The World's 5th Wealthiest Person Say If You Understand Your Ambiguous Illusion You'll Become Wealthy

Challenging your biases will help you see things differently and become a better investor.

Happy Sunday to you, wherever you might be!

It's another rainy day here in the UK (who would've guessed, right?). All kidding aside, I had a great time writing this latest piece. I've decided to make it available for free, hoping it adds some value to your day.

I’m considering taking on a part-time research assistant, so your support with a paid subscription is significant in our quest for world domination—chat soon!

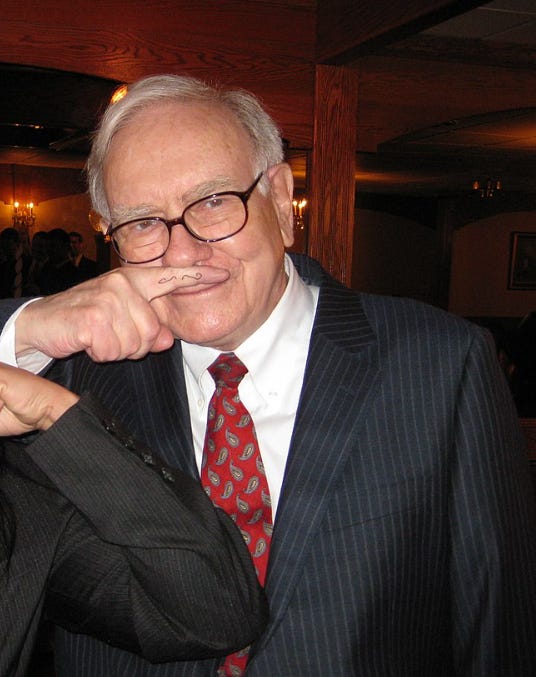

Warren Buffett once said, "I picked up this book, and I saw one paragraph, and it told me I'd been doing everything wrong".

Despite being freakishly bright and a learning machine intensely interested in stocks, he missed the mark, even for someone who had 'investing' etched into his DNA.

Buffett thought his job was to "look at technical analysis and charts, look for head and shoulder patterns and pick stocks that would consistently rise in value."

But after reading chapter eight of The Intelligent Investor, he realised his perspective was "utterly foolish".

When I read Benjamin Graham's famous book in my early twenties, chapter 8 (the one Buffett says to read and re-read) taught me successful investors buy low when there's maximum fear and sell high when there's ultimate greed and at no point should market fluctuations and price swings impact you.

Here's an excerpt.

Benjamin Graham (Chapter 8) Intelligent Investor — Source

“The investor who permits himself to be stampeded or unduly taken over by unjustified markets. That man would be better off if his stock had no market quotation at all. He would then spare himself the mental anguish caused by other persons mistakes in judgment.”

Before you invest (or sell), challenge your "apperceptive mass."

It's like your brain's treasure chest of experiences, memories, thoughts, and everything you've been through.

Your past moulds how you see and think about things happening right now. It's the secret sauce behind why you see and understand stuff the way you do.

Right before global lockdowns, I sold off some of my Facebook stock, anticipating that everything would crash based on media headlines of the market being overpriced (which it was).

People were locked in their homes and sent money they could spend primarily online. Facebook's stock price went from $149 to $378, and my arse nearly fell out (it has since fluctuated).

I was the guy Benjamin Graham referred to when he said "that man" would be "better off with no market quotation." Lol.

What was happening was businesses were advertising more online, increasing the tech giants' profit, which people in the media had anticipated. Still, I chose to ignore it and stuck to my one-sided view.

Warren Buffett says apperceptive mass isn't just jargon. After reading chapter eight at age 19, he had this light bulb moment that uncovered his ambiguous illusion.

It made him look at things differently and flipped everything he thought he knew about investing.

He explains that the mind can sometimes play tricks on us, and it can take a moment of truth or an "aha" moment to change your view.

Buffett explains that ambiguous illusions can be interpreted differently, depending on the viewer's perspective.

He uses the example of the "duck-rabbit" illusion, where some people see a duck while others see a rabbit regarding investing.

Warren Buffet — Source

“The book told me I wasn’t looking at the duck — I was looking at the rabbit, and it changed my life. If I hadn’t read that book, I don’t know how long I would have gone on looking for head and shoulders formations and 200-day moving averages on a chart.”

"But I wore the juice"- The Dunning-Kruger Effect.

Buffett was mesmerised by a persistent curiosity to produce profit as a kid, and his success was no accident.

At 11, he was investing in the stock market and starting businesses selling chewing gum and Coca-Cola door-to-door.

He outshined those cliché lemonade stand tales and even my epic school snack bar takeover. This Omaha wonder kid was like a business genius on overdrive.

He says the skills you master throughout life lie inside your "Circle of competence."

