World Renowned Investor Says You Have a 10 to 12-Month Golden Opportunity To Collect Crypto Before It Goes Parabolic (Then It’s Too Late)

Once people widely accept digital currencies, there’s no way you’ll be able to put the genie back in the bottle.

Photo By Coindesk On Flikr

Do you ever come across those people online who aren’t household names, but their ideas and insights make perfect sense?

Their ability to connect the dots and offer practical solutions deserves a wider audience.

You might not be familiar with Mark Yusko, but he co-founded Morgan Creek Capital Management.

Back in 2014, when Bitcoin was still flying under the radar for most people, Yusko, the CEO, chose to invest a part of his firm’s endowment into Bitcoin, sticking his flag in the ground as a pioneer among institutional dinosaurs by embracing cryptocurrency.

Naturally, people thought he had lost his mind.

His thesis has evolved, and he offers a unique cliche-free perspective on crypto analysis. It’s refreshing. There are no vanilla crypto terms like bear and bull markets; instead, he uses the concept of “seasons” in the crypto market.

According to Yusko, each crypto season spans approximately 12 months.

We have recently entered what he calls “crypto Summer”, which he predicts to be a relatively flat period with gradual upward movement.

However, the real excitement lies ahead in what he terms “crypto Autumn.” It’s a phase expected to coincide with Bitcoin halving next year (May 2024).

Yusko believes you’ll witness exponential price movements as everyone anticipates increased demand due to the halving event.

The halving event in Bitcoin is an important occurrence approximately every four years. It’s a predetermined event programmed into the Bitcoin protocol that reduces the rate at which new Bitcoins are created and added to the system.

The number of new Bitcoins created as a reward for mining reduces by half, significantly impacting the supply available in the market.

Mark Yusko is adamant that Investors have a golden opportunity of around 10 to 12 months to gather as much Bitcoin and cryptocurrency as possible before he anticipates “Crypto Autumn” as a phase of parabolic price increases and exponential growth.

Mark Yusko — Source

“This is the genius of the halving.

The halving creates price movement because the price needs to adjust to reward the miners.

Price movement attracts interest. Here’s the thing: when the price of anything falls below its fair value, investors tend to buy it.

Based on Metcalfe’s law model, the fair value of Bitcoin today is in the high 20s to low 30s, so we are marginally undervalued.

As the asset starts to rise in price, it attracts speculators. Speculators are not inherently bad people; they take the opposite side of a hedge.

Sometimes in the futures market, traders hedge their future investments. On the other hand, a speculator takes the opposite side of that transaction without having a specific view of the asset.

Speculators are attracted to the movement and want to buy it. As we enter the late stages of summer and move into fall, the price starts to experience rapid movements, and that’s when people tend to lose their minds”.

Speculation Leads to Chronic Gambling, Which Ruins Everything.

According to Mark Yusko, every time the halving event happens, he believes Bitcoin’s price has the potential to increase by ten times. In other words, the next halving event could push Bitcoin from tens of thousands to hundreds of thousands in value.

With the influence of late entrants to the market who speculate on assets like Bitcoin without understanding the technology, people end up in a frenzy and become outright Gamblers.

It leads to these volatile boom and bust cycles, and the entire population and their canines coming out of the woodwork, calling it a Ponzi scheme after 75% drawdowns.

Mark Yusko — Source

“We find ourselves in a funky place where the price is poised to start moving, attracting speculators.

However, the entry of gamblers follows, which wrecks it and disrupts the cycle by driving the value above its fair level.

This, in turn, leads to inevitable crashes. The historical data reveals a recurring pattern: reaching fair value, surging way beyond it, and then crashing back to fair value.

This cycle has been observed during previous halvings, with each subsequent cycle resulting in a 10x increase, effectively adding another zero.

Thus, the progression unfolds from 100 to 1,000, from 1,000 to 10,000, and this time around, from 10,000 to 100,000. Subsequently, the next halving could propel the value from 100,000 to 1,000,000.”

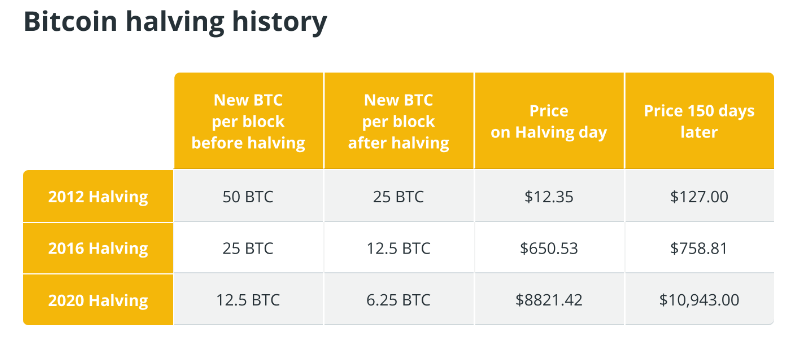

Data on previous halving events back up Yusko’s points.

History Is a Great Indicator of Future Growth.

More than 18.5 million Bitcoins, almost 89% of the total 21 million that can ever exist, have already been mined and are in circulation. About 900 new Bitcoins are mined daily and added to the digital supply.

Based on the current mining rate of one block every 10 minutes, it is estimated that the next halving will occur in early May 2024. After the halving, miners will receive a reduced payout of 3.125 BTC for each block they mine.

The first halving of Bitcoin occurred on Nov. 28, 2012, when BTC was priced at around $12. Bitcoin experienced a remarkable surge within just one year, reaching almost $1,000.

On July 9, 2016, the second halving event took place, initially causing Bitcoin’s price to drop to $670. However, it took a little while for Bitcoin to regain momentum and climb to $2,550 by July 2017.

During the same year, Bitcoin reached its all-time high of approximately $19,700 in December.

Moving forward to the 3rd and most recent halving in May 2020, Bitcoin was valued at $8,787. What followed was a period of explosive growth and significant price increases of an all-time high of $68,789.63 (Nov 10th, 2021).

The number of blocks mined increases by a tenth each time the halving event occurs, consistent with previously referenced price increases.

Final Thoughts.

Let’s be honest. You don’t need to be a rocket scientist to work this out. History doesn’t repeat entirely, but it sure as heck rhymes.

We’re becoming more digitally immersive, so we’ll increasingly value assets like Bitcoin more and more.

We’ve also seen that when people make predictions that are time bound, it adds to the speculation and, for want of a less vanilla expression, “FOMO”.

Don’t get sucked in. You have more time than you think.

Mark Yusko is right that the Halving event will be significant. It’s almost like the proof concept being signed off each time the Bitcoin halving happens.

Aside from the supply and demand dynamics, it draws more media attention and eyes balls into the space, leading to a wider scale of adoption.

It would be best if you were also wary that we might end up in a deep recession, the likes of which we’ve never seen since the Great Depression.

Something Bitcoin hasn’t been battle tested with.

If you were to ask me, and if you believe in the Bitcoin thesis, now is a good time to have a “nibble”.

If not now, then when?