The Surprising Lessons I Learned From the Godfather of Historical NFTs (That Almost Nobody Talks About).

Digging into the roots of NFTs with WhiteRabbit.

If this newsletter makes you think differently today, hit subscribe — free or paid. You’ll unlock my best work. It’s also how our community grows and allows me to keep improving the content.

Everyone piling into this crypto land grab is too busy chasing tomorrow to notice the gold buried yesterday.

In a space this young, the real missed opportunity is ignoring its short history. The part that quietly holds the clues to what comes next.

Once you understand it, all you need to do is accumulate the right assets and do nothing. It's the outsized advantage because there’s minimal execution risk in collecting historical artefacts, but almost nobody talks about it.

The first use case for NFTs is art, the thing that’s always sat at the centre of culture and upstream of wealth, so the asymmetry in the opportunity isn’t hard to spot.

As digital investing expert Raoul Pal says:

“Art is the apex token on all blockchains, and that’s something most people can’t get their heads around. But art is actually upstream of everything. If you think of somebody worth billions of dollars, how many houses do they own? Most people tap out at five because it becomes hard to manage. But when you go to their houses, they often have ten times the value of the house in the art on the walls inside it. You see, art has over the millennia been human storytelling, but it's also been that mimemetic capsule, time capsule, capsule of culture that becomes valuable and becomes a store of wealth. It's transportable. It's exchangeable. And because it's scarce, it outperforms the debasement of currency and it generally outperforms base assets over time as long as the economy is vibrant.”

Couple art with history and culture, and it becomes a formidable combination.

You can never go back and recreate these parts of the timeline, meaning there’s also a fixed supply—there can never be any more.

It’s why I felt compelled to dedicate an entire piece to the Godfather and straight-up GOAT of historical NFTs, the pseudonymous NFT historian WhiteRabbit.

He was a significant safety signal for me and one of the real starting points on my journey into NFTs. For many of my readers, I believe his thesis is essential ground zero.

I was fortunate enough to sit down with him on a private Zoom call (Passcode: ^N0@MUgT) and pick his brain about historical NFTs and his story.

Rabbit explained that NFTs were more than a fad:

“I thought this was going to be revolutionary. This concept of NFTs is going to disrupt multi-million, even billion-dollar industries because of true ownership.”

It was an aha moment for me, too, like finally tuning a blurry radio.

Digital items can now be treated like real-world ones. NFTs address scarcity, and because each one is unique (non-fungible), they cannot be copied or replicated.

The scarcity is what makes them valuable, because for the first time, supply and demand finally apply to digital goods.

Rabbit put it plainly:

“What’s in the digital space can now have the same conditions applied as physical assets. That was the game changer. Suddenly, you can’t just copy a thousand and they’re all the same. You actually have provenance. You know how many can exist. And once that’s true, supply and demand kicks in — the same way it does for physical assets.”

During our call, which lasted over an hour, I learned the most significant things about him were his love of lore, the stories behind projects, and his deep interest in history.

What stood out to me wasn’t the obsession with floor prices.

Quite the opposite.

I believe there’s a lot to be said for actually becoming interested in what you’re buying, being a positive community member, and accumulating assets you understand and care about.

Getting lost in that process allows the serendipity of these historic pieces to quietly increase in value, as time is all that is needed to do the heavy lifting.

Buckle up and let’s dive into it.

Down the rabbit hole

Rabbit in 2017 found crypto the way most of us did—late nights, too many tabs open, and matchsticks holding our eyes open.

Rabbit: “Like most people, I became obsessed. I’d be up at 2 a.m. researching, trying to piece it together. I’ve always loved emerging tech, and when I stumbled into NFTs through a project called Enjin, it hit me: digital assets could finally have provenance and scarcity like physical ones. That changes everything.”

My entrance into NFTs was through a project called VeeFriends.

