Your Crypto Is Worth Nothing — The Sooner We Introduce Central Bank Digital Currencies, the Quicker We Can Regain Control (ECB President)

If you’re worried about CBDCs, you’ll be shocked by the European Central Bank Presidents’ recent comments.

Commons Image By World Economic Forum On Wiki Media

Christine Lagarde is a hotshot French lawyer and politician now turned European Central Bank president.

She’s pretty boring.

But she’s everything you want in someone looking after the continent’s money.

Lagarde has never drunk alcohol.

She doesn’t like spending money unless it’s on designer clothing.

And she’s admitted to smoking some Columbian grass.

Wait, what?

Never mind, let’s move on.

In France, she’s the poster child for women breaking glass ceilings in a male-dominated environment.

Lagarde credits her resolve to the family she was living with while pursuing academic studies in America. After a bad day, she’d come home and vent. They’d respond, “Don’t let the bastards get to you.”

They weren’t venting about women.

Credit where it’s due, Lagarde has excelled in a banker’s world where men overpower. She says she went to a predominantly male school as a kid, which has helped her cope in later life in a male-dominated world.

While in her previous role as International Monetary Fund head, she was found guilty of negligence. Still, Lagarde avoided jail time and a fine for approving a large payout to a controversial business person.

Recently Christine Lagarde hit media headlines after being prank called by someone she thought was Ukrainian President Volodymyr Zelenskyy, asking her questions about Central Bank Digital Currency (CBDC).

The video is beyond belief.

And it’s hilarious.

Lagarde expresses her concerns over digital currencies big tech companies like Meta, Google and Amazon may develop. She fears these currencies could take over Europe’s sovereignty and become the continent’s primary trading currency.

Her statements in the prank video about maintaining control are remarkable.

The person she speaks to sounds nothing like Zelenskyy, and her unapologetic stance on wanting to control your money is alarming.

You might be from a Country where it does not currently impact you, but make no mistake. You’ll have all this coming.

Christine Lagarde — Source

“I don’t want Meta, Google or Amazon to suddenly come up with a currency that will take over the sovereignty of Europe.

I want a foreign currency to be something other than the currency of trading within Europe, so we have to be ready.

Now the problem is people don’t want to be controlled.

You know what? Now we have this threshold above 1,000 Euros in Europe. You cannot pay cash.

If you do, you are on the grey market and take your risk. If you get caught, you’ll get fined or go to jail.

But you know the digital Euro will have a limited amount of control. There will be control. You’re right. You’re entirely correct.

We are considering whether we could have a mechanism with zero control for very small amounts, anything around 300–400 Euros, but that could be dangerous.”

Yuck.

Don’t get me wrong, sovereign nations and continents must protect their interests and citizens. Having listened to hours and hours of Lagarde’s interviews, she avoids naming specific cryptocurrencies like Bitcoin and Ethereum. Instead, she refers to Meta, Amazon and Google, three centralised companies often targeted for criticism.

They’re low-hanging fruit when you want to win over the people in a popularity contest.

Make three famous culture behemoths into enemies while presenting her CBDC as a beacon of hope. I’m not buying it.

Buckle up and strap yourself in because things get messier.

Open Your Eyes. You Can Lose All Your Crypto.

Lagarde’s stance on Cryptocurrency has a similar ring to most government officials.

It’s the same old song — Crypto has no backing and is incredibly risky. It’s what we all hear. However, recent banking failures across America have suggested that it’s all risky.

Bizarrely, sentiment towards Crypto is changing.

People once on the fence about Cryptocurrencies are now considering self-custody assets like Bitcoin and Ethereum, viewing them as a safer haven than the traditional banking world.

And it shows because the prices are rallying and wallet addresses are increasing rapidly.

According to data from the on-chain analytics firm Santiment, BTC now has 45.14 million addresses, which grew by 3.95% (1.71 million wallets) during the last two months.

This trend indicates that new users are joining the network, and more people are starting to use Bitcoin.

In a separate interview with a live pro-Crypto audience in Holland, Lagarde elaborated on her thesis.

She said if people still want to invest in Crypto, they should do it with their eyes open, knowing they could lose all their money.

Christine Lagarde — Source

“I’ve said all along that Crypto is highly risky and highly speculative.

If you want to invest there, it’s your choice. But what concerns me about Crypto is that people need to make these investments with open eyes so that they can lose it all.

It went down by 20% last week in one week.

