World Class Personal Finance Expert Dave Ramsey: You’re Trying To Time the Market — Instead, You Should Get In and Stay In.

The drama Queen side of you needs to stop thinking the world is coming to an end.

Photo By Bites and Sites on Flikr

Behind every insanely successful man is a woman with the patience of a Saint.

Despite being a successful real estate investor, Dave Ramsey went bankrupt in the early 80s.

He and his wife Sharon had their share of tough times and said the root cause was simple. Don’t borrow what you can’t afford to pay back or spend more money than you make.

Heck, Ramsey’s motto is never to borrow money.

Unfortunately, our society has become a punch-drunk debt culture, thinking the money printers can carry on forever.

Ramsey had over a million net worth and a thriving real estate portfolio. When the market crashed, the banks came for their loans and foreclosed on him, leaving him with a debt bill that nuked his portfolio.

As a result, he had to declare bankruptcy.

He isn’t shy about sharing his bankruptcy experience, either. He often talks about it as a cautionary tale for others.

Dave and Sharon faced a complete lifestyle change during their financial capitulation. They sold their furniture and drove cars 10–20 years old to save money — one day, their car broke down, and they had to push it to a nearby gas station, where Dave used his mechanic skills to fix the problem instead of paying.

With his battle scars to show for his experiences, Dave is now considered one of the best personal finance experts in the world. And being the skilful sailor who’s seemingly weathered all storms, he says not to worry about the current state of the stock market.

If you’re worried, it’s normal, but it’s the drama queen in you, and you probably need to look at some data.

You certainly shouldn’t be trying your best to time the bottom. Ramsey says, “Just get in”, because the trend is always up if you’re well-diversified.

Hold tight. Prepare yourself. And let’s dive into the details.

People Who Try and Time the Market by Catching Waves Do Less Well Than People Who Stay In.

According to Ramsey, you’re doing the opposite of what the market is doing because your emotions are taking over.

People tend to jump out when the market is low and jump back in when it’s high, which leads to poor performance.

In contrast, those who get in and stay in tend to outperform those who try to catch the waves by jumping in and out.

Ramsey makes the perfect point. “Nobody gets hurt on a roller coaster except those who jump off in the middle!”

Dave Ramsey — Source

“There is all kinds of data and research available to study the stock market’s history and people who try to time the market — getting out when it’s high and in when it’s low.

People do the opposite due to emotional responses, getting out when it’s low and back in when it’s high.

People who get in and stay in outperform those who try to catch the waves by jumping in and out.

The math changes significantly, and it’s crucial to understand that nobody gets hurt on a roller coaster except those who jump off in the middle.

When you’re not in the market, it’s an excellent time to get in and stay in. The market is currently down, and historically, when the market is down, the year following is excellent.

Now is a perfect time to invest because the market is on sale, much like the blue lights specials at Kmart that we used to see when I was a kid.”

The Trick to Personal Finance Is 80% Your Behaviour and 20% How Knowledgeable You Are.

Dave debunks the common myth that investors lost everything in the stock market during the 2008 financial crisis.

He explains that losing everything is mathematically impossible when invested in mutual funds unless you had all your investments in a single stock that went bankrupt.

In reality, the market only went down by half during that period. Even if someone did sell at the bottom (which is a feat), investors would only have lost half, not everything.

Dave Ramsey — Source

“The trick is that personal finance is 80% behaviours and only 20% head knowledge.

Over the years, I’ve learned to overcome my inner drama queen by using my intellectual will instead of listening to the drama queen that says the world is coming to an end.

By looking at actual data points, I remind myself that jumping in and out of the market is bad, but staying in is good — this has been true for a hundred years.

We’ve always had incompetent presidents and a Congress handcuffed to itself; none of these things is new.”

Here’s the Data Ramsey Was Talking About.

Research studies have consistently shown that investors who try to time the market — jumping in and out — usually do worse than those who stay invested for the long haul.

If you want better investment returns, hanging tight and staying in the game is generally better than jumping in and out.

One such study is the “Quantitative Analysis of Investor Behavior” by DALBAR Inc., which found that over 20 years ending in 2018, the average investor earned only 5.19% annually, while the S&P 500 index earned 9.85%. Investors tended to buy and sell at the wrong times, missing out on market gains and selling during market downturns.

Similarly, a study by Morningstar found that investors who stayed invested in a diversified portfolio of stocks and bonds outperformed those who tried to time the market. From 1993 to 2013, the annualised return for the S&P 500 index was 9.22%, while the average investor return was only 2.53%.

A Vanguard study found that investors who stayed invested during the 2008 financial crisis and subsequent recovery outperformed those who tried to time the market. From 2008 to 2018, the annualised return for the S&P 500 index was 8.49%, while the average investor return was only 6.1%.

You can spin the data any way you like, but it’s clear that people stop investing in down markets when you could say the prices are at a discount.

But fear is at an all-time high.

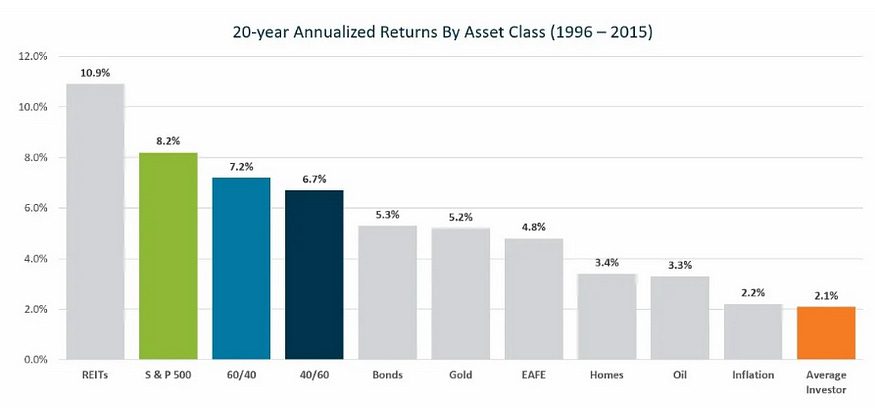

OneDigital collected data on the average return for 20 years ending in 2015, which was 8.2% for the S&P 500, while the average investor only earned 2.1%.

For context, inflation was 2.2%, so your average investor wasn’t even outperforming inflation, as the orange bar below details.

Final Thoughts

I receive many responses to my blog posts, and most of them are related to timing.

You, as the reader, don’t always explicitly state it in the comments, but most focus on the current market climate and whether it’s a good time to re-enter.

Dave Ramsey dispels this strategy, saying you’re experiencing a regular event or cycle.

Human behaviour often follows cyclical patterns when it comes to investing.

“Behavioural cycles in capital markets” by James Montier and Philip Pilkington found that investors go through four stages in their investment decision-making process:

Optimism

Excitement

Anxiety

Depression

These stages are characterised by sentiment and market activity shifts, leading to market bubbles and crashes.

The main takeaway is keeping your human emotions and behaviour away from investment decisions and market outcomes.

Because, as humans, we’re unpredictable and lean towards fearing loss.

Unless you’re a full-time trader, you might be better suited getting in and going to sleep on your diversified investments.

Or, at the very least, stop being a drama queen thinking the world is coming to an end.

Get in.

And stay in.