Why I Bought a $4,000 Mutant Ape NFT — and What Everyone Else Is Missing

What started as a painful miss in 2021 led me, four years later, into one of the most iconic NFT projects in digital asset history.

Still not on the Paid or Founding plan?

Inside, we share daily trade ideas, monthly calls, live sessions, NFT giveaways, and insights I don’t post publicly. Our tightly knit community is growing in knowledge and winning together.

If you want to be part of it, don’t sit on the sidelines.

Come join us.

Famous investor John Templeton once said:

“The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

It’s as obvious as a slap in the face, and applies to Crypto and NFTs.

The beauty of the Crypto market is it always gives you a chance to catch up.

Sunday night, I stumbled through the door just before midnight and did what any sane person would do after twelve Coronas. I opened OpenSea.

Risk assets were capitulating with doomsday tariff porn all over my timeline. Trump had fired off some tweets about China, wiping out leveraged traders left, right, and centre. What a time to be window shopping for Jpegs.

For context, Bore Ape Yacht Club is an NFT project I dismissed back in 2021.

Why? Because the founders were anonymous. It’s hilarious in hindsight, considering my “wallet of shame” is a hit list of teenage scammers who joyrode my ETH to zero like a stolen moped.

As some bizarre coping mechanism from the miss, I convinced myself licensing rights would “muddy the brand.” And to top it off, I actually let one clown online get in my head with, “What if a terrorist uses their ape to kill people?" If someone went on a rampage with a PS5 controller, Sony wouldn’t shut down gaming. We’d just agree the guy was unhinged.

Back then, my “strategy” was to buy three NFTs in each project, sell one pre-reveal, dump one post-reveal, and hold one as a hedge for a moon-shot.

And of course… the one project I didn’t buy was BAYC.

Meanwhile, it went on to become one of the greatest asymmetric bets in digital history. Famous macro investor Raoul Pal described it as “The fastest accumulation of wealth for a private corporation in history.”

Holders were airdropped Dogs, Mutants, ApeCoin, and people made millions. Not me. I needed medical supervision in a padded cell somewhere.

Anyway…

Sunday night, I’m battling Coinbase declines, my bank blocking my card over “suspicious activity,” and PayPal acting like I’m funding a cartel. Eventually, I forced the funds through and pulled the trigger on a Mutant Ape at 1 ETH.

I’d love to tell you it was my “forever ape,” some emotional family heirloom moment. Nope. I just bought it and posted the receipts on X, then hit the sack for the night.

Nursing a morning hangover, I woke up to 10,000 impressions, 250 Ape holders following me, a wall of DMs, and more “Welcome to the club” messages than I knew what to do with.

It’s the underrated part of NFTs no one talks about—the community.

I mean, look at the hype around ApeFest and how folks are organising around these assets and this iconic project. It’s friggin powerful.

I’ve already connected with hundreds of holders. Writing is a lonely game, and NFT communities fill that space in a way social media just can’t.

But don’t get it twisted, I didn’t buy my Mutant because I was drunk and sentimental. There were real signals.

Buckle up and let’s get into it.

Everyone watches the floor price but misses the most critical test.

It’s the nature of the token holder.

Or, as legendary Web3 thought leader Punk6529 says, the nature of the token attracts holders who then shape the token's nature, creating a snowball effect and network effect that becomes nearly unbreakable.

He makes a direct comparison between NFTs and Bitcoin.

“Bitcoin is brilliant tech. The real reason though Bitcoin has gotten here is because the nature of the token attracted the right hodlers. People willing to fight for Bitcoin, to proselytize, to build, to hodl through endless FUD and to joke about it. Nothing will ever be bitcoin. But also many tokens have and will make it. What is the nature of the hodler that this token will attract?”

Punk6529 notes that this also applies to NFTs and BAYC.

The question you need to be asking is: What is the nature of the holder? What are the agreed-upon realities, and why are the holders here? Why would they choose to hold this NFT instead of any other token?

He says that, surprisingly, some parts of the NFT universe are further along on this topic.

Pseudonymous Punk6529 says that while the large majority of NFTs will be worthless junk that progressively lose value relative to fiat and Bitcoin, a few will make it. Very oddly, the ones that make it are held by people who do not care very much about the price.

He says, “It is a bit of a zen koan, but it is true: ‘If you want high price, do not want high price.'" Or the more conventionally understood version: “Entrepreneurs building for a mission build bigger companies than those building for an exit.”

