Your Lack of Expertise Is Your Crypto-Investing Secret Weapon and Unfair Competitive Advantage.

If you can't explain it simply, you have the wrong thesis.

Stay ahead in Crypto: Our newsletter is free, thanks to our paid supporters. Upgrade for my most in-depth insights. Simple, jargon-free, and packed with value. When you join our informed community you’ll not only be one step ahead but you’ll help fuel my writing career.

2017, I took a leap of faith.

One day in the office, a work pal said, "Jay, have you got Coinbase? You wanna check it out—crypto is pumping on there!".

That's all the encouragement I needed. As soon as the app downloaded, I dived head first like a puppy into some autumn leaves.

I bought Litecoin, Bitcoin Cash, Ethereum and Bitcoin and watched my crypto holdings free fall like a broken elevator soon after.

It was a punch in the gut and one I deserved.

In those early days, how tech bros used to over-intellectualise blockchain technology to sound smart scared me sh*tless, so I knew having a slice of the action would require some guesswork.

It's like Raoul Pal says—Source.

"Intellectualisation of the space, which applies in macro and crypto investing, is just people wanting to sound smart, and sometimes the way of sounding the smartest is to sound very dumb."

The only ideas I had in my head were, "Are we becoming more digitalised or less? Are people going to care about this more? How the heck would you put the genie back in the bottle and stop people from holding this stuff even if you wanted to?"

My novice thinking was so simple, but what I never realised at the time was it was my ultimate superpower.

I narrowed my focus on investments in Bitcoin and Ethereum, betting on their popularity, which paid off.

Most traditional financial advisors would have heart failure listening to this kangaroo thesis, but it resulted in the most optimal and accurate bet.

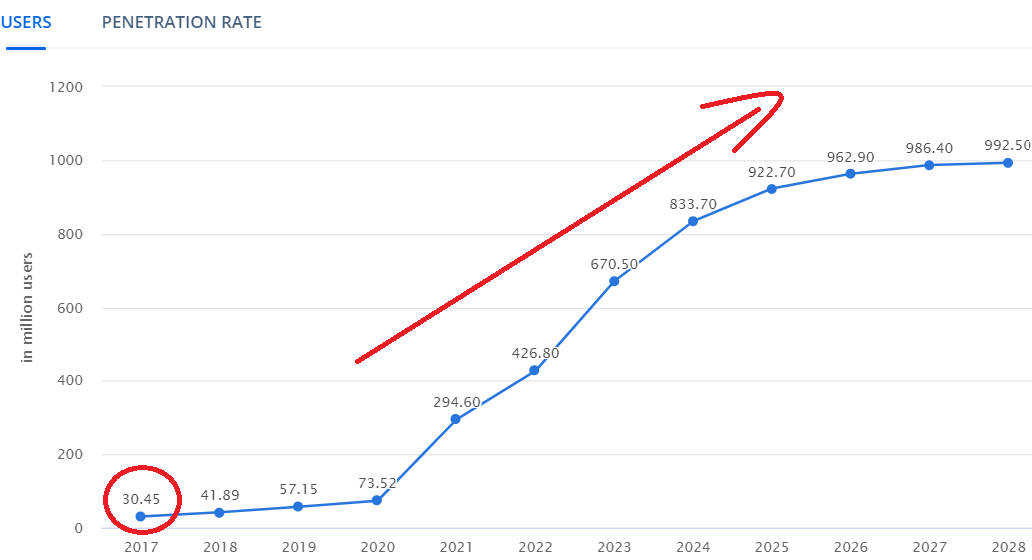

Here's a chart of cryptocurrency adoption by user, and it went exactly where I anticipated it would from when I began.

The mid-curve meme will change your life.

It'll start by rewiring your thinking.

