You’ll Make the Same Mistake I Did If You “Shake Out” of the Next Cryptocurrency Bull Market.

Warning: Reading this will improve your thinking and Crypto investing strategy (based on my real-life experience).

The Crypto bug has sunk its teeth into everyone.

It’s sparked a frantic treasure hunt for digital fortunes. And very few are now resisting the lure of “get-rich-quick” fever.

We’ve all done it, rushed into buying something like a bull in a china shop because a friend we know had a friend they knew who had some “alpha”.

A lack of discipline, impulsive decisions, and no clear plan kill your chances of success and dead in its tracks when it comes to Crypto.

But none of that matters because the grand narrative in your head has convinced you that you’re about to invest in the next “big thing”, and with zero experience, you dive in with your hard-earned money like you’re at the roulette wheel in a rundown casino.

In the back of your mind, eating away at you, you know it’s money you can’t afford to lose. But none of that matters because the prospect of seeing your Crypto shoot up by 50% feels incredible. It’s like watching a rocket take off.

It surpasses anything you’ve ever invested in before and gets you thinking, “What a time we’re living in”.

You’re riding high on confidence, so buying more of this “next big thing” is a no-brainer. But that little voice inside your head knows you’ve bitten off more than you can chew.

As the crypto prices fluctuate wildly, it becomes an emotional rollercoaster. What was once exhilarating is now nerve-wracking, and your stomach churns each time the market swings.

As a sense of urgency and desperation replaces the fun and excitement, you realise prices are crashing. While prices were pumping, you impulsively bought more, swayed by Crypto Twitter comments like “we’re going to the moon” and “it’s up only from here”. Yuck.

Your initial gains and some “extra investments” have been nuked by 50%, returning you to break-even territory, maybe even a loss, and it’s like walking on a tightrope without a safety net because you kinda need that money back.

So you say to yourself, I’ll sell out and get my money back the next time Crypto goes up. And like clockwork, a new cycle and bull run rescue you like a lost hiker found by a search party.

The part they don’t tell you, the soul-crushing PTSD part, is when, to your dismay, you witness an absolute “god candle” and parabolic rise shortly after you sell everything, having endured your first bear market.

It’s as if the Crypto Gods have gleefully kicked you out of the Irony tree, and you hit every branch on the way down.

This entire experience has been a clusterfuck.

As the prices rise, your stomach knots get tighter, and you feel physically sick.

This was precisely my experience of buying into the 2017 Cryptocurrency bull market and ICO boom and then shortly after getting obliterated during the 2018 bust.

I picked up a few things from those experiences, which have held me in good stead.

I wish people had told me these things before diving headfirst into Crypto and chasing my tail like an out-of-control puppy.

Ready?

Let’s dive in.

Weak Hands (Always) Get Shaken Out.

These folks (AKA me circa 2018) get spooked by every little change in the market and quickly sell off their investments.

They don’t have the confidence or patience to weather the ups and downs of the market, especially during tough times. Instead of sticking out and believing in their investments, they panic and bail out at the first sign of trouble.

Why?

They don’t understand what they’ve invested in.

They have a very short-term time horizon

And the kicker,

They’re using money they can’t afford to lose.

Using the money you can afford to go to zero is logical and prudent, but it does something else that people don’t discuss. It gives you the conviction to go to sleep on your investment and let it bubble in the background without checking the prices on Coinbase daily.

Using the money you don’t need gives you the ultimate superpower that few possess. It provides you with PATIENCE.

When deciding which cryptocurrency to invest in, I tend to keep this wildfire at arm’s length because everyone has their thesis on what’s best. However, after wandering through the Crypto wilderness, people often gravitate back to the same two juggernauts.

And for good reason.

If You’re New, Keep It Simple, and Don’t Get Clever (With Altcoins)

When you’ve weathered a lengthy bear market in Cryptocurrency, prices are bargain basement.

So if you’re new and want some exposure, keep it simple and stick to Bitcoin and Ethereum; there’s still plenty of upside, don’t get sucked into chasing a 10,000 X multiplier on a coin named after a dog or a frog.

Do whatever floats your boat, but make damn sure you’ve got some skin in the game with ETH and BTC before anything else.

My aha moment with Crypto was when Tyler Winklevoss described the value of each Cryptocurrency similarly to the value of social media networks. “The more people who use it, the stronger it is”.

You want exposure to the most robust networks that will grow exponentially over time.

Bitcoin is digital gold.

Ethereum is internet money (I’ll see in the comments about this one).

If either or both go to zero (which will never happen), Cryptocurrency will be six feet under pushing up daisies. So, within a speculative asset class, it’s the safest hedge you can make.

Having exposure to BTC and ETH is like investing in the Facebook, Instagram and TikTok networks of the world, which, to me, is a far better prospect than taking a gamble on the graveyard of “alts” like Friendster, MySpace, Vine, Orkut, Bebo, Ello, and Peach.

