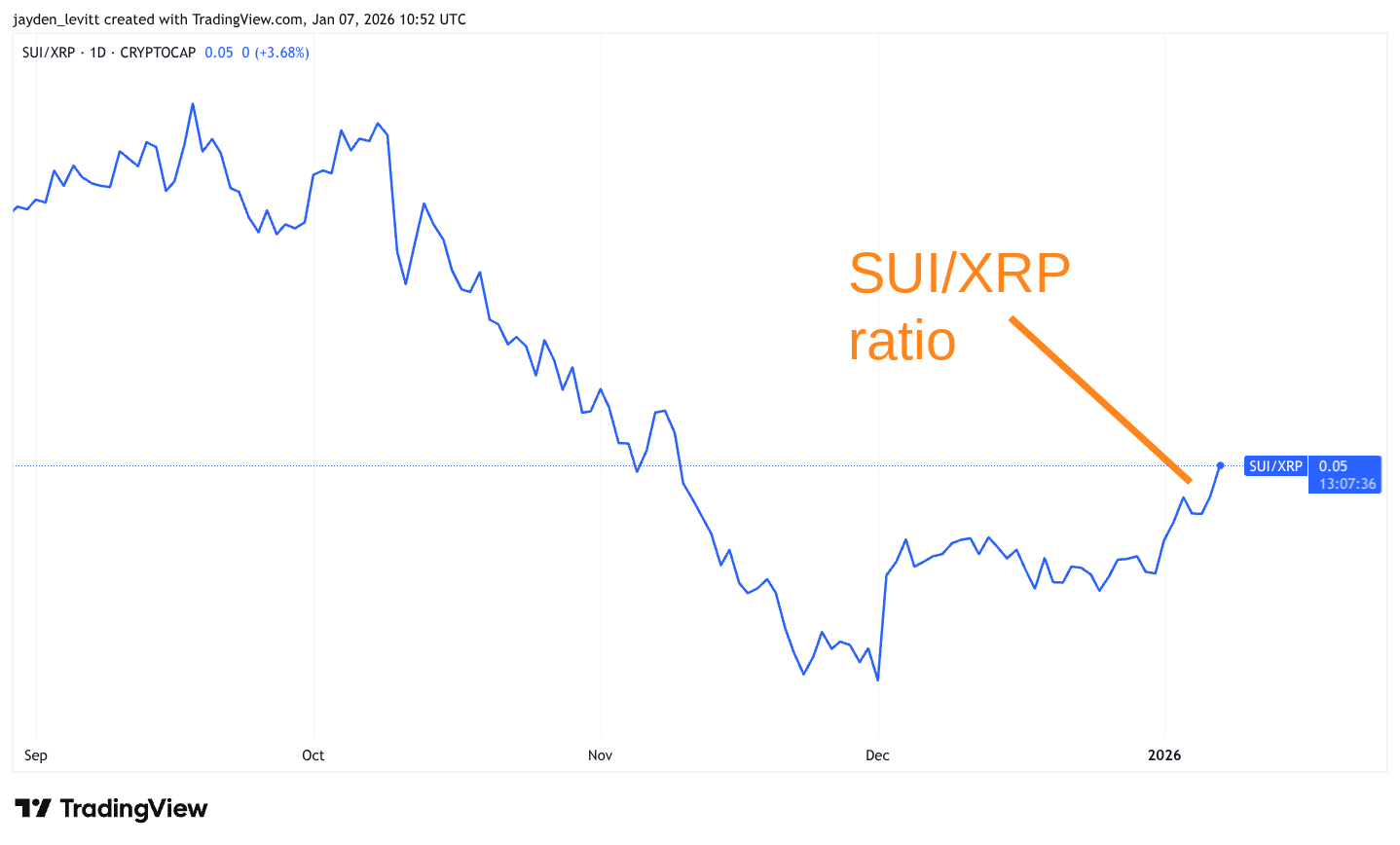

Finally, the best performer over the last twelve months has been XRP.

It initially went toe-to-toe with SUI but held much greater strength against SUI in the drawdown simply because it is a larger network.

I’ll give the XRP cult their props, they’re a strong community.

They have infiltrated the minds of every human I know who is now dabbling in crypto, and the actual mind share backs it up. XRP consistently ranks among the most-discussed altcoins online and has been one of the top assets in terms of social and community mindshare according to CryptoRank.io

The attention the asset gets is insane, which, again, you don’t need to overthink because the results just end up reflected in the price.

And if that “Swift banking” meme pops up on my timeline again, I’m taking legal action against the algorithm.

The market cap is $134 billion, much larger than SUI, and it requires far more buy pressure. Which is why, in an upswing, SUI is now outperforming.

Final Thoughts.

This SUI trade will shake you, but pairing the charts gives you a signal that’s impossible to ignore.

I once heard someone say if you can’t explain why you’re putting money into something in one sentence, your investing thesis is already too complicated.

Mine for SUI is this: It’s smaller, less liquid, and it outperforms on price when Bitcoin rises.

You don’t need to overcomplicate this. You don’t need to buy into a narrative or decide that because the price is down, the team is a bag of shit.

Everything is just correlated with Bitcoin.

Now, conversely, if your asset doesn’t go up when Bitcoin rises, you may well be in the wrong asset.

If SUI had decoupled or failed to recover in price during Bitcoin's recent rally, that would have been cause for concern. However, you can count almost hundreds of instances where even a small Bitcoin rally or decline leads to SUI outperforming or underperforming.

These are network adoption models, and this is just a race to the top for the best-performing ones. And it’s looking more and more like it’s SUI. However, there will be others. HYPE and BNB have had solid performance, too, and a handful of memes are performing well.

This comes down to your appetite for volatility, not di-worsefying and chasing every winner, because remember you can only have your bum on one toilet seat and because everything moves up in tandem, diversification doesn't give you any outperformance.

But the most important element of this cycle is knowing when to sell out of your position, because it will draw down in a bear market, and it will be ugly.

I’ll be sharing the best risk-adjusted strategies for squeezing the juice out of this, including selling strategies, inside my Founders Group only.

Come and join us.

Chat soon, Jay

If you enjoyed this blog, please consider sharing it with a friend who could really benefit. It is how Carrot Lane grows.

This article is for informational purposes only and should not be considered financial, tax, or legal advice. You should consult a financial professional before making any significant financial decisions.

Couldn't agree more. 'But this is no normal world' really hit home. Your point about the Lindy effect explains exactly why this space is so wild and resiliant.