Back in 2021, NFTs were gibberish to me. They made no sense. But one fundamental element stood out: I remember thinking, 'Hold on a second, there are only 10,000 of these, and the founder has over 60 million followers.' That was just a simple bit of 'kangaroo math' that anyone could have figured out.

Betting on founders instead of history is a roll of the dice.

It’s like herding cats. You have to know whether they have an altruistic view of business, not to want the project to fail, and whether they’ve got the commercial ability to create something significant. If all those stars actually align, they could also get hit by a bus.

Whereas history just needs to exist.

In fact, all it needs is time to properly kick the tyres because you can’t rewind and recreate that part of the timeline, and we are becoming more digital, not less.

In a recent post, Rabbit says:

“It hits different collecting early digital artefacts that were more about fun & pushing the boundaries of innovation & art rather than buying into opportunistic projects designed to take my money & enrich the founders. The latter isn’t ‘wrong’ but the former just feels good man.”

It’s the moat Uncle Buffett talked about.

For Rabbit, the early frontier period sparked curiosity because there were so few.

Rabbit: “Sometimes you think things will happen faster than they do, but the beauty of this space, and these historic assets, is that none of it’s going away. Once you’ve done something truly innovative and somewhat revolutionary — when you’ve laid a foundation for the digital future — that contribution never disappears. Whether it’s cultural or technical, you’ve embedded it in history. And whenever something significant happens, people always want to look back and ask: where did this start? How did we get here? That’s why, well into the future, these early innovators and their projects will always matter. The ones from those almost prehistoric years, 2011 through 2017–18, were incredibly significant, because compared to what came after the hype, there were so few of them.”

Why the first projects matter.

Rabbit’s thesis is deceptively simple: the earliest NFT projects will always matter.

It’s because they don't require streams of attention. People will always have a reason to revisit these early artefacts.

In one of the most definitive blogs I’ve ever read on historical NFTs—a 43-minute monster that Rabbit admits took him an entire summer to write (and he still isn’t done)—the opening monologue reads:

“I contend that we are living in a unique emergence period of a new asset class that will radically disrupt many elements of the way our society operates and how we live. Given this, I believe great value will be attributed to the very earliest of these assets and innovative projects that have pioneered this new paradigm. We have already seen this dynamic start to play out. However, there remain some largely unknown and undervalued digital relics.”

