We’re Heading for a Recession, and Your Bitcoin Investment Is About To Crash to Zero (Peter Schiff)

Brace Yourself for a Crisis Worse Than 2008

Photo By Gage Skidmore Commons Image

Do you ever feel like some financial commentators speak against the tide of popular opinion only to get views online?

There’s something sinister about radio personality and financial commentator Peter Schiff.

When you watch his videos for any length, it’s clear he feasts on a doomsday narrative, like a fat kid with no regard for portion control.

His perspective sets him apart, giving him a platform that invites accusations of being a “Bitcoin FUD puppet” who repeatedly has said the Bitcoin bubble will burst and likely go to zero.

He insists you should invest in Gold instead.

By anyone’s standards, we’re heading for a recession. It’s as obvious as a punch in the face. How the market will respond in terms of Bitcoins price is uncertain.

But we’ve seen increased adoption, with Bitcoin still growing at 116% yearly against internet adoption at the same stage of 68%.

So far, we’ve seen a cascade of bank failures, leading to growing distrust among the people and a complete shift in sentiment towards Bitcoin, now viewed as a life raft amidst a failing financial system.

Schiff says Congress and the Fed have crucified the dollar with money printing and destroyed the financial system, but in the same breath, he’s also certain Bitcoin doesn’t possess any real value.

To him, it’s fantasy.

He says there are more effective means of exchange, and you can’t rely on Bitcoin to retain value where there is none. Except for the fact that people believe its value will rise, and as a result, individuals are willing to purchase and hold Bitcoin based on this expectation (Sounds just like Gold).

He says Bitcoin is going to Zero. It’ll take a little time. But it will.

Peter Schiff — Source

“Nothing goes down in a straight line, okay? There are numerous individuals with a vested interest in maintaining the price of Bitcoin. So, there are people ready to buy.

I don’t anticipate Bitcoin reaching a new high. After this consolidation phase, which currently stands at around $22,000 during this interview, I believe Bitcoin will decline and surpass last year’s lows, around 15 to $16,000.

We’ll likely trade below $10,000 before the year ends. Will we close below $10K? I’m uncertain.

They’ll (Bitcoiners) probably buy the dip again. However, in the following year, we may see it drop to $5,000 or even $1,000.

I do expect the remaining air to deflate from this bubble. As inflation remains persistent, it becomes evident that Bitcoin is not a hedge or digital Gold.

It lacks any inherent properties of Gold; it’s merely a collectable digital token without actual value.”

Brace Yourself for a Crisis Worse Than 2008

There’s a provocative undertone to Schiff when he blatantly says Bitcoin has no value while the growing masses are starting to accept it as value.

The data for Bitcoin is undeniably clear unless you’re intentionally hiding from the facts.

Peter Schiff can be more balanced, and like most of us, he’s concerned about the financial situation that’s on the horizon. He thinks it’ll be worse than the 2008 financial crisis, possibly closer to the 1929 Great Depression.

The Federal Reserve’s actions have destabilised the banking system and the automotive and housing industries. As loans come due and the market starts to wobble, Peter says the banks holding these loans will collapse.

If interest rates reflected the actual cost of borrowing, the Government would not have been able to engage in such lavish spending.

Schiff thinks the Government’s current size and spending habits would not have been possible if interest rates were higher and the interest on the debt was unaffordable.

He’s now warning that the entire financial system, from banks to the housing and the automotive industry, is on the brink of collapse, and the low-interest rates (set by Fed) conducive to higher Bitcoin prices and speculative investing will destabilise these industries.

Low-interest rates have also artificially propped up these industries, built on a fragile foundation, and are now crumbling piece by piece.

Peter Schiff — Source

“The entire banking system is a house of cards, built on the foundation of the U.S. government, and now it is collapsing one card at a time.

Although the banks are at the forefront of the 2023 financial crisis, it is not limited to the banking system.

The Federal Reserve has also caused everything that is a function of interest rates to be all screwed up because rates were so low for so long.

It includes the automobile industry, where people bought cars with low-interest loans, propping up the whole automotive market.”