Why are the hodlers there? why did they choose to have this token in their wallet as opposed to any other crypto token or fiat? What type of people are they? do they believe in something? can they resist peer pressure and being made fun of?

And most of all: The single most important test, is can I imagine myself saying (or the token hodlers saying):

“I have no intention of selling this token, I plan to give it to my grandchildren when I die and I hope they don’t sell it either.”

This one hidden impact is often overlooked.

It’s financial conditions that dictate most of the pricing.

Every Joe Schmoe with casholla burning a hole in their pocket is the point of difference. Not so much the Founder, merch drops or “community vibes”.

The entire market is hooked like dopamine-fuelled crack addicts on ‘number go up’. However, NFTs are also a function of the strength in the ETH economy, as any excess profits made can be rotated in the most sought-after NFT projects.

Or, as world-class Crypto researcher and liquidity expert Chris Burniske says about capital rotation:

“Bitcoins incredible strength sows seeds of doubt in alts, and those seeds of doubt are what create the next opportunity. Seen it happen repeatedly, with new reasons sprouting each time for why a rotation won’t happen again -- and yet, just as Earth spins, we’ll rotate.”

Bitcoin is the most sensitive asset to changes in the money supply.

As risk appetite and financial conditions improve, people move further down the risk curve, pushing these assets higher.

Until you get to the final boss. The asset that solved scarcity, social signalling and has built-in supply friction. The one that’s the last to gain liquidity and the first to lose it. NFTs.

Raoul Pal spoke about this in his message to digital artists:

“Crypto artists - I see the market is still thin for sales except a few artists. However for people to buy art they need capital and the market needs to deliver them bigger gains before they can buy art as it’s tough to sell their liquid tokens for long term assets or pure art. I have this conversation every day with investors/collectors...

Your day will come, it’s just a matter of phasing.

You’ll do just fine. Keep going. We need you. It’s just a matter of liquidity not yet flowing down and not a reflection of your art practice.”

The index everyone ignores.

It’s CryptoPunks.

I’ve long believed that a superpower for an investor (which is what we are, until proven otherwise) in this space is keeping it simple, or, as one of my readers put it, “first-principles thinking.”

Simplicity is an edge.

As of publishing, CryptoPunks has a floor price of 40 ETH (about $150k). However, it functions like an index to the entire NFT space, similar to Bitcoin for altcoins.

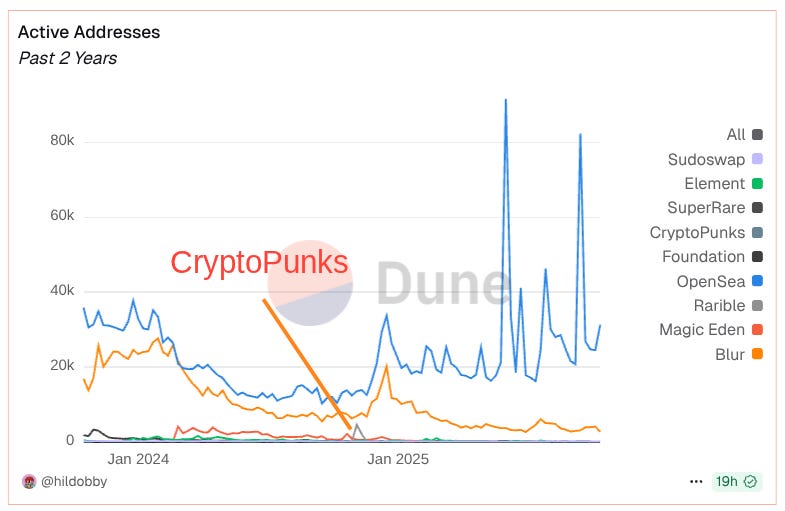

Look at the chart below.

You can see a spike in CryptoPunks in November 2024, following the election. There was a slight lag on ETH, which then rotated into Punks, and that became a positive sentiment signal for other NFT projects.

Almost immediately after, OpenSea and Blur recorded their highest trading activity since the last bull run, shown by those huge blue and orange spikes. Like a classic “tail-wags-the-dog” effect, or in this case, the ripple effect of Punks (and election clarity) across the entire market.

To understand where we're headed directionally, the question to ask is how CryptoPunks are performing.

We know that, amid a crypto-friendly president and tariff drama, the economy has been throwing mixed signals, especially for risk assets. But during that same period, Punks climbed from a 20 ETH floor to 47, before retracing back down to 40 at the time of writing.

