World Class Data Scientist Says This Cycle Is Your Last Chance To Make Generational Wealth From Crypto (While It’s New and Inefficient)

Financial freedom for life is only possible in new markets.

Ivan Liljeqvist is a Cryptocurrency genius.

He’s a data scientist who started developing games and websites at the age of nine, thanks to the support from his mathematician mom.

Like many of us, his most significant lesson in how the market worked was FOMO’ing (Fear of Missing Out) at the top of a bull run and then getting wiped out.

He recalls going all in “right at the end of the 2013 cycle, and then everything collapsed and entered the new bear market”. Yuck.

Ivan, now an international speaker, blockchain educator and a global phenomenon with 500k subscribers on YouTube, says this may be the last major cycle for you to make generational wealth while the market is still waiting for mainstream adoption and is inefficient.

Ivan On Tech — Source

“This is the last major cycle when you’re looking at the current bear market and the fact that we’re exiting the bear market, we’re entering a new bull market.

We must realise this is probably our last chance to make insane gains. And when we’re speaking about insane gains, it’s gains that you can retire off — financial freedom for life.

It’s only possible in markets that are very new and inefficient and still not fully discovered, where you have a whole new industry that is becoming big, taking its place in the world, and you’re early.

That’s when these wonders of finance typically happen. It’s the last one because, after this bull market, we will have full financial integration with traditional finance.

After the next bull market, what’s going to happen is that banks are going to merge with Crypto fully.

In the US, you are seeing all of these ETFs being filed right now, and listen, they’re going to push it through.

Everyone right now is pushing an ETF. BlackRock is moving into an ETF, Fidelity, WisdomTree, and VanEck. Everyone is pushing for an ETF.

They will likely push it through in the coming year or a year and a half. And then, we got to ask ourselves what the Bitcoin and Ethereum prices are and how big this industry is when everything is in place.”

At the End of the Coming Bull Run, We’ll Be Above 10 Trillion, a 10x Increase.

Ivan says this will be the most important and biggest Bull Market you’ll ever face because there’ll be so much integration with the traditional finance space, leading to exponential buy pressure.

Once the technology becomes more widely adopted and accessible to the average person, speculation and volatility decrease, so it’s vital to seize the potential now while Crypto is still relatively new.

When people are unsure, speculation happens, and you can have a 10 to 15 x quickly.

He says there’s a lot of opportunity for regular people like you and me. It’s like having a hidden treasure right in front of us. However, time is running out because, eventually, all industries become more established, and the opportunity subsides.

Ivan On Tech — Source

“My prediction for this is that we will be above 10 trillion dollars for the entire market cap, and if you compare it to today, we have a 1.2 trillion overall market cap right now for all Crypto.

After all, this is done, we will be at a factor of 10x to the upside, so 12 trillion, 15 trillion. These numbers are not that crazy. You look at Gold and other assets in relationship to those assets.

It makes sense if Bitcoin, ETH, and the top 10 coins together go to something like 10–15 trillion.

Crypto would still not even be a massive asset class, it’ll be a respectable asset class, but it’s not a massive asset class at 10–15 trillion. So these are the kinds of numbers we’re speaking about.”

Here’s How You Get Your Strategy Right

Ivan’s practical advice never misses.

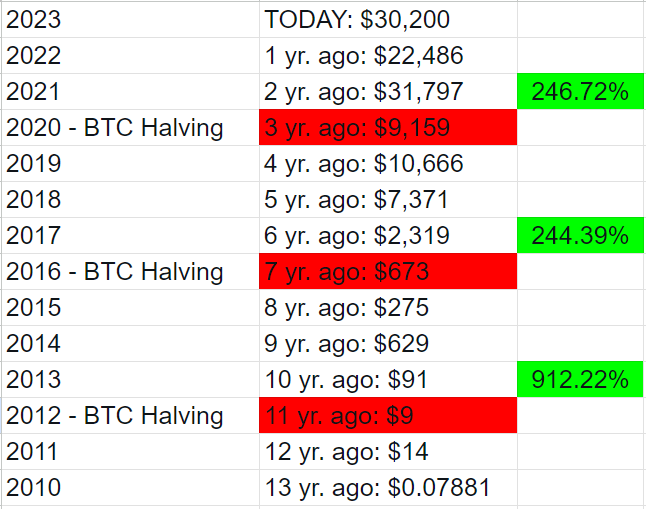

He has one message: be bearish and risk-averse before the Bitcoin halving and bullish and more aggressive after the halving.

The Bitcoin halving is an event that occurs approximately every four years in the Bitcoin network. It’s programmed into the Bitcoin protocol and designed to control the supply of new Bitcoins created.

The number of new Bitcoins generated as a reward for miners’ mining blocks reduces by half during the halving. This scarcity is essential to Bitcoin’s value proposition and appreciation potential.

If you’re new to Crypto, Ivan says to take the time now in the lead-up to the halving to build your capital and education in Crypto, which will help you manage this cycle effectively.

He says now is NOT the time to be greedy because we are still in a sideways market, so you have time, but you mustn’t get to the halving event as a “newbie”.

Be educated.

Have capital ready to invest.

Be bullish and take risks after the halving.

He emphasises having a long-term time horizon. It would help if you thought as far out as 2025.

For me, it’s further.

Historical indicators of price movements during previous halving events give insight into what could happen in the upcoming halving from around April 26th 2024.

When you see the price movement after each halving event, it becomes evident that Ivan’s bullish strategy following the halving is highly logical. The evidence highlighted in green below strongly supports his approach.

Final Thoughts

Ivan’s assessment of the Crypto market increasing by a factor of 10 after each halving based on its current trajectory and the cascade of ETF application seems a fair base case.

ETFs are a fancy word for stocks representing an underlying asset or a basket of assets, i.e. Bitcoin.

If Ivan’s right, you’d see Bitcoin reach $300K, giving it a market cap of $5.64 trillion, double the investable market cap of Gold.

I like his practical approach: If you have a plan, you can maximise your opportunities and make the most of the upcoming bull market in the crypto space, provided you’re in the market until 2025 and do not have a short-term perspective.

He suggests being a crypto native means having knowledge and experience to navigate the market effectively, but you must get there first.

There’s also no major rush.

You have time.

Whether this is the final significant cycle for exponential price surges is uncertain.

Undeniably, the opportunity to purchase Ethereum and Bitcoin at what can only be described as pre-IPO prices or before the stampede gets here won’t last forever.

Financial freedom for life is only possible in new markets.

Seizing the opportunity may be the most important thing you do.

🙏