Why Buying Crypto During This Crash Might Be the Best Move You’ll Ever Make.

It starts with understanding this one framework.

A big shoutout to the paying subscribers who made today’s newsletter possible. If you want early access to my best stuff, consider upgrading (annual plans are 50% off). It fuels my writing and helps to improve the content delivered to your inbox.

The best advice I've ever heard in Crypto is — "Have a long-term time horizon, learn how to take pain, and when there is pain, you buy more."

Buying assets after they've crashed by 50% or more sounds crazy, but that's often when the biggest opportunities appear.

It's tough, it's risky, and it goes against every instinct, but if you can keep adding to your position, you'll enjoy the compounding effects later.

I've been deep in Crypto since 2017, and hands down, the ISM framework is the best tool out there. It gives you a 22-month head start on where things are going and provides a rock-solid roadmap.

The Institute for Supply Management runs a sentiment survey where over 50,000 execs running their company's supply chains weigh in on key activity levels—things like employment, new orders, production, inventories, stock prices, backlog orders, and imports.

It tracks 400 U.S. manufacturing companies and gives a glimpse into their productivity expectations. It's widely regarded as the most reliable indicator for predicting the direction of the U.S. and global economies.

It's significant for crypto because, once productivity increases, it leads to corporate profits and higher stock prices, which increases investor risk appetite.

People then rotate further down the risk curve into assets like Bitcoin, Ethereum, and Solana.

Once I got this part, it was a total aha moment—finally, some clarity on how to really squeeze the juice out of a trade.

Motley Fool calculated:

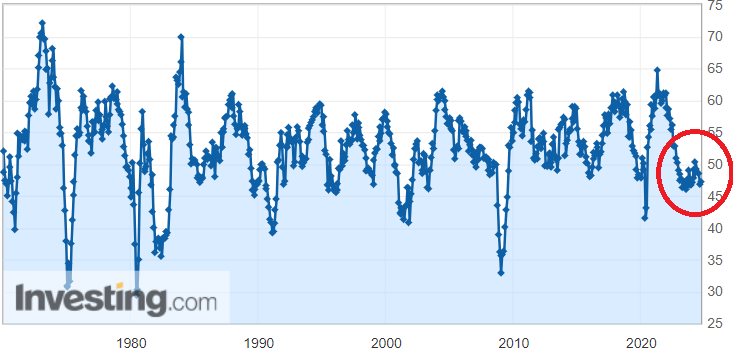

"Between the beginning of 1948 and January 2023, the ISM Index fell below 43.5 on 14 occasions. Except for a steep decline in the early 1950s, a drop below 43.5 has signalled a U.S. recession every single time for seven decades."

It's as sharp as a surgeon's scalpel and hasn't missed in 70 years.

An ISM score below 50 signals contraction and can be a warning of an approaching recession.

Conversely, the economy grows when the score is above 50—anything over 60 means we're hitting boom time.

We're sitting at a score of 47.2 right now, but it looks like we've hit bottom. Before you check the chart, consider the perspective of top Marco guru Raoul Pal.

"What you don't want to do is look at where the ISM is today. The secret is the ISM goes up and down in a cycle — when it goes down, it usually goes all the way down into a recession, and when it goes up, it goes up to a boom — once you know that, you know how to invest, and I find the ISM the single most important indicator".

When liquidity changes, everything changes.

People are talking about this increasingly:

Asset prices are a product of money printing.

In 2008, every major economy hit the reset button, dropping interest rates to 0%. Business cycle expert Julien Bitel calls this the "everything code" — a cycle in which multiple liquidity events align every four years, driven by central bank debt refinancing that sped up after 2008.

That same year, during the Obama-McCain election and after the worst recession, stimulus was handed out like candy. The stock market crashed, marking the bottom of the cycle. Meanwhile, Bitcoin emerged with its built-in halving event that cuts mining rewards in half every four years.

They all align in this cycle, and we're at the beginning of a new one. Or, as the best liquidity cycle expert in the world, Michael Howell, says:

"The very best time for risk assets is when you get a sluggish economy that central bankers want to stimulate, and that's what we've got now, but there is an upside, a bigger upside than potentially expected by many."

All the signals are pointing in one direction.

Q4 in October is the most bullish month for Bitcoin, with an average price increase of 30%+.

September, where we are now, is notoriously rough—so bad that Twitter users have dubbed it "Rektember”, with a price average of minus 6.3%.

A weakening economy actually benefits Crypto.

When financial conditions soften, the money supply is boosted to protect 75 million Baby Boomers whose pensions are tied to the stock market. They can't afford a crash, so the economy is re-stimulated, which keeps driving up asset prices but debases currency at 9% a year.

Zoom out a bit, and you’ll see global M2—total money in circulation—just hit a new all-time high.

Everything's set for crypto to take off like one of Uncle Elon’s rockets.

Why have exposure to the top 3 Crypto assets?

I’m personally 90% in Solana instead of Bitcoin or Ethereum, but that’s just my risk profile.

My takeaway? I want to be in the top 3 assets to cash in on this macro trend.

People think they’re being smart buying dog tokens, meme coins, or CBDCs—they might as well hit the casino. Stop chasing those imaginary 100x gains. Stick with the top 3, and you’ll do just fine. The space is expected to jump from $1.2 trillion to $15 trillion this cycle—a 10x multiplier.

Firms like Ark Invest and Global Macro Investor expect the space to hit $100 trillion by 2030. The game now is just about being patient and grabbing a piece of that on a solid risk-adjusted basis.