That’s with Ethereum having gone up by over 100% in the same window. To me, that suggests this rotation will eventually give way to more inflows into expressive assets. It’s just a matter of patience.

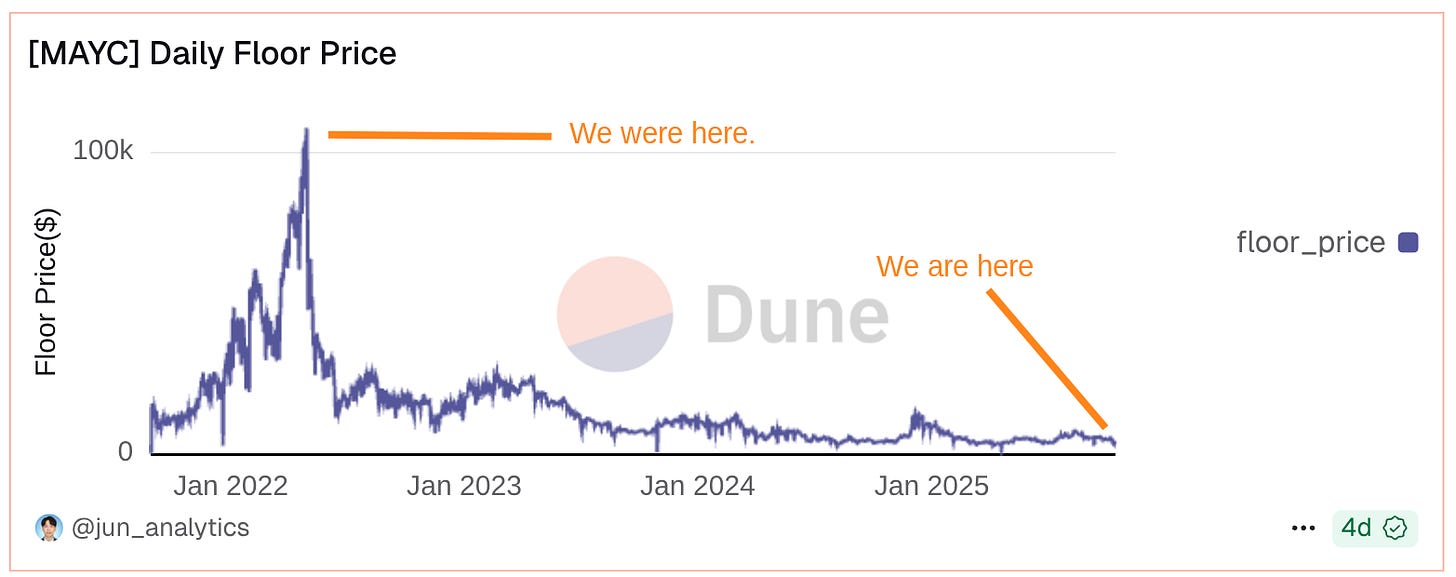

So where does that leave me with my Mutant Ape? The floor has crashed from $116,000 to $4,000 in a brutal bear market, and a single world leader’s social media account nuked $19 billion in Crypto leverage, wiping out 1.6 million traders in just 48 hours.

To me, that was my shot. And while mildly intoxicated, I swung and connected, landing a Mutant Ape at a smidge under 1 ETH, which now looks to be the bottom.

To steal Jeff Bezos’ famous line: “Given a 10 per cent chance of a 100 times payoff, you should take that bet every time.”

The data everyone sees but very few digest (properly).

Floor price is embedded in NFT's DNA.

One thing I’ve learned on this journey of holding NFTs from over 50 projects spanning XCOPY, Beeple, Veefriends and a bunch of historical projects is that the floor prices when financial conditions get crushed have very little to do with holder sentiment because it’s usually (in a successful project) a small % of the collection being actively traded (or dumped).

When leverage gets wiped out, ETH drops, and NFTs naturally follow. The same force that pushes prices up on the good days pulls everything down on the bad ones.

But here’s the part most people aren’t paying attention to: Mutant Ape holders are a fucking beast.

