Your Biggest Mistake With Bitcoin Is Worrying About Volatility; Significant Fluctuations in Price Don’t Equal Risk (Mark Yusko)

You need to read this if you worry like mad when cryptocurrency prices drop.

Photo By Coindesk on Flikr

If you’ve been in Crypto for any significant amount of time, you’ve likely experienced the excitement of investing followed by the sinking feeling in your stomach when your assets plummet by 50%.

We’ve all been through it.

Heck, I bought the top of the bull run in 2017 and then sold my Ethereum and Bitcoin for a loss in 2018 in the face of an anticipated apocalypse.

It’s remarkable how the market (always) recovers, and everything falls back into place after all the chaos.

I look back at the screenshots from 2018 and kick myself. My thesis was right, but I got caught up in the emotion, which cost me dearly.

How I wish I didn’t sell at these prices.

I was still a newbie, fresh and inexperienced. Nevertheless, I broke one cardinal rule. I associated high volatility with risk and decided to lower my risk by selling for a loss. Yuck.

Mark Yusko is an investor, hedge fund manager, and Bitcoin maximalist. I’ve started writing about him more often, mostly because he has his head firmly screwed onto his shoulders and is from the traditional finance world.

When someone has been in investing or finance throughout their career and plunges into Cryptocurrency, their behaviour isn’t helter-skelter.

Yusko has one overarching message regarding any new technologies you consider investing in.

Ready?

“You want volatility”.

You only need to examine historical references to see how new technologies are volatile but the fluctuations present opportunities for substantial upside.

The amount of information available to investors often influences periods of high and low volatility in the market.

People in the market may become more cautious (just like I did) and make more trades when there’s a lot of uncertainty or confusion, like during big economic events, political unrest, or unexpected situations. This can make the market more unpredictable as people’s feelings and attitudes change quickly.

On the other hand, Crypto investors may feel more confident and less inclined to make frequent changes to their positions during periods with more clarity and stability. This reduced level of uncertainty and the perception of lower risk can result in lower volatility.

Yusko says people have expressed concerns about the volatility of Bitcoin, comparing it to the likes of Amazon. But here’s an interesting fact: Amazon stock and Bitcoin exhibit the same level of volatility, up to just under 90% on the volatility index.

Yusko says it’s worth noting that Amazon has been around for 27 years, while Bitcoin has a history of 14 years.

Over those 27 years, Amazon has seen a 40 x increase in value.

Yusko then introduces the compounded growth rate calculated on the previous year’s results (Amazon 40%). He says if you take the annual rate, “1.4 raised to the power of 27 years”, you get an exponential figure.

However, Bitcoin’s compound return is even more impressive, approaching 90%. With 1.9 raised to the power of 14 years, the potential gains are significantly larger over time if you can stomach the volatility.

Mark Yusko — Source

“Amazon has experienced its fair share of ups and downs, like any other investment. Every year, including this one, Amazon has seen double-digit drawdowns.

It has had five times more drawdowns exceeding 31% than the average market. It has even had five times more drawdowns exceeding 50% and twice as many drawdowns exceeding 90%.

Despite these fluctuations, the key question is when was the right time to sell? The answer, according to historical data, is never.

But who bought it 27 years ago and had the foresight to hold it until today? There are only five people in the whole world.

Jeff Bezos, Mom, Dad, an ex-wife, and Bill Miller. Bill Miller’s cost basis for his Amazon stock was seven cents.

So everyone else was afraid of volatility, and that’s why people don’t like Bitcoin because it’s so volatile. But, well, you want volatile assets in your portfolio.

The worst asset you could ever own is cash”.

Over Time As Assets Mature, Volatility Will Go Away, and You’ll Wish It Never Left.

Yusko says short-term sitting on cash is ok, but long-term you’re better off being in a volatile asset that will increase in value over time and not get chewed up by inflation.

Bitcoin’s price movements are known for their wild swings, making it stand out from traditional assets like gold, regular currencies, and well-established stocks. However, it may come as a surprise that Bitcoin is less volatile than shares of tech giants like Amazon and Meta.