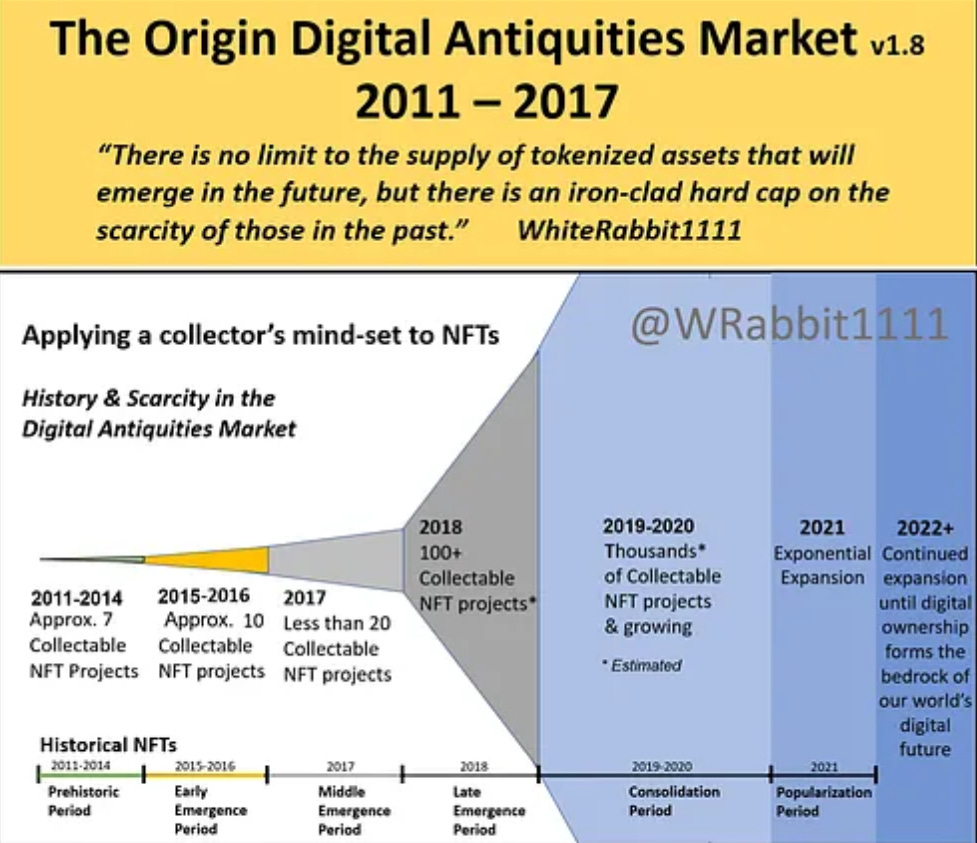

The old marketing cliché “a picture speaks a thousand words” has never been truer than when you look at the digital antiquities charts below through a collector’s lens.

I told WhiteRabbit straight up—this viral post changed everything for me. What it screamed out was how scarcity only grows teeth the further you rewind the clock.

Meme culture and Gaming.

Memes are the most viral cultural unit of the internet age.

At their core, they’re online inside jokes—pictures, videos, or phrases that people remix and pass around until somehow your distant aunt has shared it.

Some fade overnight, others circle back over multiple cycles and have this Lindy effect.

They spread faster than news, outlast traditional forms of advertising, and connect people in ways language alone can’t. So when memes collided with verifiable ownership online, it was like strapping rocket fuel to internet culture.

WR views meme culture, particularly Rare Pepe NFTs, as a cornerstone of digital art and Web3 innovation. He credits them as pioneers of crypto meme art that predate mainstream NFT projects, such as CryptoPunks.

Rabbit sees Rare Pepes as far more than internet humour—they’re a fusion of art, tech, and community-driven value that launched on Counterparty in 2016 and laid the groundwork for the NFT movement, proving the potential of digital ownership and decentralised creativity.

As he put it:

“It’s a whole universe. It started with this mysterious figure, Mike, and a group of ‘Pepe scientists’ curating cards. It was organic, global, and community-driven—before the money came in. The meme was too big for Web2 to contain, so it spilled into blockchain.”

He speaks highly of another project called Spells of Genesis.

His thesis is beyond fascinating.

SOG was the first game to integrate NFTs, launching the FDCARD on Bitcoin’s Counterparty platform in 2015—a milestone for digital collectables and Web3 gaming.

The FDCARD (short for Founder’s Card) was the first-ever tokenised in-game asset, minted on the Bitcoin-based Counterparty platform. It demonstrated that ownership of a unique game asset could be directly tied to the blockchain, making it transferable, scarce, and verifiable outside the game itself.

If you’ve ever read The Everything Token, Steve Kaczynski explains:

“If Epic Games—the company behind Fortnite—went bankrupt, you’d lose all the skins, gliders, and emotes you’ve bought in the game. And don’t even get me started on digital articles vanishing when online media platforms shut down.”

It’s why people will value digital ownership.

While current gamers are rejecting the idea that gameplay will happen on blockchain rails, Rabbit and I kinda laughed that it would be almost ludicrous for them not to be.

Why on earth would you buy an asset and let someone else keep it?

What Rabbit was saying is that if verifiable ownership and Gaming collide, becoming the next frontier, people will look at Spells of Genesis as the project that started it all.