Raoul Pal says:

" I'm choosing Crypto over other investing frameworks because I'm looking for the most optimal expression of a trade, not any trade. Crypto and technology are the only true secular trends out there that are extremely powerful and will accelerate. My personal preference is Crypto, which even eats tech, so I want to make the superior bet."

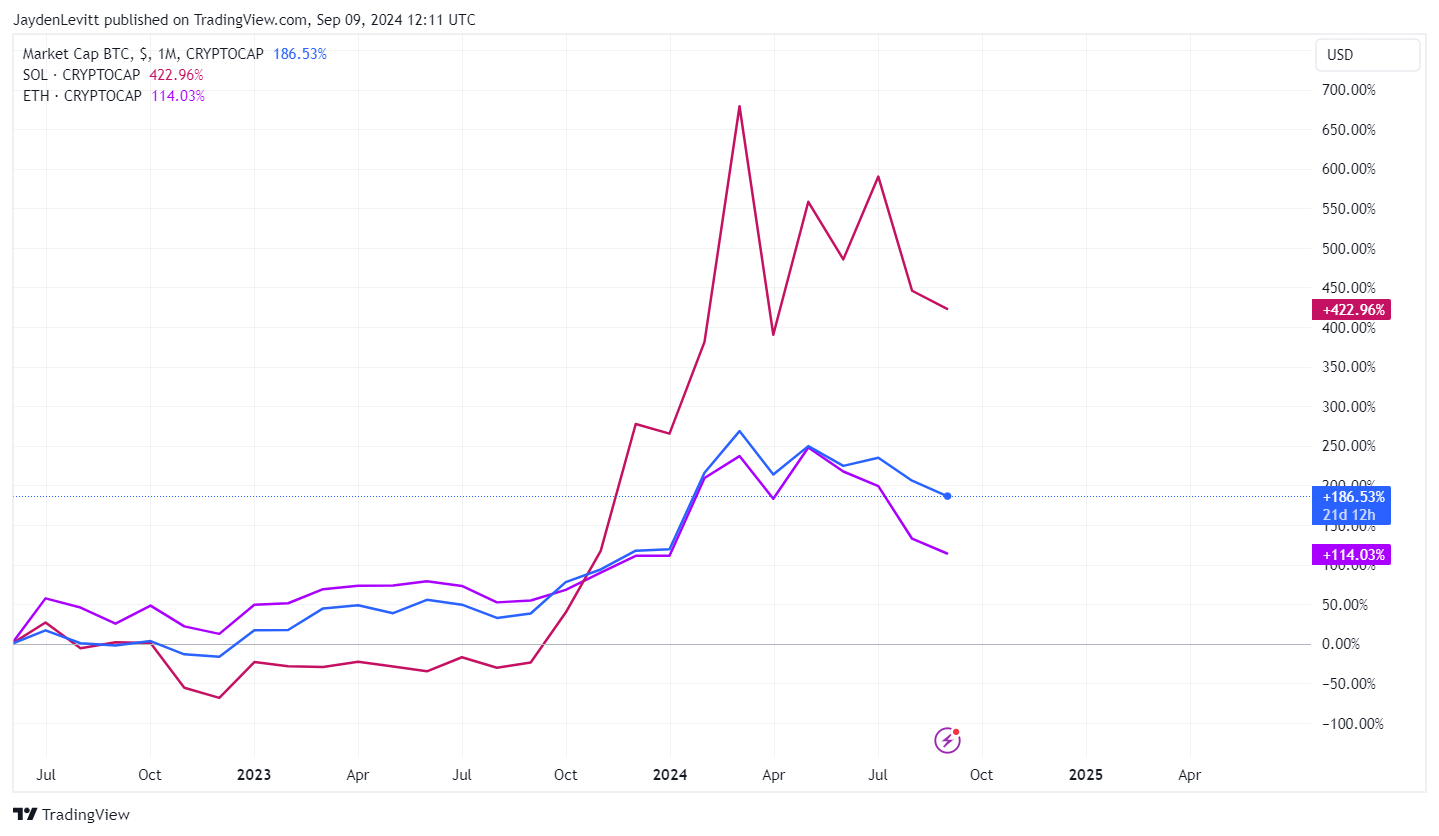

Solana's market cap is a fraction of ETH or BTC, so it needs much less buy pressure to see a more significant percentage jump.

But since all these assets tend to rise optically together, staying concentrated in Solana seems like a much better bet.

It's up 433% since July, and while it's not always the case, performance trends usually amplify during a bull run—it also has the mindshare of the entire crypto community.

SOL = Purple line.

BTC = Blue line.

ETH = Purple line.

Final Thoughts.

The playbook here is simple.

Global liquidity is rising, financial conditions are worsening, and the money printer is about to go brrr.

I tune out the noise, ignore price swings, and touch some grass when things get rough.

Most importantly, I draw from 5 to 10 of the top business cycle, liquidity cycle, and macro investors as my safety signal—and by every measure, now is the time to be in crypto.

It’s as obvious as a slap in the face.

Just don't screw it up by panicking or overtrading.

Raoul Pal — Source

"The whole idea of this cycle is do not f**k it up. You can capture most of the returns just by being in Bitcoin, Ethereum, and Solana.

If you need to feed your inner degen, put 80% in stuff like those and 10% or 20% in the stuff you want to punt on.

Just don't screw up the whole trade.

The Key mantra for this market is don't overtrade, don't use leverage, don't fomo following your friends or look at a trade you missed out on, just stick with the programme, hold your trade, add on sell-offs, anything over 20%, add into it and just calmly let it play out.

Your job is to not part with your coins until 2025, particularly until the end of 2025.

That's your one job."