Your Bitcoin Time Horizon Might Be Too Short if You Care About the ETF Being 'Priced In' or Not.

Sometimes, it's hard not to look at the scale of the opportunity.

As Bitcoin and the the crypto market heats up, I'm committed to keeping you informed. This newsletter is free, thanks to our paid subscribers—If you value these insights, consider supporting my writing by joining us and upgrading to a paid subscription.

The anticipation of the ETF approval has people hanging off of dopamine-fueled price predictions like adrenalin junkies.

The feeling of optimism this time, with so many positive events on the horizon, is giving everyone a sense of euphoria.

We're about to reach the summit of the most significant period of liquidity injection into the BTC and cryptocurrency echo system, with a cascade of potential ETF approvals as close as Wednesday this week.

The blow-by-blow ETF action has consumed my Twitter feed.

Famous venture capitalist and Bitcoin bull Chamath Palihapitiya say it's the most significant thing ever to happen in Bitcion's short history.

Chamath Palihapitiya—Source

"This is the most important year for Bitcoin that has ever existed. We are probably days away from a series of ETFs being approved. So this is the moment for Bitcoin to cross the chasm and really see mainstream adoption where our parents and grandparents understand what it is. Can buy. But also do buy it. If all of this comes to pass, Bitcoin will be a part of the financial lexicon by the end of 2024."

If you're not in the loop, a Bitcoin ETF (Exchange-Traded Fund) is a financial instrument designed to track Bitcoin's price.

It allows traditional investors to gain exposure to Bitcoin's value through a stock-like format without the need to store the cryptocurrency directly.

It's a significant event because it's a signal from the traditional finance world that finally gives BTC credibility that we retail investors have recognised for years.

After a rumour about BlackRock maybe putting in $2 billion, folks have been doing quick maths on napkins, guessing how much this cash injection could pump up the prices.

Statista says BlackRock's got $9.4 trillion in assets under management, so their first move into the ETF game would be a minuscule 0.0212% of total assets.

Matthew Sigel, head of digital assets research at VanEck, hopped onto a Twitter Spaces chat to dish out his take on what might go down if those rumours are true and made some parallels to the gold 2004 ETF launch.

MS —Source

"If that $2 billion happened in week one, you know, that would blow away our estimates. We're at $2.5 billion in the first quarter of trading, which we do by looking at the past flows into the first gold ETF and adjusting by the US money supply. And we have a $40 billion market opportunity over two years based on the similar analysis."

The NYSE introduced the first gold ETF in November 2004, and since then, the price has never returned to its former levels.

While various economic factors like the increase in money supply and the great recession of 2008 have influenced gold prices, the launch of the ETF played a significant role in attracting a substantial influx of global institutional funds.

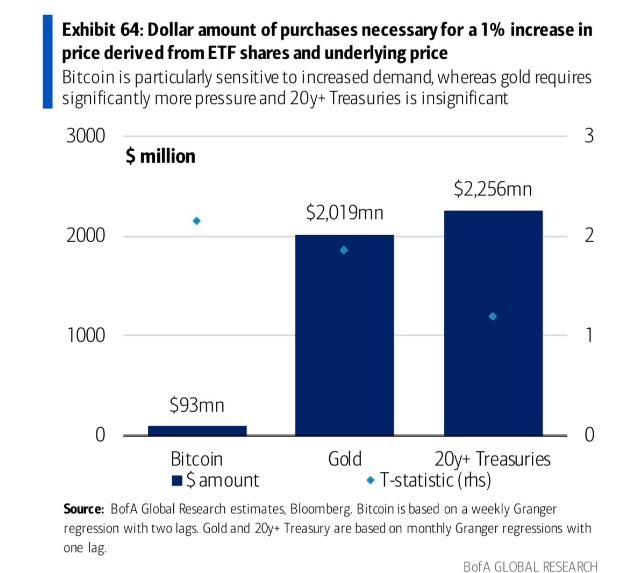

Global Financial research firm Bofa says it would only take $93 million of capital inflow for Bitcoin to increase by 1%.

Due to the high percentage (71%+ as per Glassnode) of people holding onto their assets for over a year, every dollar invested boosts the market cap by $4.

So, for every $1 Billion that inflows in a short period of time, as per their research, there would be a 10% increase in the price.

They said, "We find Bitcoin is extremely sensitive to increased dollar demand. For example, we estimate a net inflow into Bitcoin of just $93m would result in a price appreciation of 1%. While to reach a similar figure for gold, you would need to be closer to $2b or 20 times higher."

Final Thoughts.

Everyone in Crypto has their buzz back because there's so much positive sentiment on the horizon.

The most significant lesson I learned from 2017-20 is to be bullish but not to get sucked into the media headlines.

They make you excited. And when I got drunk on the punch, I made some silly mistakes. I reverted my mindset to quick hits, like trading in and out of assets to chase pumps.

When you're in shortcut land, it takes away all the fun, and you make mistakes.

This time around, I'm blocking out the noise.

I'm not looking to rush in like a bull in a china shop and do silly things like leveraging myself to get a position.

Stick to the programme.

I've found it effective to concentrate on holding a mix of the top 3 assets: BTC, ETH and SOL.

It's very similar to the traditional finance space, where people rotate out of bonds into equities as their risk appetite improves. When people profit from Bitcoin, they rotate into assets further down the risk curve.

ETH and SOL, next in line after Bitcoin, offer significantly more room for price appreciation due to their lower market caps. It's always best to follow your own strategy. A balanced mix of all three can be a great starting point.

One thing I don't try to do is suppress my inner degen.

So, I have a small allocation for stuff I play around with and get exposure to. It's mainly because it makes it more fun, and I like the idea of something 50x'ing for no reason, lol. Or reasons I can’t explain.

I'm also not wiped out if it goes to zero.

Most importantly, adopt a broader perspective to act as your shield and filter out the daily market noise whenever short-term thinking peaks its nose in.

We’ll have frequent pullbacks and there'll be plenty of opportunity.

So, no FOMO.

Just increase your position slowly.

Nice article. There is a chance that BTC will drop shortly after ETF is finalized. Some big investors are simply banking on a bounce after this is announced and have little understanding or interest in holding the asset. I see this as a possible buying opportunity!

Well done article.

Thank you very much!