The Value of Your Money Is Plummeting Like a Broken Elevator Ahead of an Unavoidable Recession (Peter Schiff)

We’ll be fortunate to escape with just a recession. Try Depression.

Photo By Gage Skidmore on Wiki Media

Peter Schiff is a Stockbroker and financial commentator who talks a lot about money and how it works.

Usually, he speaks against the tide of popular opinion.

He’s a lone voice amidst a sea of conformity, and he’s not short of receiving criticism for his tendency to be overly pessimistic, making dire predictions about the economy’s future.

Recently, CEOs of big companies like Facebook, Alphabet, Microsoft, and Goldman Sachs are cutting thousands of jobs because they fear a significant recession is coming.

Strangely the Government think the economy is doing ok based on unemployment figures. But Schiff says the dollar is heading towards disaster, and if we get off with a recession, we’re getting off easy.

Try a depression — the likes of which we’ve never seen before since the 1930s.

After ten years of interest rates at 0 per cent, he says there’s no prayer we’ll get away with a soft landing here.

Let’s get into it because this gets good.

There’s a Crisis Coming That You’ve Never Seen Before.

The Great Depression was an awful time for the United States. It started as a regular recession in the summer of 1929, but things worsened later that year and continued until 1939.

During this time, the number of goods made decreased significantly, and prices fell dramatically.

Industrial production in the United States dropped 47%, and real gross domestic product (GDP) dropped 30%

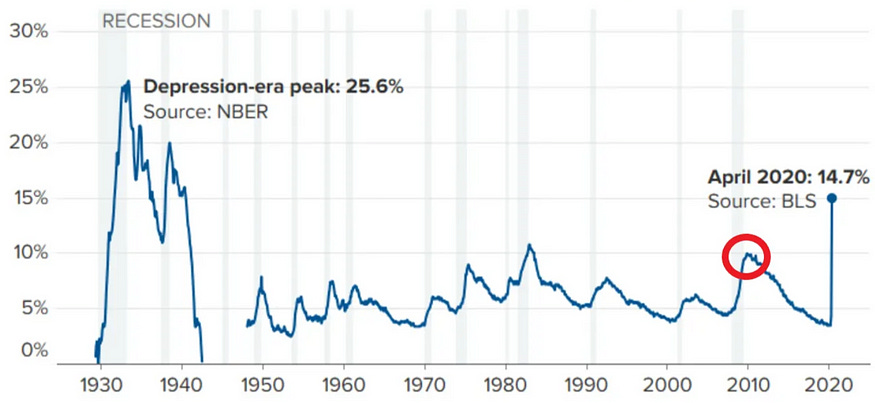

The unemployment rate was also high.

Data shows it was up over 25% at its worst during the Great Depression. As of publishing, it’s currently 3.5%.

Comparing the Great Depression to the Great Recession of 2007–09, America’s next worst recession, it’s clear how severe 1929 was.

During the 2008 Recession, the country’s GDP decreased by 4.3%, and the highest unemployment rate was less than 10%, still well below the 25% of the Great Depression.

Below is the monthly unemployment rate for the National Bureau of Economic Research. Circled in red is the 2008 financial crisis.

Banks Won’t Be Allowed To Fail

The banks as businesses have failed but will never be allowed to go out of business because the Government will continue to bail them out instead of letting them die and wash out the system.

It results in you being able to get your money out of the ATM, but it stings everybody because the dollar’s overall value plummets.

Peter Schiff — Source

“If the Government and the FED allowed it to happen, many banks would fail, but unfortunately, they won’t let them fail.

They’re going to print a bunch of money and create inflation instead. So, instead of losing your money at the bank because it fails, your bank won’t fail, but your money at the bank will lose its Value.

You can go to the bank and take out your money, but when you go to the grocery store or the gas station, you won’t be able to buy much.”

Don’t Overlook the True Danger Looming Over the Economy

Schiff thinks the real threat to the economy is the possibility of foreign countries no longer accepting the U.S. dollar as a form of payment for the products they sell.

The U.S. currently has a significant trade deficit, meaning it imports more goods than it exports. It’s only possible because foreign countries are willing to accept U.S. currency in exchange for the goods they produce.

If foreign countries stop accepting U.S. dollars, it wouldn’t be good for the U.S. economy. The U.S. wouldn’t be able to buy things from other countries and would have to make things themselves, but it needs more factories to do that.

Peter Schiff — Source

“I think we’re probably already in a depression. We’d be fortunate to escape with just a recession.

It’s just going to get worse.

One of the reasons why the jobs report wasn’t much worse, as far as the numbers are concerned, is because the Government created something like 50,000 jobs.

Somehow, the economy is more robust because, based on a number, we’ve got more jobs. But the quality of those jobs has decreased, and most people with two or three lousy jobs would rather have one good-paying job. Unfortunately, they no longer have that option.

The real threat will be the foreigners pulling the rug from under our economy by abandoning the dollar.

That’s what makes this dysfunctional economy possible. We have a trillion-dollar trade deficit, meaning we import a trillion dollars worth of stuff we didn’t make.

We can only do that because foreigners take the paper we print in exchange for everything they produce. But if they stop accepting our currency, how will our economy function without all this stuff?

We certainly don’t have the factories to produce it.”

Final Thoughts

Peter Schiff is correct. Although slightly alarmist.

We’re heading towards something unavoidable.

Interest rates are sky-high.

Inflation is running rampant.

And the Value of your money will slowly dissipate while America faces a debt crisis and continues raising the debt ceiling.

Still, there’s no comparison between how bad things were during the Great Depression and how good our lives are today.

In modern times, there are too many economic safeguards and politically motivated people in the equation for an economy to experience a depression.

Social safety nets, fiscal policies, and monetary interventions are go-to strategies during economic downturns. These measures work together to mitigate a harsh recession’s impact and promote a smoother recovery.

You shouldn’t take a recession lightly or even trust governments not to fumble the ball and get us through this shit storm. But I think Schiffs take on an economic depression is something that wouldn’t be allowed to happen.

America has a giant money printer.

And when there’s no more runway for the dollar, the next frontier?

CBDCs.

Misinformation, the idea that foreign countries will not accept the US dollar is pure BS. It will never happen. The BRICS will not succeed at avoiding the US dollar system. There is no indication of that. Their economies are weak, their bond is weak and no one will store money in those countries currencies or bonds. They can do some intra trading at best. Small potato. For overall global trading they will need to pay in dollars. And by the way, money printing does no create CPI inflation. I affects asset prices, not consumer prices. Consumer prices are affected by supply and demand. Why even mentioning Peter Shif***t!

“America has a giant money printer.

And when there’s no more runway for the dollar, the next frontier?

CBDCs.”

You should see the way the banking industry is being grifted with the spinning of FedNow. So far, very few have signed up.