You’ll Miss Another Inevitable Crypto Run if You Don’t Invest in Assets Like Bitcoin Ahead of Time (Raoul Pal)

You only need to use a handful of historical references to see why.

Do you ever find yourself constantly questioning your investments in cryptocurrency, where uncertainty, apprehension, and doubt seem to be at their peak?

You’re human.

It’s normal.

The most effective way to navigate uncertainty is to lean on financial experts or use a group of them as safety signals. Over time you’ll find the same message appearing on the surface.

It’s like turning on your flashlight in the dark.

Raoul Pal, a renowned economist and a best-in-class hedge fund manager, is bullish on the Cryptocurrency revolution.

I write about him mainly because he has a broad and deep understanding of financial markets.

He’s often called the leading Business Cycle Economist and Economic Historian. The latter is down to his ability to break down complex ideas and use clever historical references to describe what may happen in financial markets.

Pal says if you’re considering investing in Bitcoin, you must consider the current stage of the economy’s “liquidity cycle”, which measures the amount of money available for spending.

He says instead of investing all your money at once, start small (Dollar Cost Average) and be cautious, as the economy can worsen. But now is an excellent time to start “having a nibble”.

By any standard, we are heading for a recession and sentiment around every asset is negative. Despite all this, Pal is a lone cheerful voice in a pit of negativity.

He says you may not catch the bottom, but asset prices can’t drop substantially from here because of the business and liquidity cycles. More money is due to come into the system, which signals increased asset prices.

If you understood this, you’d do a better job ignoring the negative sentiment, which would present a significant growth opportunity for you ahead of time.

Raoul Pal — Source

“With Bitcoin, I treat it as an asset that protects my long-term wealth. It sounds crazy with its ups and downs, but going through the full cycle, you’ll notice that each low is higher than the previous one.

It’s in an uptrend, so I don’t sweat the ups and downs. I just accumulate during the down cycles. The down cycles signify economic contraction and a slowdown in the world, with money being withdrawn from the system.

Assets fall, and interest rates rise, leading to a decrease in disposable income. However, at this point, it’s important to recognise that economic activity will eventually pick up. In a year’s time, they will start printing money again.

Therefore, it’s advisable to buy more during these downturns to take advantage of the upcoming upside cycle.”

Whenever We Have a Bust Period, People Yell, “Bubble.”

Pal says the “Scam! Ponzi!” crowd will be buyers in the next cycle.

You must have a long-term time horizon.

Add on the despairing lows.

It’s a game of survival.

Filter out all the noise.

Don’t use leverage.

Stay in the game.

Pal says there are multiple historical references to show what the market is doing is entirely standard, and liquidity prices will return if you can be patient.

