The World’s Top Business Cycle Expert Just Explained Why Selling Crypto Now Is Madness.

Some folks are already calling last orders on this cycle. They’ll soon find out why the party’s just getting started.

Today’s post is on the house. Usually, it’s reserved for the legends keeping Carrot Lane alive with a small fee.

If you’ve been getting value from these pieces, consider upgrading and joining our crew. That’s how this whole thing keeps running.

Otherwise, kick back and enjoy the read.

Famous American writer Mark Twain once famously said:

"It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.”

I love that quote.

The second you think you’ve got it nailed, that’s usually when it slips through your fingers.

This is Julien Bittel’s wheelhouse.

He’s not just another Jo Schmo researcher. He co-developed what’s now known as The Everything Code. It’s a framework that pulls together sentiment, monetary policy, and business conditions to map where the economy’s headed.

Bittel doesn’t just read the business cycle. He bends the friggin thing over his knee. His research has been a significant sanity check, especially when the economy’s staggering around like a drunk uncle at a wedding.

His view is clear. If this were truly a late-cycle economy, as people claim, and asset prices are near their peak, we’d see businesses, consumers, workers, and investors all brimming with confidence. Hiring and wages would be ripping. Think—CEOs hosting stripper parties and throwing midgets at a dartboard, lol. Surveys across manufacturing, services, housing, and small businesses would be running at extremely high levels.

Bundle that all up, and you’d get the textbook overheating that comes right before a slowdown, the cycle that everyone’s screaming in my DM’s about.

We’re nowhere near that. Sentiment is muted. And as he says, we’re not at the “end of the party” stage. Not even close.

Translation:

Don’t confuse today’s conditions with a late-cycle blowoff.

The usual red flags of an overheated economy just aren’t here.

We’ve still got runway before things reach that kind of euphoric, unsustainable high.