Here’s What This Could All Mean for Bitcoin.

Bitcoin has never experienced a period of quantitative tightening or a recession, making it hard to gauge what might happen when the economic shit hits the fan.

The only comparison is to see how other comparative assets with the same characteristics did during a downturn.

Despite what Schiff says, Gold as an investment could be as close as you’ll get to a comparison to Bitcoin.

Heck, Goldman Sachs has said Bitcoin is eating away at the market share of Gold and will continue to do so as more millennials continue to place value on digital assets.

Gold has traditionally been considered a safe-haven asset during economic downturns. It tends to retain its value or even increase when other investments crash.

We can get insights into how Bitcoin might fare by examining how Gold performed during past recessions.

Let’s take the Great Recession, which lasted from 2007 to 2009. Gold experienced a significant increase in value, solidifying its reputation as a safe-haven asset.

Here are some key data points regarding Gold’s performance during that period:

Pre-Recession (October 2007): At the onset of the recession, the price of Gold was approximately $740 per ounce.

Financial Crisis Peaks (2008): Gold’s value steadily rose as the crisis deepened. By March 2008, it surpassed the $1,000 mark, reaching around $1,000-$1,030 per ounce.

Market Volatility (2008–2009): Gold continued to appreciate throughout the volatile period. In September 2008, following the bankruptcy of Lehman Brothers, Gold reached an all-time high of around $1,190 per ounce.

Recessionary Bottom (Late 2008): Despite some temporary pullbacks, Gold remained relatively strong compared to other assets during the recession. It maintained a price range of $800-$900 per ounce.

Recovery Phase (2009): As the global economy recovered from the recession, Gold’s price remained relatively stable. By the end of 2009, it was trading at around $1,100 per ounce. (Current $1,952.00)

Final Thoughts

Peter Schiffs take on Bitcoin strikes me more as someone appearing as a pantomime villain.

It’s almost like how flat earthers revel in their delusion.

Since 2009, the inflation-adjusted return of Gold annually has been about 3.3%, and the total return has been about 57%.

You have to consider since then, we have had ten years of the best global economy in living history. You could’ve farted into the wind and made money in the stock market.

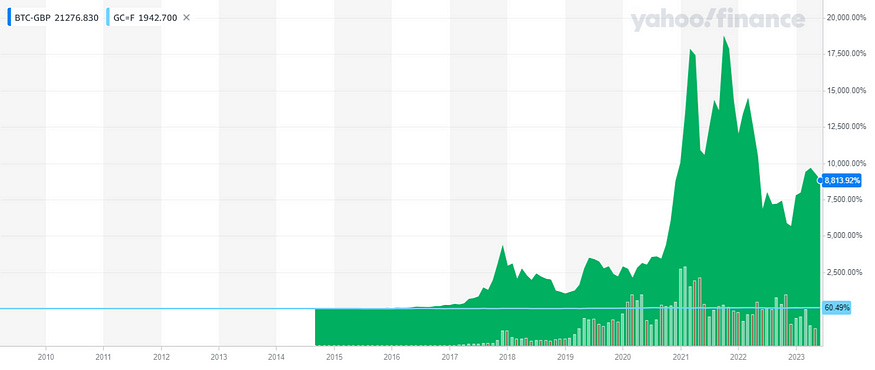

In the same period, Bitcoin had an inflation-adjusted annualised return of nearly 145% and a total return of 33,983,965%.

Since 2009 Bitcoin has outperformed Gold by 8,813%

You could look at the flaws in this comparison.

Gold has an extensive history spanning thousands of years, whereas Bitcoin has existed for just short of 15 years and is still going through its discovery phase.

Bitcoin shows all the right behaviours in moments of a crisis.

It’s being battle tested against the economic elements.

Even just for the prospect of a price increase

People are holding onto it for dear life.

Great article. It always amazes me how we can get such extremes of opinions each with so much certainty!

As Ray Dalio says very eloquently in his book on "Big Debt Crises", Technological advancement generally trumps history. All major advancements in history occurred with Technology. These often changed the World Order