We’re Heading for a Recession, but if You Panic, the Economy Will Encounter a Catastrophic Failure (Jamie Dimon)

The most powerful banker in the world says we need to negotiate the debt ceiling before a disastrous default.

Photo By Steve Jurveston Free Wiki Image

Panic permeates.

It clouds your judgement.

But amidst all the chaos and uncertainty, you’ve got to remind yourself that humans will figure it out.

Jamie Dimon is America’s most potent banker and one of the few with a net worth of over $Billion.

He comes from a rich heritage of bankers.

His father, Theodore Dimon, was a stockbroker, and his grandfather, Panos Papademetriou, was a Greek immigrant who worked as a banker. Their influence played a significant role in shaping his path to success.

Through the hours of interviews and reports I’ve read, Dimon’s personality is a bit like “Jekyll and Hyde” — someone who exhibits drastically different behaviour or temperament at other times.

Heck, his name isn’t even Dimon. His grandfather fell in love with a French girl and wanted his name to sound French. Come on.

I appreciate Dimon’s old-fashioned approach.

He embodies the “word is bond” mentality. So much so that throughout his carrier, he’s carried a folded-up piece of paper in his pocket with a handwritten list of who owes him favours and who he owes.

The man who describes his political stance as “barely a Democrat” is now expressing concerns for the state of the economy and that the government is using the debt ceiling as a political hockey puck.

If you weren’t aware, America is about to run out of money because they spent like a drunken sailor for 20 years.

I don’t want to be all doom and gloom, but Dimon is saying we’re all heading for catastrophe faster than the spread of a bat virus if we don’t do something about the debt ceiling.

Buckle up, strap yourself in and let’s get into it.

Current Market Conditions Are Tricking the Hell Out of You.

Your everyday person still has a savings pot that felt like a bottomless well when it was raining free pandemic money. It’s why the so-called experts are extending their timeline for a recession.

The economy’s doors have opened across the globe, so people are spending generously dining out, travelling, and engaging in other experiences limited by the pandemic, leading to a resurgence in people’s spending habits.

The Bureau of Economic Analysis reported that personal income increased by $67.9 billion (0.3%) in March. Disposable personal income (DPI) saw a boost of $71.7 billion (0.4%), and personal consumption expenditures (PCE) rose by $8.2 billion (less than 0.1%).

Things look hunky-dory.

Dimon is cautioning that your bottomless well of money is nearing depletion. Consumers are gradually spending surplus funds, and soon you’ll feel the impact. The bite of this financial situation is around the corner.

Jamie Dimon — Source

“There’s a contradiction in the current economic landscape. Equities are performing well, but there’s a recession coming.

There are still consumers in America, and job unemployment is 3.5 per cent. Home prices and stock prices have been rising for 10 to 15 years.

People have an extra trillion dollars in their checking accounts, and they’re spending that money.

You can see it in travel, restaurants, and hotels. It’s all good, but that excess money will eventually run out.

The consequences of this will likely occur later this year or early next year. Additionally, quantitative tightening (QT) effects have yet to be felt.

With higher inflation, it’s reasonable to expect these factors to come together, possibly resulting in a mild recession, which I would welcome right now.”

Politicians Are Using the Debt Ceiling as a Political Football

Recently Donald Trump went live on CNN in a combative Q&A session that produced a piece of television theatre that’s still going viral on various social media platforms.

He clarified that he wouldn’t raise the debt ceiling because he isn’t the president. However, when asked what he would do if he held the presidential position, he humorously responded, generating laughter from his fan base, “I’d raise the debt ceiling.”

Congressional Republicans want to refuse to raise the debt ceiling to force a default. Why? Because unemployment would surge, making the Democrats and Joe Biden look bad.

Heck, they look bad already. Republicans playing Russian roulette with the potential of 8 million job losses is insane.

Jamie Dimon — Source

“One more thing, he (Trump) knows very little about (Debt ceiling).

Let’s break it down into two categories. First, there’s the actual default scenario, which could be potentially catastrophic.

This could unfold in countless ways, but everyone knows it would have severe consequences.

However, it shouldn’t happen because it would be considered catastrophic, and as we approach that point, Panic will ensue.

As we get closer to a default, markets will become volatile, and there could be a decline in the stock market.

This situation is far from ideal.

We must remember the American financial system is the foundation of the global economic system.

There’s a possibility of getting downgraded, just like the last time. Our debt-to-GDP ratio was around 65 or 70 per cent back then, whereas now it stands at 105 per cent. (It’s much higher)

Our deficits are two or three times higher than before. We need to exercise extreme caution. Ideally, we should stay within that point.

I respect both sides of the argument. I would love to eliminate the debt ceiling issue. However, negotiation is essential.”

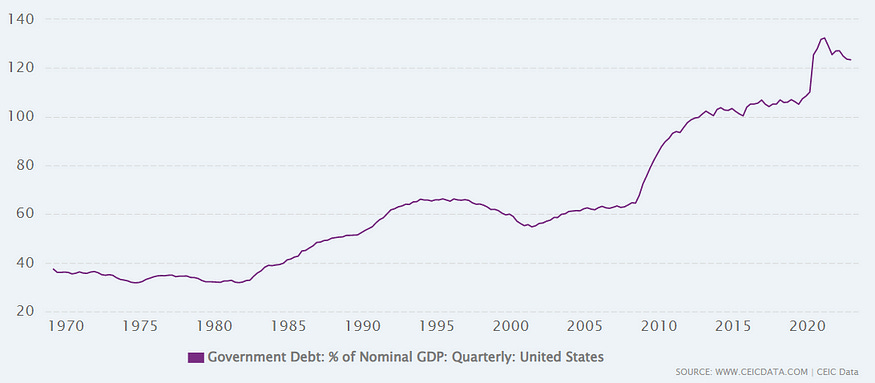

The Debt to GDP Data in America Is Shocking.

The debt-to-GDP ratio is a way to measure a country’s debt against its economic output.

It compares the government’s total debt to its Gross Domestic Product (GDP), the full value of all goods and services produced within the country.

It’s what Jamie Dimon is alluding to, and it’s never looked this bad for America.

In short, the U.S. is borrowing more and producing less.

In December 2022, the United States Government debt was equal to 123.4% of the country’s Nominal GDP. This percentage decreased slightly from the previous quarter, which had a ratio of 123.6%.

It’s worth noting that the debt-to-GDP ratio reached its highest point ever at 132.4% in March 2021, but in September 1974, it was at a record low of 31.8%.

Final Thoughts.

Jamie Dimon is right when he says we should tread carefully and not underestimate the power of panic in the markets.

Politicians using the country’s debt limit as a bargaining tool is out of our control.

History has shown fear and uncertainty can lead to irrational selling, where securities and people seek refuge in cash.

Even during the 2008 financial crisis, we witnessed assets sold at a fraction of their actual value due to panic.

Using the Microfinance Lab data, one study shows that the average recession in advanced economies over the past 150 years lasted one and a half years.

Recessions that are preceded by or associated with financial crises and credit booms are much more damaging to the economy than recessions that are not.

The same data showed that when a country enters a recession with high levels of public debt, it limits the ability of governments to tackle the situation effectively. As obvious as a slap in the face.

As we approach the brink of default, heightened panic can trigger a catastrophic event.

Stay calm.

Keep your powder dry.