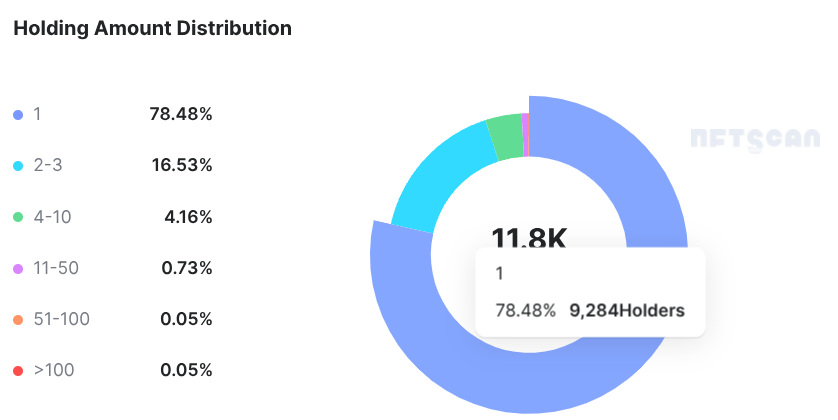

There are 19,557 Mutants and 11,824 unique holders, resulting in a roughly 60% holder ratio. That’s incredibly strong for a collection of this size.

Look a layer deeper, and it gets even clearer: 78.48% of holders own just one Mutant. That matters. When most of a collection is one per wallet, it creates significant supply friction. People are far less likely to sell their only piece because of the emotional attachment and expressive nature of the asset.

This is precisely what Punk6529 was talking about. Projects with strong, invested holders, such as MAYC and BAYC, exhibit a Lindy effect, which enables them to survive into the future.

Or as Gmoney recently said:

“NFT collectors don’t know how to hit the sell button. Don’t overthink it.”

According to Etherscan, 60% of the collection hasn’t moved wallet addresses since minting 4 years ago. This core of religious-like superfans clearly believe in something and have no intention of selling.

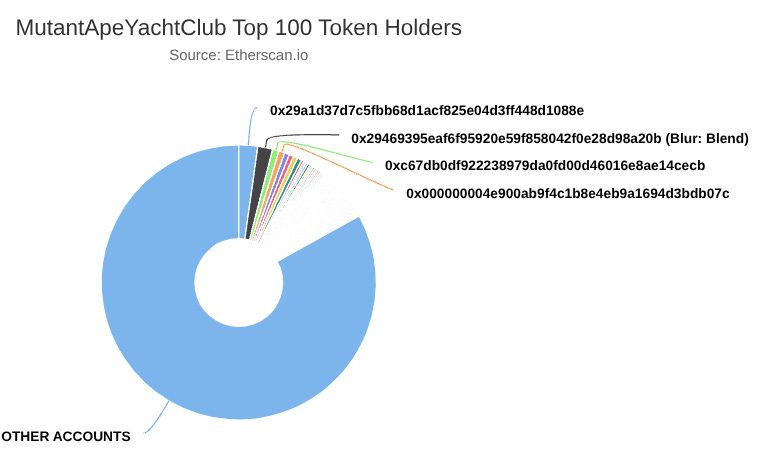

The distribution of this collection is also insane. The top 100 holders collectively own only 16.94% (3,313.00 Tokens) of MutantApeYachtClub.

Azuki is 35.6%

Doodles is 43.79%

Veefriends is 31.57%

Moonbirds is 22.19%

Pudgy Penguins is 25.18%

Final Thoughts.

The truth is, I can genuinely see myself never selling my Mutant Ape.

I realise many others feel the same.

The holders of each NFT collection reveal far more about sentiment than this obsession with floor price. Although somewhat ironically, the price getting crushed is what gave me my entry.

It makes me wince when I see people online dunking on genuine founders who are actually working hard, but are, excuse the phrase, pissing into the wind of brutal financial conditions.

There has been too much downward pressure from multiple angles. An out-of-control dollar was crushing ETH like a recycled can, and a tiny percentage of the collection being dumped still reflects negatively on an entire project.