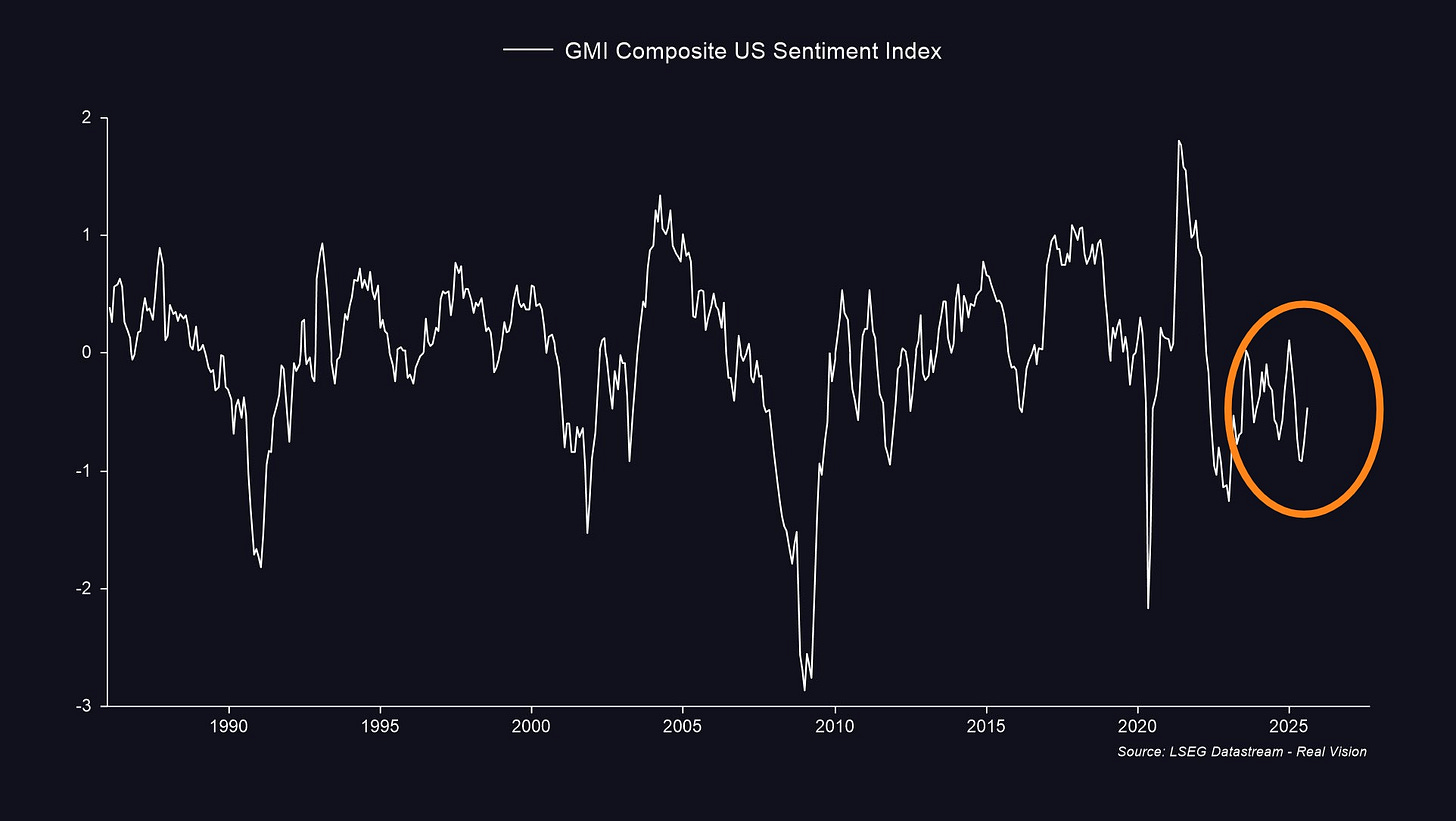

“A classic late-cycle economy typically has all the following ingredients: manufacturing sentiment is extreme (think ISM ~60), services sentiment is extreme, homebuilder sentiment is extreme, consumer confidence is high, worker confidence is high (JOLTS quits rate rising sharply), investor sentiment is very bullish, small business confidence is high, job openings and hiring plans are rising, wage data and surveys show accelerating pay increases, and CEO confidence is strong with capex booming. Now, I could add more to this, but when you score all of these inputs and turn them into a single timeseries, here’s what you get.

Using data from the Institute for Supply Management (ISM), the National Association of Home Builders (NAHB), the National Federation of Independent Business (NFIB), the Bureau of Labor Statistics (BLS), the American Association of Individual Investors (AAII), and The Conference Board, U.S. sentiment—when viewed as a complete picture—remains very subdued. We’re nowhere near the euphoric levels you see late in the business cycle, when all of these indicators are stretched to extremes.”

Author note:

Capex (Capital expenditure) is the money companies spend on long-term assets—such as buildings, equipment, and technology—to drive future growth or efficiency. High capex usually signals business confidence.

JOLTS: (Job Openings and Labour Turnover Survey): published monthly by the BLS, tracks job openings, hires, quits, and layoffs. Lots of openings and quits typically mean a strong, confident labour market.

Bittel says when you roll all these signals into one index, the timeseries points to early-cycle strength, not an overheated market.

90% of central banks are cutting rates. Few realise what that means for the next 12 months.

Julien Bittel believes there’s nothing new here.

It’s just The Everything Code playing out.

“Liquidity drives markets. The Fed won’t hit the QE button until debts can be rolled over at sustainable levels — meaning rates have to fall first. But it’s not just the Fed. Liquidity can come from the PBoC (Public Bank of China), private credit creation, rate cuts, a weaker dollar, or lower bond yields. Back in 2017 the Fed was hiking and doing QT, yet Bitcoin still did a 23x. The playbook is simple: Phase One: rate cuts. Phase Two: debts get monetized.”