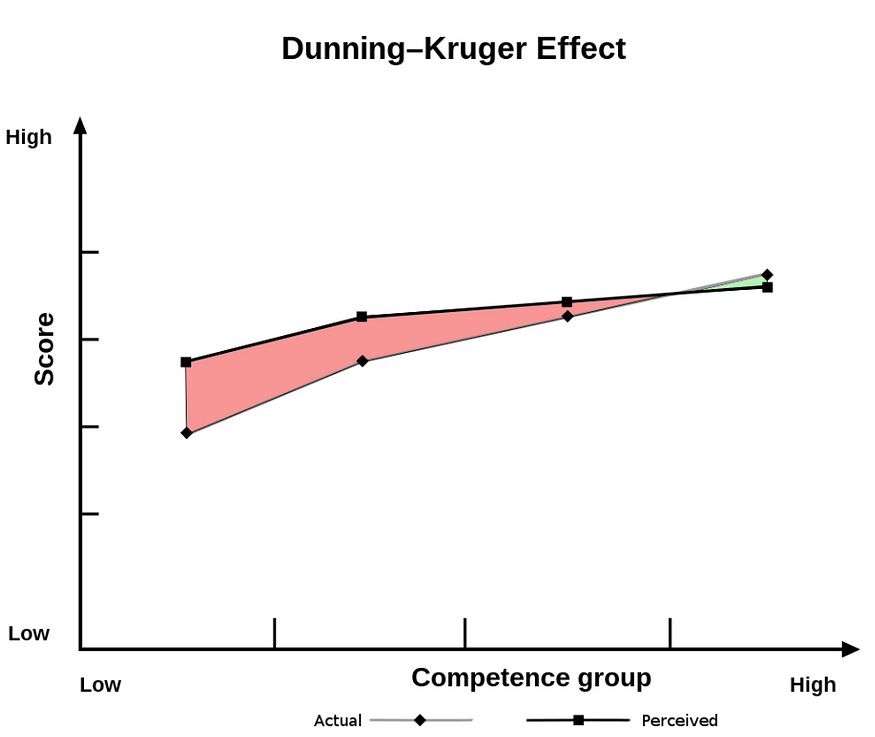

What Warren Buffett is illuding to in investing draws comparisons to a study by David Dunning and Justin Kruger coined the "Dunning-Kruger Effect", where people tend to think they're good at things even when they're not.

One hilarious example they cite in the study where people overestimate their abilities was during a bank robbery where McArthur Wheeler covered himself in lemon juice.

Wheeler then walked into two Pittsburgh banks and robbed them in broad daylight without trying to disguise himself.

Police arrested him later that night, less than an hour after surveillance cameras showed his face splattered on the 11 o'clock news. When police showed him the surveillance tapes, Mr Wheeler stared in disbelief. "But I wore the juice," he mumbled.

It was based on his "apperceptive mass".

Wheeler believed that covering his face with lemon juice would make him invisible to security cameras because lemon juice could be used as invisible ink on paper. Lol.

While this is an extreme example, Buffett says these Ambiguous illusions impact our decision-making when investing.

The study showed almost a level of delusion when people overestimated their value and played outside of their Circle of competence.

Across four studies, Dunning-Kruger found participants scoring in the bottom 25% on tests for humour, grammar, and logic grossly overestimated their test performance and ability.

Although their test scores put them in the bottom 12%, they estimated themselves to be in the top 62%.

If you're not sure, stop guessing and do this instead.

Avoid confirmation bias.

It occurs in investing when you favour information that supports your beliefs while downplaying or ignoring conflicting data (like my Facebook story).

For example, if you invest in a company and only pay attention to positive news while dismissing adverse reports, you exhibit confirmation bias.

It can lead to making investment decisions based on a one-sided perspective, potentially impacting your portfolio's performance.

Warren Buffett says the first important step is to "give voice to opinions that contradict your own."

At a Berkshire Hathaway annual meeting, he famously invited long-time critic and hedge fund trader Doug Kass to participate in the discussion, which is often considered a PR event and for investor confidence. Not a spicy showdown.

Back then, Kass was betting against Berkshire Hathaway stock by short-selling it. It might sound a bit out there, but Buffett saw it as a chance to shake things up and test his own biases.

Buffett explained his view on tackling this mind model, quoting Charles Darwin.

Warren Buffett — Source

“Charles Darwin used to say that whenever he ran into something that contradicted a conclusion he cherished, he was obliged to write the new finding down within 30 minutes. Otherwise, his mind would work to reject the discordant information, much as the body rejects transplants.

Man’s natural inclination is to cling to his beliefs, particularly if they are reinforced by recent experience — a flaw in our makeup that bears on what happens during secular bull markets and extended periods of stagnation.”

Final Thoughts.

The lesson from this is to avoid making lousy investing decisions or knee-jerk reactions when selling and to be aware of our biases and why they exist.

Are your decisions grounded in knowledge and experience, or are we rubbing lemon juice in our faces with the illusion that everything will pan out the way we expect?

I'm totally with Buffett on this one — we've got to ditch our foggy thinking and hunt down information and people who passionately challenge our views.

The part where we talk to people or read opposing views, like Warren Buffet did in chapter 8, is where we grow.

We become more confident when we look at all the facts with a clear head, leaving our personal biases behind.

You can still believe whatever you want, just like Buffett didn't convert Kass into a long-term value investor and vice versa.

Ultimately, it ensures our choices are well thought out, considering all perspectives.

It might even unluck your investing eureka moment.