You’ll Think Saving Money Is for Losers When You See How the Upcoming Chess Moves of Society Play Out (Bitcoin)

The opportunity for exponential growth is here, but it won’t be around forever.

Do you ever hear those stories where someone you know got into something early and made ludicrous amounts of money?

We’ll talk about those people in 20 years.

We may even reflect on this digital revolutionary period and think this was the moment.

You may wish you were less cynical or had dug deeper and been open-minded to the opportunity instead of gobbling up headlines shouting crypto scams and Ponzi schemes.

Somewhere underneath all the fear-mongering news is a formidable technology that’ll take time to improve, but when it weaves itself into our daily lives, we’ll speculate about it less and less.

Blockchain technology will become the norm.

You might be like me, a kid from a generation of parents who told you you had to go to school, get good grades, get a good job, and save for a house.

Investing wasn’t pop culture like it is today.

Between 1980 and 1990, the average savings rate was 10% and reached a high of 13%. You were more inclined to save money because there was no avenue to get hold of cheap credit or personal loans. In short, you were up sh*ts creek without a paddle if you didn’t save.

Today (as of publishing), the personal savings rate is 4.3%

The American national debt is $32.6 trillion and getting out of control. And the debt to GDP ratio is 122.8%, meaning America spends more money than it produces in productivity. Yuck.

With more money in the system, you’d think there’d be giant savings pots with people swimming in cash, ready to spend recklessly in a mall like one of the Kardashians.

During the most prosperous years between 2010 and 2020, when America (and the world) built its economy on 0% interest rates after the housing crisis, people kept borrowing and saving less. We were tripping over briefcases of cash.

After being locked in our houses with it now raining free bat virus money, we had more mullah than we knew what to do with, which caused some of the worst inflation in living history.

According to government figures, which in the run-up to an election year are probably twisted, inflation reached just under 10%, the highest since the 70s and the great depression in the 30s.

Now inflation is under control (somewhat), and everyone is waiting to see when the Fed reduces interest rates and stimulates the economy with those sweet money printers. Again.

It’s a vicious cycle, and there’s a deceptive effect on your savings. You’ll work like mad to save but feel like you’re treading water because your money in the bank will have less spending power.

Your money sat in savings is marching towards extinction.

In Jeremy Siegel’s book “Stocks for the Long Run”, he measured the spending power of $1 since 1802 and determined that a $1 equivalent today would have the spending power of 5 cents.

If you’re a saver, you’re most likely losing.

When you pull your head above the bunker and ask yourself, what’s my best opportunity to protect myself against value destruction?

Is it the stock market?

Is it saving money?

Is it in property?

Any average human would agree that exposure to the above is prudent, even for some healthy diversification.

Aiming to create value or protect your future where you don’t have the friction of land issues, property sales fees, or the risk of a failed product launch nuking your stock portfolio helps.

You also want to avoid sitting back and watching your savings dwindle in value like a melting ice cube.

Considering this, if you’re asking me, your answer is Bitcoin.

You can buy fractions of Bitcoin without friction

It’s entirely decentralised

It has a global demand

It has a fixed supply

There’ll always be, at most, 21 million.

Here are three critical metrics you need to know about (they mirror each other).

I’m not some Bitcoin evangelist; it doesn’t bother me what you choose to do.

In 2013, a friend swung his chair around in the office, flicked his heels off the ground, and scooted over to my desk. “Mate, have you heard of this Bitcoin?” he started explaining it to me, and I genuinely thought he had lost his mind.

I immediately shut off when I read about the anonymous creator Satoshi Nakamoto and that people were mining for this stuff.

It sounded like some far-fetched wizardry and far removed from reality.

I was also in the “no business”.

I said no before even considering it as an option.

Bitcoin was $300 then, so I’ll have to take a big fat L.

It became crystal clear as I researched more and saw data from previous cycles. Bitcoin had built-in network effects, and people within the network became the most significant proponents.

Raoul Pal describes it as Metcalfe’s Law. The more people who join the network, the more valuable it is. Try telling 140 million Bitcoin holders that their pet rock has no value.

It’s also precisely how social media networks operate.

Mark Zuckerburger has no qualms about copying features from other apps because people don’t want the mental arithmetic of learning the new “thing”.

There are three key metrics, and they all mirror each other. You don’t need to be a rocket scientist or economist to understand.

Ready?

The Business Cycle

The Liquidity Cycle

The Bitcoin Halving

Bitcoin launched in the middle of a financial sh*t storm in 2009, so it syncs perfectly with the start of the business and liquidity cycle.

Stick with me; it’ll start to make sense.

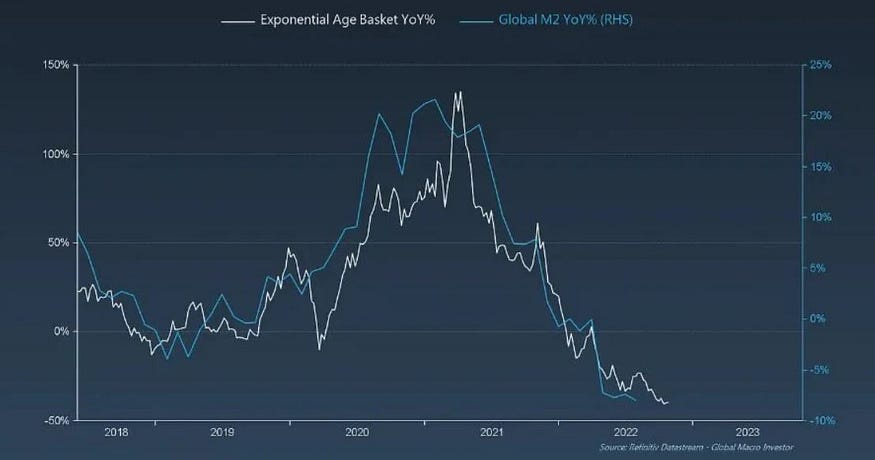

The stock market (business cycle) performance drops when the money (liquidity) dries up, negatively impacting Bitcoin’s price.

