Warren Buffet: You Can Win Big in the Stock Market Instead of Bitcoin, Which is "Rat Poison"

The world’s most successful investors tell you how to think when investing.

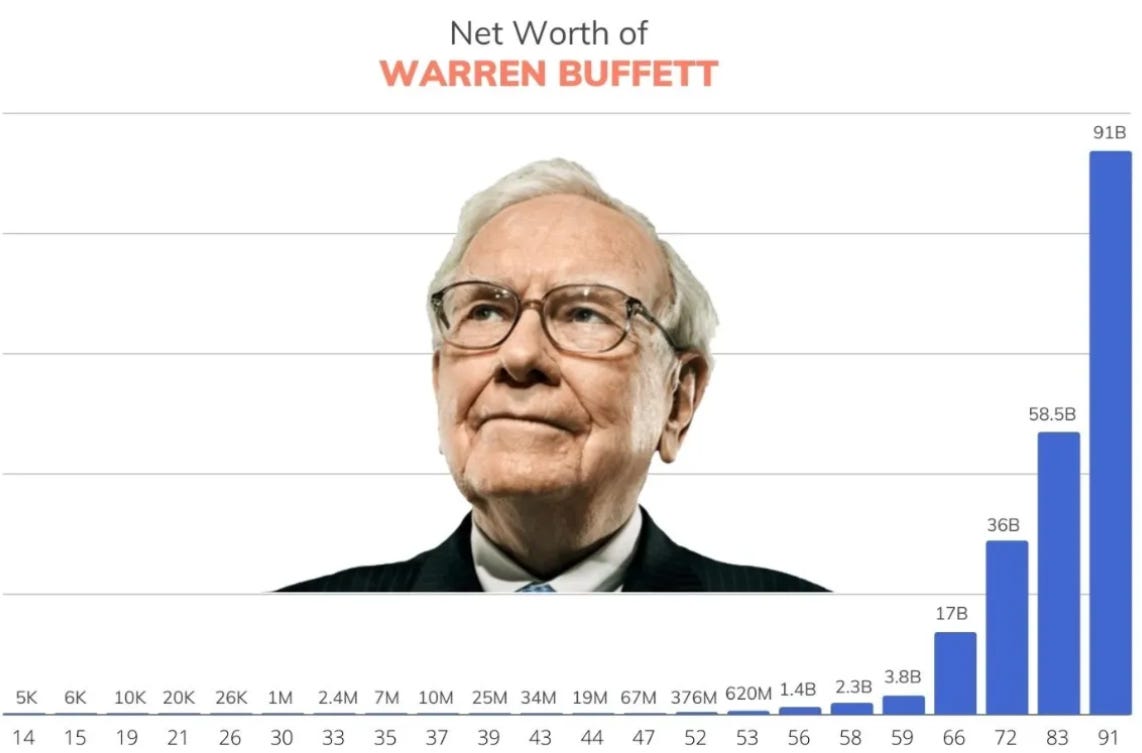

Source — Finmasters

Warren Buffett is one of the most successful investors in history and one of the world’s wealthiest men.

He’s repeatedly criticised Bitcoin and other Cryptocurrencies as risky and worthless.

Warren Buffett:

“Now, if you told me you own all of the Bitcoin in the world and you offered it to me for $25, I wouldn’t take it because what would I do with it?

I’d have to sell it back to you one way or another. It isn’t going to do anything.

I can say almost with certainty that they will end badly.”

It’s well known the legendary investor, and his business partner Charlie Munger are not fans of the crypto movement.

It’s hard to argue with a man of Buffett’s skill and experience. He probably has a point if he’s aiming at the entire crypto market.

Denying Blockchain technology is where he loses me slightly.

Buffett has also previously stated that he does not understand the appeal of cryptocurrencies, such as Bitcoin, and has warned that they are likely to have no intrinsic value.

He’s known for his long-term approach to investing, and he often advises you to take a similar strategy regarding the stock market.

