You Don’t Need To Be an Expert in Economics To Be Insanely Successful in Cryptocurrency.

Once you understand the odds are in your favour, you’ll have your aha moment.

Photo by Taton Moïse on Unsplash

Have you ever encountered those stories that felt like urban legends, where someone you know invested in something incredibly early and made mind-boggling amounts of money?

Well, you’re about to hear more of them.

And more often.

As a rough back of the cigarette packet estimate, the digital asset space makes up 0.5% of the global money supply. Let’s say you worked on the balance of probability.

50% chance it goes to zero

50% chance in increases to 1%

Where we are right now is ‘net even’.

Anyone with some common sense would say it’s likely, not less, that the percentage will increase over a long-term time horizon.

We’re all becoming more digitally immersive, so it makes more sense, not less, that we’ll value digital assets more and more as time goes on.

You could look at it entirely differently. We’ve never been able to put money into something that could be 100 x. Never. Until now.

They’re the returns you only hear about from these high-flying silicon valley venture capitalists.

Decentralisation and Blockchain have opened the door to little guys and girls.

While you don’t have to be Einstein to understand the principles to supply and demand, you still have to apply timeless investing principles.

It’s also wise to have a touch of common sense.

Let’s dive into it.

Here’s What Not To Do.

Don’t invest more than you can afford to lose

Don’t engage in emotional trading

Don’t blindly follow the hype

Don’t chase quick gains

All of these things involve your emotions and managing yourself. Crypto storms can be choppy, and if you’re playing with money, you can’t afford to lose or get caught up in the hype; it’ll play mind games with you.

Having a significant portion of the money you need for everyday living tied up in Cryptocurrency can be unsettling, particularly when it frequently experiences sharp dips in the price of 50% or more.

It makes the whole process of being in Crypto completely dissatisfying.

Here’s how we fix that.

Dollar Cost Average (DCA)

You’ll have heard of DCA, but is it something you’ve implemented?

DCA is a strategy where you invest a fixed amount of money at regular intervals, regardless of the price. It can reduce the impact of volatility and lead to more consistent returns over the long term.

Most importantly, it takes your emotions out of play.

It may surprise you, but data shows that DCA doesn’t necessarily give you a better return than a single lump sum payment (on average) but works better in other ways.

Reduces your risk with smaller transactions.

It allows you to buy when the price is lower.

It helps you ride out market downturns.

It gives you a disciplined savings tool.

Prevents bad timing.

DCA enables you to manage your emotional investing

The underlying advantage of DCA is it can help you buy more assets when the market is down.

Use traditional stocks or equities, for example.

If you compare this DCA approach to investing a lump sum, you’ll see that DCA can result in buying more shares if the price is in a downward trend.

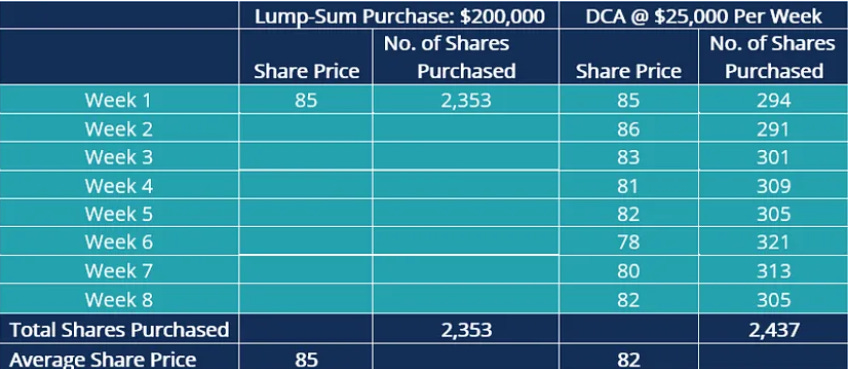

In the below chart, for a lump sum of $200,000, you could buy 2,353 shares. But with DCA, you’d buy 2,437. Eighty-four more shares worth $6,888 (at an average share price of $82).

(These figures may not resonate with the average investor, but their purpose is to illustrate a concept.)

Here’s Why You Don’t Need To Be an Expert With Crypto To Win (Apply Common Sense).

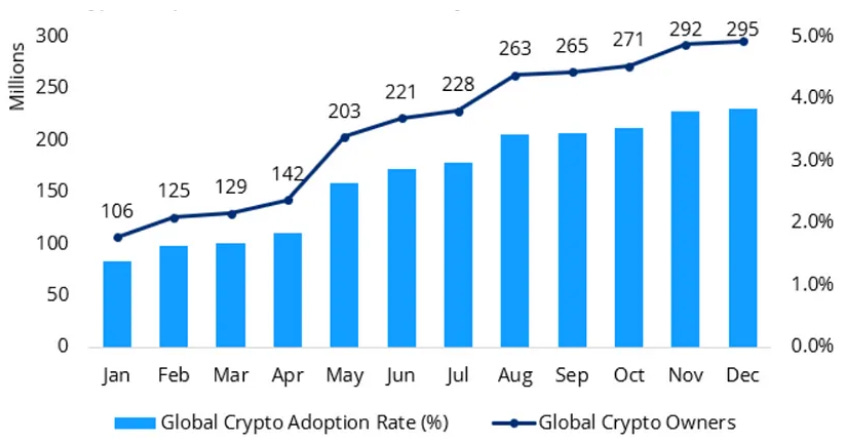

With the current speed of adoption, Crypto will reach a Billion People by the End of 2024.

Given the potential for massive adoption and explosive growth, it’s like throwing a dart at a barn door.

You’d expect a child not to miss.

The number of people worldwide who own Cryptocurrency is genuinely remarkable. Over 10% of global internet users, approximately 500 million individuals out of the 5 billion internet users globally, hold some form of digital currency.

Crypto.com data shows Crypto represents 300 million people worldwide, a 275% increase from their numbers in January 2021. These statistics demonstrate the growing interest and adoption of Cryptocurrency globally.

Despite a slight slowdown in growth rate because of economic issues, cryptocurrency adoption is still significantly outpacing the internet’s peak growth rate.

As a result, it’s projected by 2030, or perhaps even earlier, there will be approximately 4 billion cryptocurrency users, presenting tremendous potential for price increases.

Final Thoughts

Don’t Overthink It.

It’s easier than you think to make the right decision.

You’ll have noticed I didn’t say what cryptocurrencies to invest in. But if you’re pushing me for an answer. Here it is.

50% into Bitcoin

50% into Ethereum

DCA with whatever you can afford to lose and forget about.

If you were hoping for a sophisticated portfolio strategy or a beautifully crafted math equation etched onto a glass window, I can’t provide that.

BTC and ETH are two of the leading Blockchain networks in the world.

The store-of-value capability of Bitcoin and the network effects of Ethereum are unrivalled. Will there be another blockchain that surpasses them? Only time will tell.

Do your research.

Take the emotion out of it.

Realise this stuff isn’t rocket science.

And you might be pleasantly surprised by the outcomes.

Totally agree! Except id put 40% in BTC, 10% im ETH and 50% in AVAX. Look at subnets technology, the AAA titres and big institutions launching their own chain(avalanche subnet) and all the huge partnerships they are doing. The best tech will win and thats what made a welder like me, in crypto since 2021, transform 3k into almost 100k. 🫡