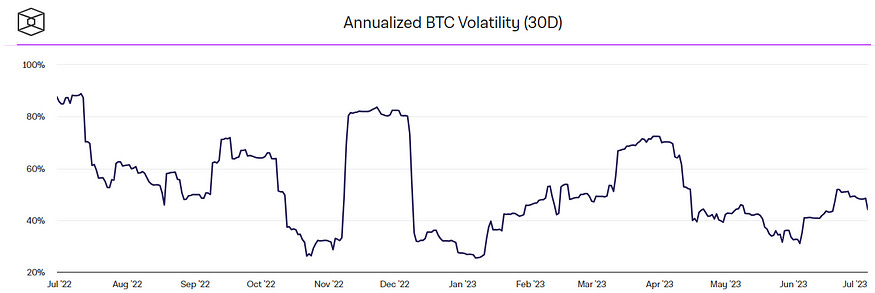

When we measure the volatility of Bitcoin, which looks at how much the price has changed daily over the past 30 days, it currently stands at around 32%. This figure is relatively low compared to its historical average volatility of 71%.

In other words, while Bitcoin is still considered a relatively volatile asset, its recent price fluctuations have been less intense and unpredictable than its overall price history.

It indicates a certain level of stability in the market, especially when we compare it to the often turbulent movements seen in stocks of established tech companies like Amazon and Meta.

If you look at the 12-month chart below, you’ll notice that the recent upward trends resemble stable growth rather than volatile spikes. The graph no longer compares a top hat in the middle of the chart but shows a more consistent and steady pattern.

Volatility With Bitcoin Is Good Because Other Financial Assets Drive Their Value From the Same Source.

Yusko says you should look at volatility differently and not associate it with risk. All assets have some form of volatility, but some are more established than others, so they’re less volatile.

Crypto, particularly Bitcoin, is an uncorrelated asset; it’s not linked to what drives those other financial assets, making it more of a safety bet than anything else.

What you must consider is long-term volatility. The long-term fluctuations of Bitcoin are low relative to financial assets because financial assets derive their value from the same things: GDP growth, inflation, interest rates, and corporate profits.

None of those things have anything to do with Bitcoin. Bitcoin is driven by Millennial adoption.

Yusko wants to make sure you understand the digital divide between generations and the exciting wealth transfer that lies ahead.

He says the younger generation will inherit around $37 trillion after the over-40 pass-on.

Money will find its way into digital assets, not the stock market or gold (unless securities get tokenised).

Gen Z and Millenials embrace digital assets like Bitcoin. They will have a fresh take on money, putting more emphasis on digital forms rather than traditional paper money, physical wallets and even gold.

Mark Yusko — Source

“Over the long term, you’re going to get chewed up by inflation, and you’re going to lose money. So you add less riskier bonds than cash, and your return increases while your risk decreases.

How can that be?

If you had stocks, the risk goes down further. If you had hedge funds, the risk goes down. But all those assets are volatile. They’re correlated to each other.

The beautiful thing about Bitcoin is it’s perfectly uncorrelated to all the other assets. It’s 0.0 correlated to bonds and 0.15 linked to stocks.

“Oh, Mark, you know, it was highly correlated last year”. Short-term correlations don’t mean anything in crises, particularly liquidation crises.

All correlations go to one in all assets: stocks, bonds, currencies, hedge funds, and commodities.”

Final Thoughts.

Significant fluctuations in price do not equal risk.

Yusko is saying if you invest in Bitcoin, you’re hedging against risk even with the volatility because it’s growing in adoption. It’s not impacted by the same factors traditional assets are.

Given the expectation that people adopt digital currencies as a social norm, we’ll likely see less and less volatility.

You should also consider your alternatives to not being able to stomach volatility.

Inflation will drain your cash.

Your savings rates aren’t keeping up with inflation either.

The stock market will swallow fees and expose you to economic factors and execution risks.

Millennials drive Bitcoin demand, and over time, the volatility will go away as they reach the pinnacle of their earning power and institutions come in.

In years to come, you’ll wish for volatility and today’s buying opportunities.