World Class Economic Historian Shares How AI Will Impact Your Cryptocurrency Investments — His Insights Are the Most Profound You’ll Hear

There’s a compounding effect you need to see, which leads to explosive growth for Cryptocurrency.

Note From Author: I hope you’re enjoying your Sunday wherever you are in the world. I’m just about to head out and watch the season’s first football game with friends (Manchester City vs Arsenal).

I’ve started researching and writing about the effects of AI and Crypto converging and what will happen when both technologies grow exponentially.

Hope you enjoy

You and I are entering an exponential era.

We’re about to swallow a “limitless pill” of cutting-edge advancements and unprecedented technology.

Heck, human intelligence, the final frontier, one we thought couldn’t be scaled by technology, is now being commoditised by AI, and it’s fucking scary.

With AI, intelligence becomes infinite.

Raoul Pal, a macroeconomic wizard, can explain things in a way that makes sense.

He says the convergence of AI and Cryptocurrency creates an unprecedented economic landscape with unimaginable wealth opportunities.

You’ll struggle to see how this can all play out because “humans don’t deal with exponentiality very well.”

We understand predictable things and are better at dealing with gradual rather than sudden and fast changes. Exponential growth is fast and keeps getting more rapid, and it’s hard for us to comprehend.

Pal has quoted Metclafe’s Law which states that the value of a network is proportional to the number of participants or users in that network. In simpler terms, as more people join a cryptocurrency network, the value of that network increases exponentially.

Now Pal says if you understood Reed’s Law, which describes the compounding effects of multiple technologies working together, you’d see how obvious it was that Cryptocurrency would explode in the future with the help of AI.

With Reeds Law, the network’s value grows linearly (consistent and predictable path without significant deviations) exponentially with each new participant.

It also considers subgroups of new technologies, i.e. Where AI and Cryptocurrency come together.

Raoul Pal — Source

“Humans don’t deal with exponentiality very well.

We can’t think in those terms, and what we’re dealing with here is not just Metcalfe’s Law of network adoption, but we’re dealing with all of these things compounding on each other, which is called Reed’s Law.

It’s very, very, very hard to get your head around. And our current infrastructure of government and establishment cannot even vaguely deal with it. They have yet to deal with internet regulation, let alone bloody Crypto.

How the hell are they going to deal with this (AI)? Why are they just not set up to do it? Because nobody knows.

It’s (AI) moving too fast.

They tried to call a six-month moratorium on AI that never happened.”

Your Crypto Will Explode As We Reach a Turning Point in the Economic Cycle.

Raoul predicts a massive bull run driven by network adoption and multiple technologies compounding on each other.

Beyond most humans’ comprehension, this compounding effect will challenge existing governance and regulation.

The changes are both terrifying and exhilarating.

Raoul emphasises the critical importance of investing in technology and Cryptocurrency as we approach these turning points in the economic cycle.

Understanding and acting upon this framework of inevitable change and advancement is the key to your wealth creation.

Raoul Pal — Source

“This (AI) scales intelligence, a scarce supply only humans hold. We’ve now made intelligence infinite.

It’s a very disruptive big idea.

The one thing we thought was scarce was knowledge and intelligence; it’s now infinite.

If we get to an energy price near zero, what does that mean if you have infinite intelligence and marginal energy costs?

There are no constraints.

I mean, it’s terrifying and exciting at the same time.”

AI Will Create a Significant Deflationary Shock — You’ll See Why It’s Bullish for Crypto.

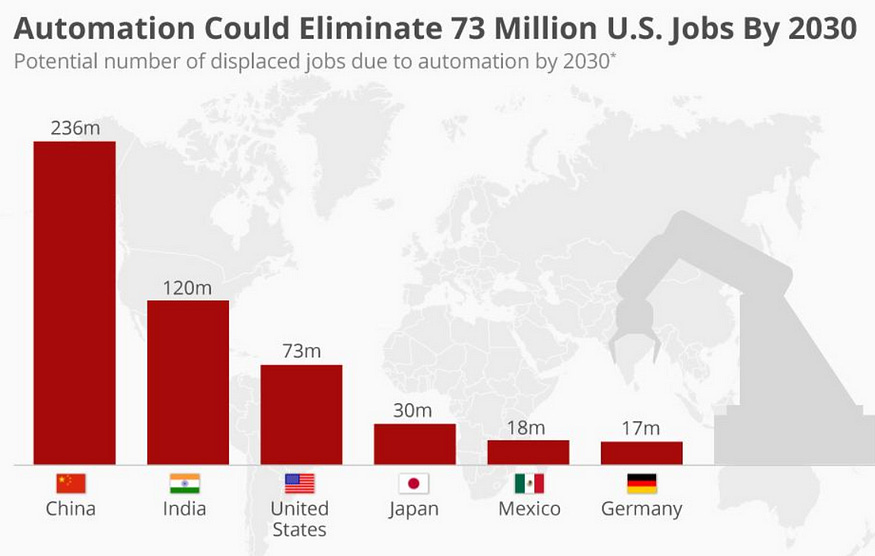

Automation is increasingly prevalent and will significantly impact the job market soon.