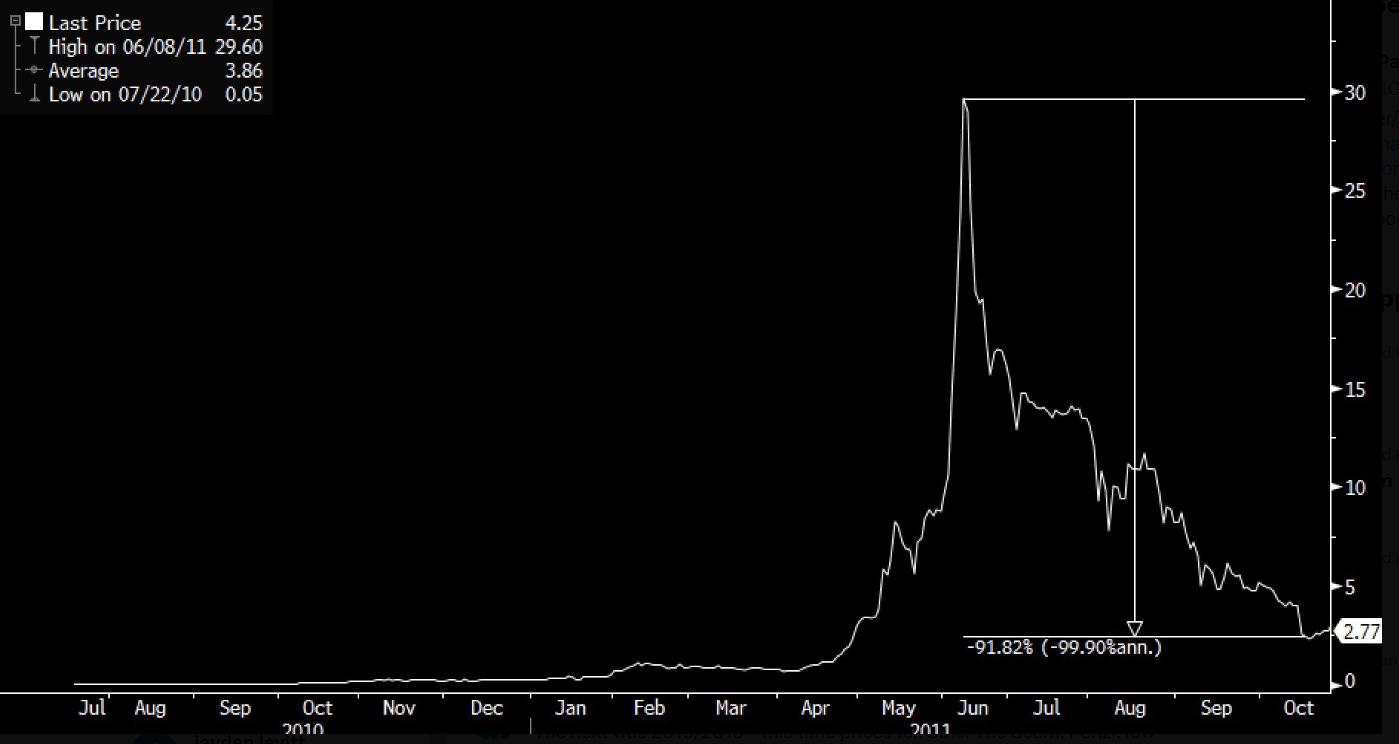

Raoul Pal — Source

“The global liquidity cycle leads to large booms and busts. Each time we have a boom, everyone not in the space yells ‘Bubble!’ and truly enough, eventually, prices collapse, and we get to the ‘It’s all a scam! It’s a Ponzi! It’s never coming back!’ phase of the cycle. But prices never return to the previous low.

The first was the 2010/11 cycle, where prices fell 92%. The ‘Scam! Ponzi! It’s never coming back!’ phase this time was Mt Gox.

The next was 2013/2015 — this time, prices fell 85%. The Scam! Ponzi! Low was Bitfinex.

Then again in 2018 — down 83%. The ETH DAO hack, ICO bust and BTC forking wars were this Scam! Ponzi! FUD.

Raoul Pal — Source

“This time, it’s the CeFi and FTX collapse, and here we are again in the Scam! Ponzi! Phase. People tend to leave the space at all these phases and return in the next bull run.

The global money supply drives the boom/bust phase. When money is tight, people go bust. Also, there is less money for speculation.

This is when the tide goes out, and you can see who is swimming naked.

But this tiresome ‘Scam! Ponzi!’ nonsense hides that the network growth in BTC (taken from using the low to low) is 125% per year, which is astonishing growth.

Each ‘Scam! Ponzi!’ low leads to substantial price increases (unlike any other asset) as liquidity returns, and the network keeps growing.

Liquidity will soon turn.

You don’t need a super cycle of liquidity like 2020, just a positive cycle for crypto to perform as the network keeps growing.”

(Each new low is higher than the previous market cycle’s high.)

Final Thoughts.

Pal has simplistically taken the last three significant crashes in crypto to pave the way for what might happen in the future.

What’s common sense is only sometimes common practice.

Bitcoin has never gone through a significant quantitative tightening period or recession. So there are still some uncertainties.

The early signs are that younger investors see Bitcoin as a vehicle that’s a flight to safety, much like people invest in gold during times of uncertainty.

The other added factor in all of this is the debasement of currencies. More money will continuously come into the system.

More liquidity is bullish for Bitcoin.

You may not catch the bottom of the market, but a gigantic crypto run in the future is inevitable.

At the very least, you want to protect yourself against the value destruction of currencies.

You’re either going to be sitting on cash.

Or have invested in assets ahead of time.

I know which bet I’m placing.