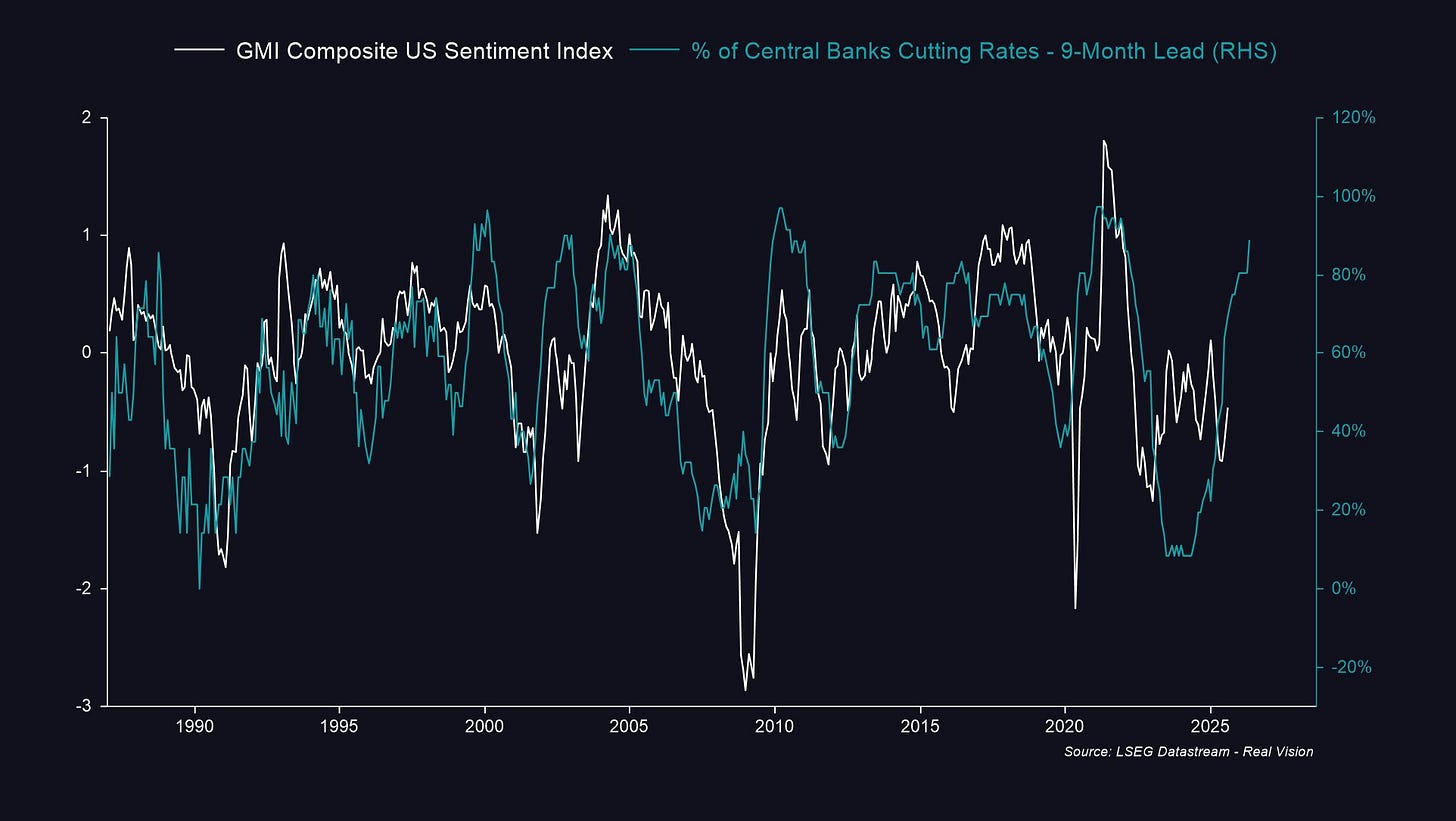

The green line on the chart below indicates the percentage of central banks cutting interest rates, with a lag of approximately 9 months.

It tracks how many central banks worldwide (like the Fed or the ECB) are lowering rates to make borrowing cheaper and kickstart spending when the economy slows.

Central banks don’t wait until the house is on fire—they move when they see smoke. Rate cuts also don’t take effect instantly. It typically takes around nine months for the extra liquidity to be absorbed by businesses, consumers, and markets.

So if that green line spikes today, it’s basically forecasting looser conditions in 6–12 months: cheaper credit, more liquidity, and a tailwind for risk assets like crypto.

In short: rate cuts now are tomorrow’s jet fuel.

Julien Bittel: “Peak cycle is when the ISM rolls over from 60+ to sub-50, inventories unwind, and demand cools. Supply and demand reset, inflation pressures ease, and the cycle eventually recovers out of the slowdown or recession – mostly depending on the extent to which financial conditions tightened during the cycle, particularly late on as central banks hike rates and drain liquidity. However, based on this full set of indicators, the data is pointing to something very different. This does not look like an above-trend late-cycle economy. It looks much more like an early-cycle economy trying to build momentum. Another really important factor, and a key reason we believe both the ISM and this sentiment composite will grind higher this year and into 2026, is the sheer scale of central bank easing via rate cuts. Right now, nearly 90% of central banks are cutting rates. That is extraordinary, and on a forward-looking basis, it is a massive tailwind for the business cycle”

One signal very few even look at.

So Bittel says we’re nowhere near the “late-cycle” stage.

That only kicks in when central banks stop cutting and start hiking rates. Even when that happens, it still takes some time after that before it actually slows the economy. Right now, the opposite is true: central banks are easing, not tightening.