I’m concerned for the people who don’t understand the risks, who will lose everything and be disappointed.”

Lagarde — Your Crypto Is Worth Nothing.

It amazes me how people in high-flying finance positions still don’t understand that Bitcoin is solving a significant store of value issue worldwide.

It’s giving people digital property rights and a tool for economic freedom, and the only thing it needs to be backed by is a network of people agreeing on its value.

For Christine, it’s all just hype.

Christine Lagarde — Source

“I say number one. Those who invest should know it cannot be this crypto hype where you think it will work and continue to increase just because a friend of a friend has made x amount.

It’s a super risky asset.

My very humble assessment is that Crypto is worth nothing. It’s based on nothing, and there are no underlying assets to act as an anchor of safety.

If the day comes when we have the central bank digital currency or any digital euro, I will guarantee that the central bank will be behind it.”

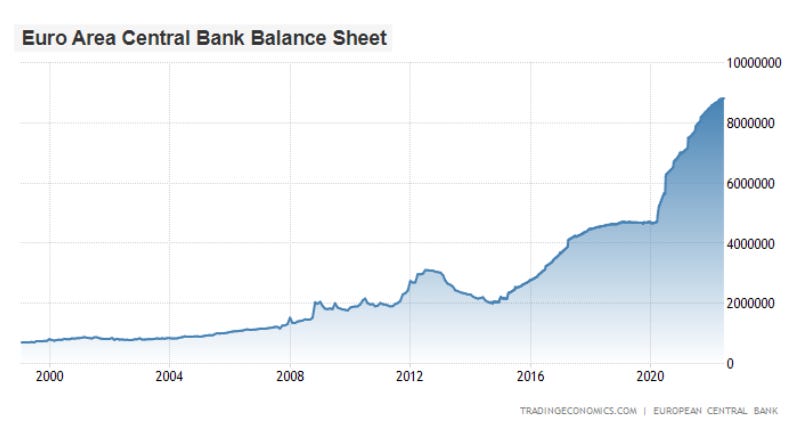

The European Central Bank’s Balance Sheet Is Out of Control.

In the same interview and a stunning piece of Dutch television that seemingly has no filter, the presenter shows Lagarde a European Central Bank balance sheet graph in front of a live audience and asks her how she plans to reduce it.

It starts to make for some uncomfortable viewing.

Presenter:

“Your balance sheet is over 8 trillion euros now. Isn’t what you just told us about Cryptocurrency, what we see here, this gigantic bubble on your balance sheet with the Euro? And isn’t this graph very nerve-racking?”

In her response, Christine Lagarde almost attempts to derail the conversation by saying there are no Crypto assets on the ECB’s balance sheet.

That would be obvious, but it doesn’t explain why her balance sheet is out of control. She further mentions she was only four months into her role.

Christine Lagarde — Source

“I can tell you there are zero Crypto assets on the balance sheet of the ECB — point number one.

You have to think counterfactual. We had to put together a post covid plan and subsequently increased our commitment to the European Union.

If we didn’t, we would be in a devastating position, so I do not regret any of the moves we took four months into my job.

Increasing the size of the balance sheet is all we had, or the economy would have collapsed.”

Presenters Response:

“You say it was the Covid crisis, but how do we get the balance sheet down? Do you sleep at night when you see this?”

Christine Lagarde — Source

“It will come. It will come in due course. Yeah.

And, of course, I have to sleep at night, but I have to worry every morning.”

Final Thoughts.

Bitcoin was born out of the 2008 financial crisis when the US government introduced stricter and stricter rules around monitoring “Know Your Customer” (KYC) and anti-money laundering (AML) following the attacks on 9/11.

It was all to eliminate and trace money used for terr*r*st finance.

Your everyday, law-abiding person prefers to avoid being monitored by something centralised like governments who say they have our best interests at heart. Or so we say.

We give our information out all the time, whenever the narrative suits us.

Facebook have our information.

So do Google

Credit Card Companies

Streaming services

Health care providers

Online retailers.

The list is endless.

But this time, it’s our money, and it’s our freedom. And people aren’t going to take this one lying down.

While I’m sure the prank video is something Christine Lagarde wishes, never saw the light of day, her point of view is telling.

Her stance is she wants to know what you’re doing with your money, and if you mess around with your cash over 1000 euros, you’ll be playing with fire.

If you play around in the “grey”, expect fines or jail time.

It’s slightly alarming.