When there’s more downward pressure on interest rates or periods of stimulus (money printing), it promotes business growth, frees up liquidity for investing, and is inherently good for Bitcoin.

Here’s how Bitcoin has matched up against the business cycle of the stock market, which responds to the liquidity cycles.

It’s almost a mirror image of performance.

Liquidity and user adoption are about to collide, making your savings look silly.

I’m not saying you should have no savings.

It would help if you had that emotional barrier protecting you against the bumps and bruises of everyday financial life.

If your only strategy is hoarding cash like a cautious grandparent, you could miss an opportunity.

We’re about to hit a sweet spot where Bitcoin adoption increases and liquidity returns to the market.

78% of Bitcoin holders have held for more than six months, and the chances of it ever being sold have decreased significantly. So it’s creating this beach ball-held underwater effect.

There’s only one way for it to go: toward the heavens.

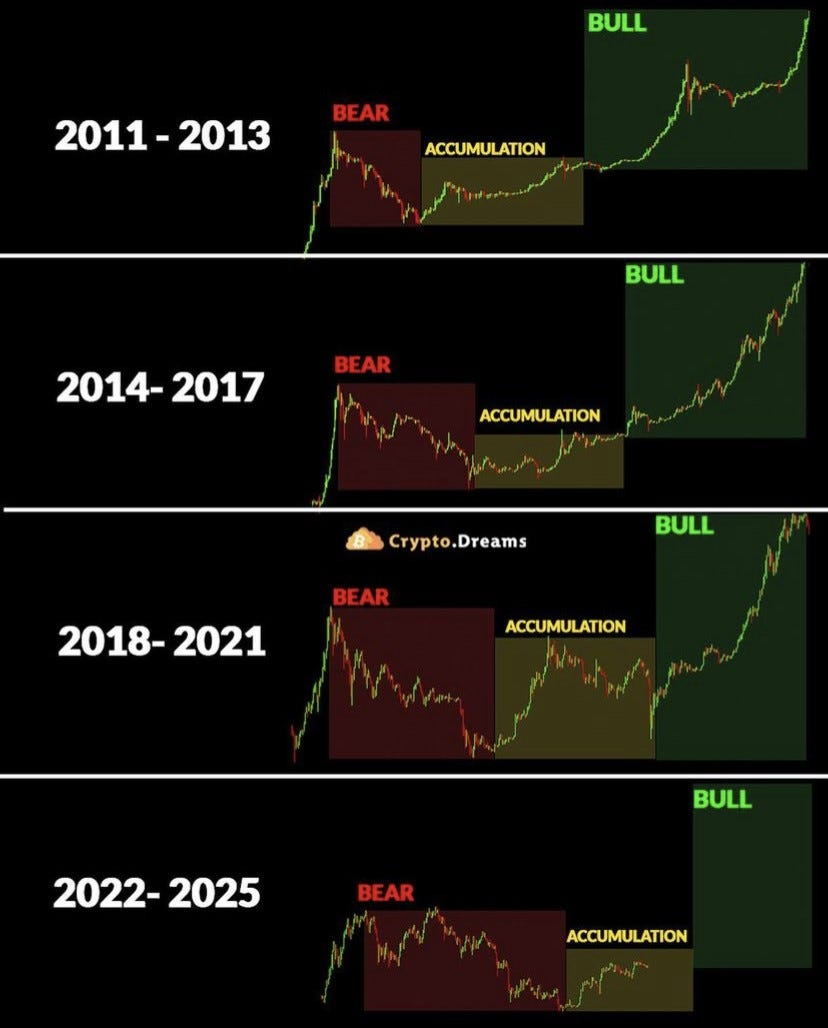

The final piece that pulls the acorn out of the river wall, causing exponential growth, is the Bitcoin halving.

The next event is due in around April or May 2024, which reduces the reward given to miners, lowering the supply of available Bitcoin, which inherently boosts market sentiment.

It happens at or around the same time the liquidity returns to the system and is in sync with the start of the new business cycle.

When you throw in a sprinkle of more demand and less supply, it exponentially increases price pressure.

Here’s how each cycle has faired so far.

Final Thoughts

No one knows what to expect in the future in terms of price, economic or political events, but we sure as heck can put our best foot forward and look for an investment vehicle that has a reasonable shot.

Bitcoin has moved with the motion of the ocean when it comes to liquidity, which subsequently matches the business cycles.

So you can see the tidal wave coming.

It’s as obvious as a punch in the face.

The secular trend has been upward over a long time horizon, and every new market low has beaten the previous market cycle high.

People are impatient.

Now, everyone is waiting with bated breath to see when interest rates are coming down because that will be the final indicator that liquidity is set to return.

You’ll have a window of opportunity before the next round of early adopters.

When it does, I won’t be sitting on savings.