He also points to oil as a strong signal.

When oil prices shoot 50% above their normal trend, that has historically been a recession signal because it acts like a tax on the entire economy. However, today, oil is 16.6% below the trend and still sliding, indicating easing conditions, not tightening them.

Bottom line: Oil prices as a component of financial conditions aren’t flashing the usual late-cycle warning.

“By my playbook, the time to start talking late-cycle is when the green line (above chart) rolls over and begins to drop, as central banks turn to hiking rates to slow growth. Even then, there’s usually a nine-month lag before higher rates hit the real economy. Right now, we’re just nowhere near that... in fact, the opposite is true. To my earlier point, slowdown or recession is largely a function of how much financial conditions tighten late in the cycle. Oil prices are a big part of this equation. When oil runs 50% above trend (below chart), that represents a massive tightening and has almost always signalled recession, looking back to the early 1970s. However, right now, we are nearly 20% below trend and still falling, which shows this component of financial conditions is still easing.”

Buried in this productivity measure is the first hint of what’s coming next.

It’s overtime hours.

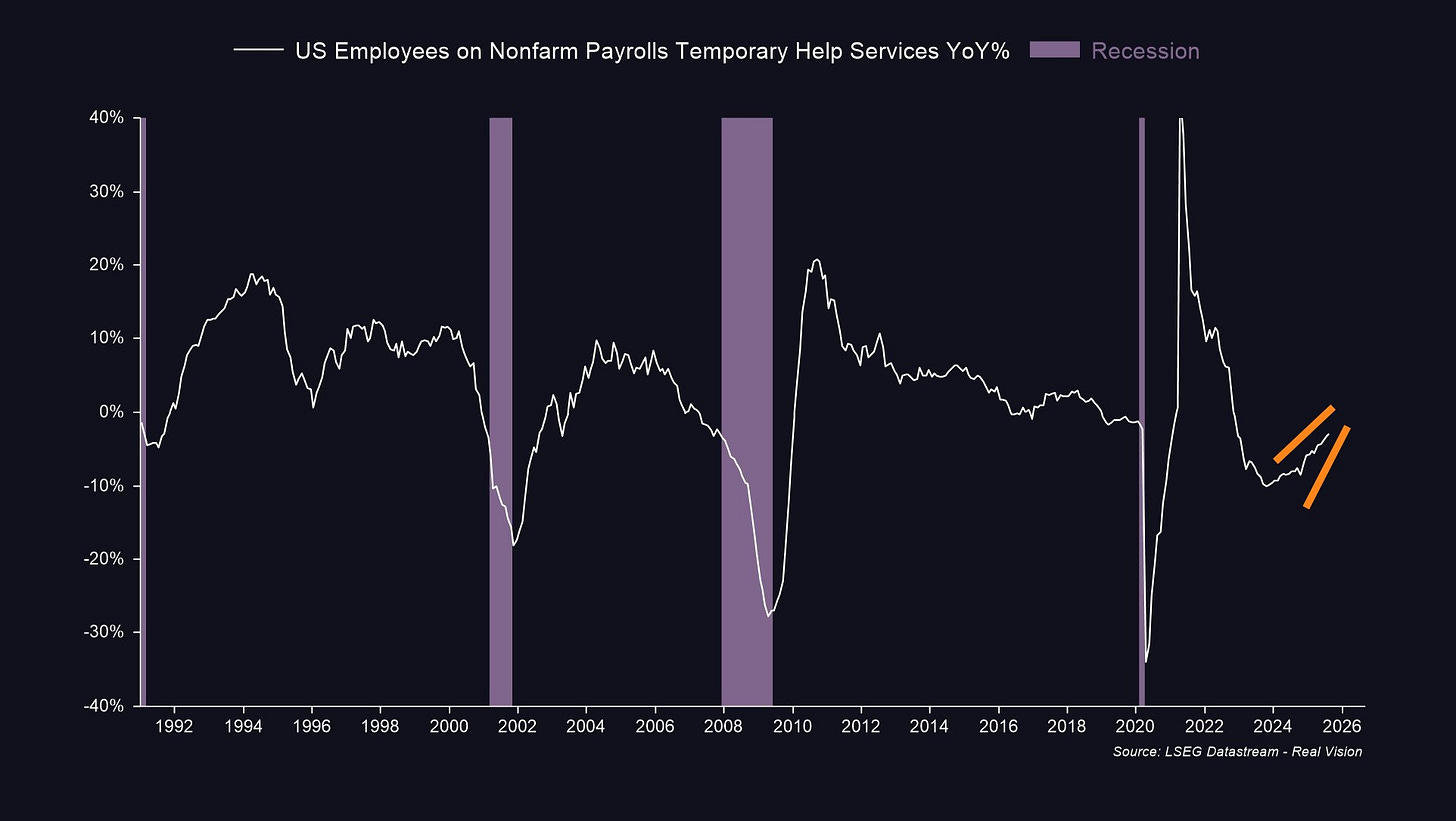

Bittel says he views Temporary Help Services (temp jobs) as a strong bellwether of financial conditions.