Rabbit: “In the future, the next generations will look back and say, I can’t believe you guys spent so much time and money on these digital assets in games, only to abandon them when you got sick of playing — or worse, lose them when you were locked out of a server. How did the gaming company own everything I was buying? How was that theirs and not mine? People will have a much higher expectation of digital ownership, because blockchain provides a superior model. Gaming has used digital ownership for years, but in an inferior way. That shift is inevitable. It hasn’t cracked the mainstream yet, but it will — because once users understand the difference, they’ll expect it.”

Tribalism vs. history.

Of course, no space this early is without tribalism.

Projects argue over who was “first.” Collectors fight about what counts as a “real” NFT or what is or isn’t art.

Twitter (X) wars erupt over definitions that, frankly, nobody outside of the crypto community cares about.

Rabbit’s perspective on that was refreshing. “It’s unnecessary,” he said:

“These projects give each other value by existing together. It’s like antiques from different eras. The variety makes the space richer. What matters is recognising the innovators who laid the foundations, not rewriting history.”

It’s something I agree with wholeheartedly.

In 2021/22, we saw the “rising tide lifts all boats” effect—every historical project had its moment. This space isn’t player vs. player, but rather, it’s just attention that drives buying flows.

If individual communities are toxic, in my opinion, it leads to friction, which eventually results in less attention and ultimately impacts buying activity.

If you’re dunking on another project, you’re shooting yourself in the foot.

There needs to be more cross-pollination, because if a project closely tied to yours on the timeline fails—whether it came first or not—your project won’t succeed either.

Attention vs. significance.

Rabbit made another point that stuck with me: attention is fleeting, but significance lasts.

“In 2021, everything pumped because of attention,” he said.

Rabbit: “Historical NFTs are anchored to something outside of attention. They’re tied to cultural or technical contributions that can’t be undone. People will always want to know: Where did this start?”

Humans often perceive things that came first as more authentic, purer, or more original, and owning them is usually seen as a sign of status.

We romanticise about this stuff.

Just like people get nostalgic about the first PlayStation, the first iPod, or the first Facebook post, we put extra weight on personal firsts too—our first steps caught on camera, the photo outside the test centre after passing our driving test, or that awkward smile on the first day of a new job.

We give added weight to items or ideas that kick-start something new.

It gives us the feeling of being closer to the start of history, like holding a piece of the timeline itself. That’s why people chase vinyl first pressings, rookie football stickers, first-edition comics, rookie basketball cards, and Genesis NFTs. There’s this belief, sometimes irrational, sometimes dead right, that what came first will always carry weight.

Provenance taps into status, history, and a sense of nostalgia that always gives us a reason to come back.

Author of "Against the Gods: The Remarkable Story of Risk," Peter Bernstein, a financial historian, broke down how we measure risk and why our obsession with scarce assets runs deeper than just money.

As he put it:

“The fundamental value of a scarce asset is not in its utility, but in the fear of not having it when everyone else wants it.”

Collecting with intention.

So where does that leave collectors?

I asked Rabbit what advice he’d give to someone new in the space. He was quick to clarify he wasn’t giving financial advice, but his principle was clear: collect with intention.

Rabbit: “Buy what you love, and know why you’re buying it. Some people collect for art, some for speculation, some for history. But if you don’t know why, you’ll always chase the wrong thing.”

We both agree that once you’re in the historical ecosystem, just buying things you like is an underrated approach.

I’ve yet to meet anyone who’s stepped into the historical NFT space and walked away saying, “You know what, this just isn’t for me.”

Personally, I’ve gravitated toward CurioCards. They predate Punks—they were one of the first experiments in artists getting paid on-chain, which the entire space is now built on.

Their price performance during this soul-crushing 3-year bear market has shown sustained liquidity. You can debate whether they’re “the first” or not, but you can’t deny their significance.

Rabbit agreed. He also pointed me toward niche projects I had heard of but haven’t really dived into, like BitGirls — a Japanese experiment that’s part game, part collectable, part social commentary.

The more he talked, the more I realised that he revels in the fun of historical NFTs. It isn’t just the price potential. It’s the thrill of discovery. Of digging through digital history and unearthing the stories behind the projects nobody’s paying attention to.