In general, he says, the stock market is an excellent place to invest for the long term, as it provides an opportunity to participate in the growth of companies and the overall economy.

Warren Buffett’s first-ever investment was in the stock of a company called Cities Service Preferred. He invested at 11, using money he had earned from delivering newspapers and other odd jobs.

Unfortunately, the stock could have performed better, and he lost almost half his investment when he sold it several years later.

Despite this early setback, Buffett continued to study the stock market and develop his investment philosophy.

He eventually became one of the most successful investors in history.

His early experience with Cities Service Preferred is a valuable lesson in the importance of careful research and long-term thinking in investing.

While doing a Master’s in Economics at Columbia University, Buffett got introduced to the work of Benjamin Graham, the father of value investing, who would significantly influence Buffett’s investment philosophy.

Value Investing.

Value investing involves looking for companies undervalued by the market and buying their stock at a discounted price.

This approach has allowed Buffett to identify and invest in several companies that have become industry leaders, such as Coca-Cola, American Express, and Wells Fargo.

Over the years, Buffett has made a name for himself by focusing on long-term investments in high-quality companies rather than trying to make quick profits from short-term market fluctuations.

He’s also been known for his willingness to hold onto stocks for extended periods, even if they temporarily underperform, to capitalise on their long-term growth potential.

He’s a Down-to-Earth and Humble Person With a Simple Lifestyle.

Despite his vast wealth, Buffett has a simple lifestyle and modest personal habits. He still lives in the same house he bought in Omaha in 1958 and famously has a Big Mac and soda daily.

He’s a source of inspiration and guidance for aspiring investors, and his advice is sought after by business leaders and policymakers worldwide.

Let’s set aside his stance on Bitcoin for two seconds and dive into his mindset when investing in the stock market.

In addition to his focus on value investing, he emphasises discipline and rationality. He believes investors should base their decisions on careful analysis and reasoning rather than emotions or speculation.

You can see why he’s not keen on cryptocurrencies. They’re speculative by nature.

His simple and timeless advice will help you with your investing mindset when everything is on sale in the current market.

You’ll Learn 5 Critical Pieces of Advice From the Most Significant Investor.

Buffett’s approach to investing emphasises the importance of finding high-quality companies and holding onto them long-term.

Some key pieces of advice from Warren Buffett include:

Focus on the long term. Rather than making quick profits, focus on finding companies with a strong track record and the potential for long-term growth.

Look for companies with solid and reliable earnings. Buffett has said that he likes to invest in companies with a history of consistently generating profits.

Be bold and hold onto your stocks for a long time. Buffett is known for his “buy and hold” approach, where he buys stocks and holds onto them for years or even decades. It allows him to take advantage of the power of compound interest.

Be patient and disciplined. Investing can be a volatile and unpredictable process. Don’t let short-term market fluctuations discourage you, and stick to your long-term investing strategy.

Do your homework. Before investing in any company, thoroughly research the company and its financials. It will help you make more informed decisions and increase your chances of success.

Warren Buffett’s advice emphasises the importance of being patient, disciplined, and well-informed when investing.

Following his advice can increase your chances of achieving long-term financial success.

Final Thoughts.

Warren Buffett is a master communicator who can explain complex financial concepts in a way that is accessible to a broad audience.

And he’s one of the most successful investors in history, with a track record of consistently outperforming the stock market.

To put the icing on the cake, he’s a generous philanthropist who pledged to give away 99% of his wealth to charitable causes during his lifetime.

His candid assessment of Blockchain technology is ironic, considering Berkshire Hathaway, the company Buffett controls, has made several investments in technology-related companies, all making inroads into Web3 and Blockchain technology.

These investments include companies at the forefront of the internet and technology revolution, such as Google, IBM, and Apple.

Overall, selectively using only some of Buffett’s expert advice can be a helpful way to incorporate his insights and expertise into your thinking while also allowing you to maintain your perspective.