When temp jobs are growing after being very negative, that’s a classic early-cycle signal. It means the economy is recovering and businesses are cautiously adding labour.

Late-cycle would be the opposite: temp jobs are already high but start slowing down, showing the economy is overheating and running out of steam.

So why is unemployment still rising? JB says it’s because job data lags. It reflects what happened in the “rear-view mirror”, not what’s happening right now.

Here’s how businesses usually behave:

First, they allocate more overtime to existing staff.

Next, they hire temp workers (flexible, lower commitment).

Only when they’re confident, they commit to full-time hires (which come with benefits, pensions, overhead).

Currently, the pattern is one of temporary jobs rising, as indicated in the chart below. That’s not late-cycle weakness. It’s early-cycle recovery.

“As I’ve pointed out many times, when you look at Temporary Help Services, it has early-cycle vibes written all over it. Rising growth from deeply negative levels is an early-cycle dynamic. It tells you the economy is in recovery mode, not rolling over. Late-cycle is the opposite: positive year-on-year growth that’s slowing, which reflects an overheated economy losing steam. Why is unemployment still rising? Because it lags the cycle. Jobs data is a six-month look in the rear-view mirror. Here’s the thing: full-time hires are expensive. Benefits, pensions, overhead… So what do businesses do first? They typically increase overtime hours and bring in temp workers. Only when they feel confident do they finally lock in full-time staff. That way, they can scale without locking themselves into long-term payroll commitments. So, this isn’t late-cycle. It’s early-cycle (growth up + inflation down = Macro Spring), soon transitioning to mid-cycle (growth up + inflation up = Macro Summer). That’s how I see it, anyway..”

Final Thoughts.

I get emails like, “Jay, time to sell before you get wrecked.” lol.

I’ll take my own advice on that, thanks. More to the question, what is the “why” behind that decision?

I think a whole bunch of noise drives it.

Bittel shows us what late-cycle actually looks like. It’s maxed-out confidence. People are punch-drunk on easy money. Businesses are splashing cash like a busted fire hydrant, and workers are quitting jobs. Or as a recent online meme suggested, it’s ‘watch your mouth’ season for employers.

We’re not even close to that. Sentiment’s still flat, and the party still hotting up.

Then there’s liquidity. Nearly 90% of central banks are cutting rates. That’s not bearish, it’s rocket fuel. Everyone’s out here obsessing over the Fed, when the truth is liquidity flows from every nook and cranny, including China and the declining dollar.

The Everything Code keeps it simple. Phase One: rate cuts. Phase Two: debts get rolled. More money in the system means more money for discretionary spending.

Oil is showing that it’s running under trend, which historically means easing financial conditions, and another tailwind.

Jobs? Look at temporary labour. When temp hires climb after being slammed, it’s early-cycle energy. Businesses test demand with overtime and temporary hires before committing to full-time employees.

Put it together: rising liquidity through rate cuts, no euphoric sentiment, oil prices easing, temp jobs flashing recovery. This isn’t the setup of a market on the verge of collapse.

Selling now? After dragging yourself through one of the ugliest bear markets? I think it’s pure madness.

My words, not Julien’s.

If today's newsletter provided any value to you, please consider sharing it with a friend or family member who would benefit. If you'd like to provide additional support, consider becoming a paid member to access my best work.

I owned a temporary personnel agency in downtown Chicago for many years a long time ago. I love the economic bellwether connection made here, which indeed is true.

That said, temp jobs at companies may have its peaks and valleys, but my Fortune 500 clients budgeted year round for temps, in good and bad economic times. Definitely much lower overhead for them and zero commitment, whenever they’d use temp help.

I often had major companies “test out” my temps, and then they’d call my company to say, “we want to hire your temp full time” - and while it was a nice conversion fee for my agency $$ - I then lost a great temp.

There was always something happening in the world of temps and the companies that hired them ;-) Never a dull day.

Thank you for the analysis.