Yet.

You can’t take back that first shot.

I opened up a segment at the end of the call for listeners to ask Rabbit a question.

One excellent question that stood out was from one of my Founding members, who is a V1 CryptoPunks holder.

For those unaware, the original CryptoPunks V1 contract, launched on June 9, 2017, contained a critical bug in its marketplace function that allowed buyers to exploit the system by withdrawing their payment after purchasing an NFT, leaving sellers unpaid.

Despite this, all 10,000 CryptoPunks V1 had already been claimed and were in circulation by June 17, 2017, before the V2 contract was deployed on June 23, 2017, to address the issue.

The V2 is now regarded as the official CryptoPunks project.

Michael asked: “How do you see the value of the V1 in comparison to V2 playing out over time, without giving financial advice, of course?”

I prefaced the question to Rabbit by saying that there is clearly some controversy surrounding the timeline, with official Punks holders claiming the V1 is “cope” or people unable to afford an official collection, but V1 holders feeling like they own a niche part of history.

Rabbit's response was epic.

“My take, moving away from the price for the moment, is that you can’t change the history of what happened. You see this with projects like Etheria and Punks. The way I see it is, when this incredible, immutable, decentralised, and powerful technology emerged, it was like the biggest weapon you could pick up. They didn’t realise how powerful it was. They experimented with it, tried to use it, and they fired it. Then they realised you can’t take back that first shot. The technology is immutable. You can give intent with what you want to do with your work afterwards, but you’ve already given something life that you can’t take back. For me, that’s the nature and history of this — it’s part of the lore the fact that you screwed up the first time, you got it right the second time, but the first one still sits there and is available. I love that. I think that's part of the history of this space in learning how to use this new technology in a more responsible way.”

I loved his take on this.

A related, but slightly different, debate came up with CryptoStrikers, where the project was launched without securing the image rights of the players. It was so early frontier that there were no digital licensing laws in place. When Sorare teamed up with the English Premier League, they were not the first to issue digital collectables of the players, because you can’t take back that first shot.

As a result, a bunch of digital rookie cards were created of all of the players from the 2018 World Cup, which included Messi and Ronaldo. And without them even knowing.

Moving away from controversy, I also see these first shots like the rough draft of Mickey Mouse—the first sketch or concept idea that’s not polished, full of rough edges, which is precisely what makes it alluring.

When Walt Disney first doodled Mickey Mouse on a train, he probably never imagined that scrap of paper would one day be worth tens of millions.

The one key distinction is that the piece of paper wasn’t immutable, and he could have taken that first shot back.

Final Thoughts.

The edge here is owning digital assets where their stories can not be unwritten.

None of this is going away.

You’re simply betting on us becoming more digitised because the beauty of NFT is the built-in supply friction, which creates the same conditions you’d expect with physical items.

Except that now these items are transportable over the internet, which is lightning-fast, you also have minimal storage fees and can use your piece of art as a financial tool to borrow against.

It makes me wonder why people wouldn’t own digital items as an investment when compared to owning, say, multiple houses.

Scarcity and firsts have been hardwired into our brains since the earliest cave drawings.

Historic NFT assets also capture culture because the first use case is art, and art has an expressive nature.

But NFTs, which are really an “everything token,” also organise community, letting you socially signal the groups you’re part of online. Be careful not to get too tribal, though—this isn’t player vs. player.

All of these assets will continue to get attention over time.

In fact, the performance is largely a product of better financial conditions. When people have more money in their pockets for discretionary spending, I expect to see significant increases in this space.

Provenance doesn't care about anyone's feelings—no matter what anyone says, you can’t undo these first shots.

They’re the surprising lessons I learned from the Godfather of historical NFTs.

If you want to unlock all of my best work, please consider becoming a subscriber to Carrot Lane. It’s how our newsletter grows.

Excellent interview full of new insights. Thanks!