(Note: Ethereum is technically an Altcoin, but it’s the granddaddy.)

You Only Need the Tiniest Exposure To Set Your Learning Wheels in Motion.

Damn, I’d be chilling on a yacht somewhere if I had just put in 20 hours of hardcore homework before diving in headfirst. Joking — I wouldn’t say I like the sea.

The point is making educated decisions is paramount.

Understanding why your investment has gone down gives you greater conviction in holding for the longer term.

Because everything is decentralised, you don’t have the execution risk related to traditional stocks or a product release that could tank.

You have global economic issues and policies around interest rate increases, inflation and consumer price index data that impact cryptocurrency prices. It’s good to know some of this stuff.

Becoming a full-time economist is unnecessary, but it’s worth knowing a little about how macroeconomics impacts the price of Crypto.

Heck, if you have no interest in doing any of that, here’s what you do instead. You take the smallest amount you can think of, something negligible, say, 50 dollars.

You put 50% into Ethereum

You put 50% into Bitcoin

The amount you invest is irrelevant, but something strange happens when you have skin in the game. It changes your mindset, and you gravitate to learning about the space.

You’re not exposing yourself and vast amounts of your hard-earned money to guesswork, uncertainty and gambling, but it’s giving you a little taste.

It’s the difference between doing push-ups or having someone tell you how. It’s just different.

As your confidence and knowledge grow, Dollar Cost Averaging, i.e. investing small amounts over a more extended period or at regular intervals, is an effective strategy to absorb volatility and keep away those grey hairs (it’s too late to save mine).

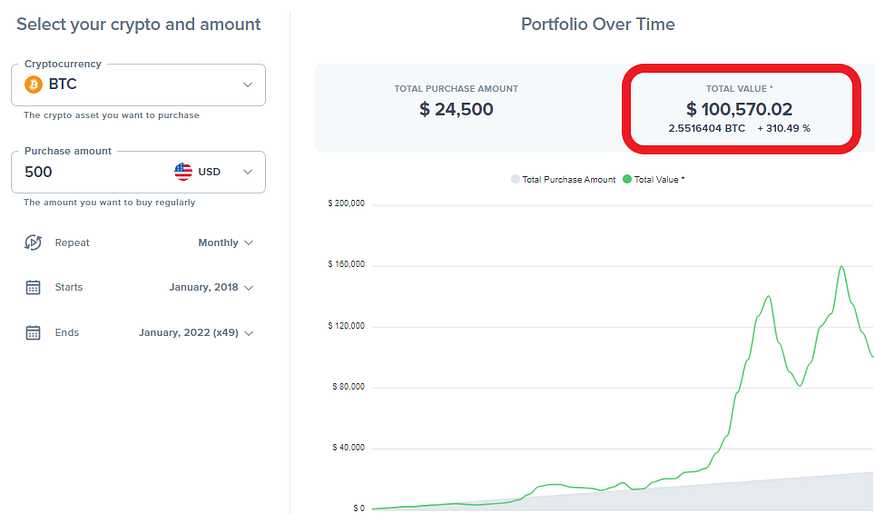

Being educated on this can be highly beneficial. Let’s consider a relatively standard personal loan duration of 50 months with a monthly repayment of $500. Instead of having that personal loan, imagine you invested the same amount monthly in Bitcoin using Dollar-Cost Averaging (DCA). Here’s what the outcome would have been.

You’d be up 310% with over $100K in Bitcoin (even with the recent correction) — using the exact figures, you’d have $222k in Ethereum and be up 807%.

If you invested 50/50 in Bitcoin and Ethereum, your overall portfolio gain would be approximately 558.5%.

Final Thoughts.

You’ll make a massive mistake if you “shake out” of the up-and-coming cryptocurrency bull market. There’ll be one and many more to come.

You want staying power.

It helps to have some framework for a plan when investing that’s not impulsive and falls outside of trying to pin the tail on the donkey blindfolded.

It would help if you had some idea of why you’re doing what you’re doing that’s sturdier than “because Twitter said so”.

Here’s a thesis I lean heavily on.

It’s grounded in common sense.

Ready?

We’ll become more digitalised as time passes. It makes more sense, not less, that we’ll value these digital assets more and more.

Considering the entire global money supply in the cryptocurrency market, let’s assume it’s 0.5% of the total. By investing in the two leading cryptocurrency assets with the highest probability, you are speculating that their value will increase to 1% or decrease to 0%.

0.5% where we are now means we’re at net even.

I believe, along with many others, that the percentage will likely increase.

Only time will tell.

Very well stated. I had the good fortune of reading and following someone who is very knowledgeable about which projects are the most relevant, since 2016 and he explained that if you imagine closing costs for a house suddenly run on Ethereum, Title, etc will be run at a fraction of today's cost. The Banks will be happy because there will be no delay. The purchaser will be happy because the cost will be a fraction of what it is today. The only losers in the new order will be the people who have been milking homeowners for years.

🙏👍