Pal says when computers and robots start doing more human jobs, the increased productivity will create a lower cost basis for goods and services, leading to deflation.

He’s not the only person who thinks we’re in for a shock.

Rocketman Elon Musk says automation and robots will improve so much that there’ll be fewer jobs for humans to do to the point where it’ll be necessary for governments to send us money each month.

Elon Musk — Source

“There’ll be fewer and fewer jobs that a human cannot do better than a robot.

Mass unemployment is going to be a massive social challenge. And we’ll have to have some universal basic income. We won’t have a choice. It’s going to be necessary with unemployed people paid across the globe.

These are not things that I wish would happen; these are things that I think will happen.

The output of goods and services will be extremely high. So, with automation, there will come abundance.

Almost everything will get very cheap. We’ll end up doing a universal basic income, which will be necessary”.

Pal believes additional market liquidity from AI commoditising goods and services will benefit Cryptocurrency prices.

Short term, there’ll be mayhem for the job market.

It’s projected that automation will displace 20 million manufacturing jobs by 2030. 25% of American jobs are highly vulnerable to automation, potentially losing 73 million jobs within the next five years.

Data from Zippia suggests that AI will replace 85 million jobs by 2025 and possibly create 97 million new jobs as a consequence of AI.

93% of people researched in the study said they were receptive to AI-driven training. The findings demonstrate that people view AI as an opportunity for growth and not a threat to their employment. Yet.

They said the same about the tractor.

People are open to AI training, which can help bridge the gap between lost jobs and new job opportunities.

Cryptocurrency Has the Opportunity for Exponential Growth.

Raoul Pal believes cryptocurrency growth will be exponential because of the deflationary shock of AI taking over our workforce.

If Pal is proven correct, increased AI adoption will reduce the cost of output, causing deflation and bringing consumer prices down.

He says Cryptocurrency responds to liquidity in the market with the added kicker of the Bitcoin halving event that happens approximately every four years (around April 2024).

Price trends upward for cryptocurrency before each event. There have been 3 Halving events so far.

First Halving:

Date: November 28th, 2012

Pre-halving uptrend: +341.90% price increase

Average Bitcoin price at halving: $12.31

Bitcoin reached around $1,000 in late November 2013 before entering a bear market, declining over 80% until October 2015.

Second Halving:

Date: July 9th, 2016

Pre-halving uptrend: 112.0% price increase

Average Bitcoin price at halving: $650

Bitcoin experienced a bull run from mid-2016 to December 2017, reaching a peak just shy of $20,000.

Afterwards, Bitcoin dropped nearly 80% to a presumed bottom of around $3,200 in December 2018.

Third Halving:

Date: May 11, 2020

Pre-halving uptrend: 23% price increase

Average Bitcoin price at halving: $9,100

Bitcoin experienced a parabolic rise to $64,000 during the pandemic due to a surplus of money in the system from bat virus relief.

Afterwards, Bitcoin dropped nearly 76% to a presumed bottom of around $15,600 in November 2022.

(Summaries are based on historical data and past trends, and there are no guarantees regarding future price movements).

When you combine exponential computing power, vast knowledge, self-learning capabilities, and near-zero energy costs, the significance of humans becomes questionable.

We have all these significant trends unfolding simultaneously, and for society, it becomes overwhelming.

But for Crypto, it’s exponential.

Raoul Pal — Source

“This is the largest disinflationary shock the world will ever have, and it’ll keep playing out as these other exponential technologies become implemented.

Three years ago, I’d see a couple of Autonomous Vehicles, and now I see them every day, ten times a day.

I looked around me in New York City, and every car was an Uber, a taxi, a bus driver, and you’re like, ‘Oh my God, AI.’ It’s the biggest disinflation shock the world will ever face.”

Final Thoughts.

This year, American companies have announced to cut 417,500 jobs, a significant increase of 315% compared to the 100,694 cuts announced during the same period last year.

Apart from 2020, it’s the highest number of cuts in the first five months of the year since 2009, when 822,282 were reported by May.

Job losses usually indicate less liquidity in the market and downward pressure on wages which should bring down inflation.

Pal says the opposite will happen, and I agree with his sentiments entirely.

When the robots commoditise everything, it all becomes as cheap as chips. We’ll be back to where we started when it rained free pandemic money on us all.

As we’ve seen historically, when people have spare cash, they’re more than willing to invest in Cryptocurrency.

$NXRA

$SHx

$XXA

$ABT