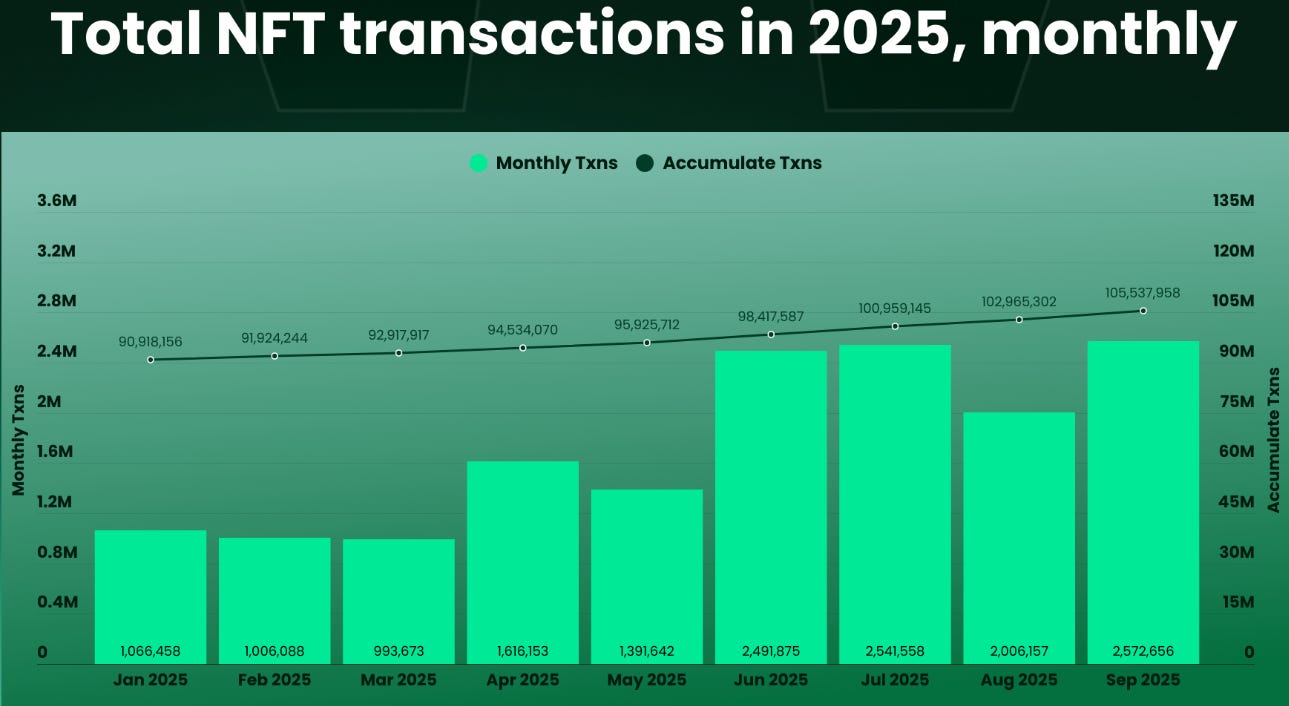

We appear to have moved past that with trading activity and monthly transactions across the NFT market trending upward across 2025.

Meanwhile, the core holders of MAYC and BAYC are uniting around an NFT project so firmly that people are getting tattoos, launching merch brands, using their Apes as their digital identities, and building genuine friendships around them.

When you add all of that up, you get an asset that’s incredibly hard to let go of, regardless of price. We want the price to rise, but we don’t actually want to sell.

I anticipate that as people climb the crypto wealth curve, just like profit rotates from BTC into alts, we’ll see the same pattern from ETH into NFTs. A significant part of that will be the expression of wealth through these trophy assets.

In the old world, that showed up as watches, cars, and fancy suits. However, as my buddy Zeneca quite rightly pointed out to me recently, we spend at most 3 hours in our vehicles and 50+ hours a week online.

We’ll want to socially signal in these online spaces regardless of how silly outsiders might think it is.

Like Punk6529 said:

“In an extreme example, people go and die for their national flag. In less extreme examples, people tailgate every week after a football game. In other less extreme examples, people will pay $10,000 for a watch when a $15 watch does the same. I’m not here to tell you this is bad. This is fundamental to human nature. It’s how we are: identity, community, and emotion matter. NFTs are the moment we can take all those feelings from an off-chain world, on chain.”

It’s why I bought my Mutant Ape at a time of maximum pessimism. I know, independent of any “utility”, the community is a powerhouse.

It’s what everyone else is missing.

And why I’ve got to take that shot every time.

If this piece brought you value, please consider sharing it — or, if you want to support Carrot Lane, consider upgrading to a paid membership. It’s how we keep this whole show running, and it genuinely means a lot.

Great that you jumped in and bought a Mutant. I’d like to think I played a small part😉

Hey Jayden, I enjoyed this post. In part because I also believe it's a great time to pick a few Mutants.

I write monthly crypto rambling. Would be super if you checkout my page. I would be grateful and happy to support each other's newsletter growth. Cheers!