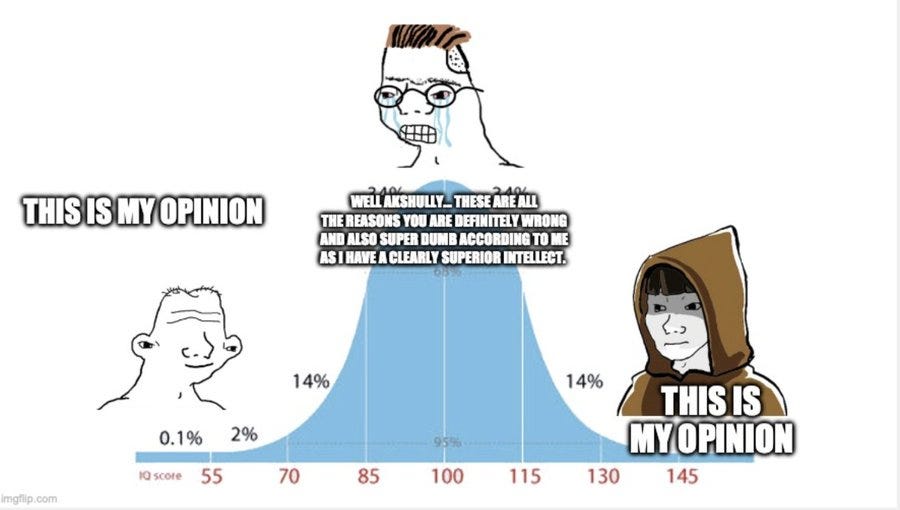

I'm very active on X (Twitter), and the "Midwit" viral meme showing an intelligence bell curve depicting people's thoughts about Crypto is one of the most significant maxims I've ever come across.

It relates to every polarising topic like music tastes, sports teams, and politics. Not just Crypto.

The curve depicts a picture of a guy on the left who's portrayed as a simpleton, a genius on the right, and everyone else in the middle arguing, "No, this can't be the case."

The two on the extreme ends of the spectrum are shown in agreement, while those in the middle, called "Midwits", are fighting over the details of mainstream opinions.

Raoul Pal says—Source

"It has occurred to me over time that the IQ Bell Curve meme (with all its variants), when applied to financial markets and investing, remains the biggest truism of all.

If you can't make it simple, you likely don't know what you are talking about."

When I first came across this concept and understood its meaning, it changed how I viewed the space forever.

Macroeconomic wizard and global investor Pal goes on to say:

"What I've learned is never be the mid-twit: be the guy on the left who simplifies it all down to 'well, crypto's going up,' or the guy on the right who says 'well, crypto's going up.'"

He says if the space is going up to $10 Trillion, you just want to buy it and not be the people in the middle arguing—"Well, it's decentralised, it's not decentralised, there's regulation, and oh my God, inflation, and can't you see what's happening to the economy?"

The two people at the extreme ends have simplified things.

The main difference is that the person on the far right understands all the arguments from the middle and everywhere else, and they've boiled it down to just one essential Idea.

It’s an idea not far from the so-called simpleton.

How to make it in Crypto as an Average person.

My earliest experience of doing anything resembling Crypto research was diving into the weeds on X (Twitter) and getting my hands dirty reading X threads.

As a former recovering "Midwit" who tried to sound clever as my knowledge increased, I have the ability to spot these people from a mile away.

But occasionally, you come across someone who knows their stuff inside and out and can describe a complex topic.

I was astonished by how straightforwardly PUNK6529, an anonymous yet highly respected figure in the cryptocurrency community, explained his investment strategy in the digital asset space.

It's a thesis I have pegged myself to since reading the thread.

Buckle up because this will rewire your brain.

For me, the macro question is:

"In 2030, will the % of global asset value represented by decentralised digital assets be more or less than 0.5%?"

For me, the answer is: "Probably yes from a technology perspective, but maybe not because of regulation / the centralised system."

My first form of analysis is an "expected value" analysis. e.g

Say there is a 50% chance that crypto % of total assets goes to 1% and a 50% that Crypto literally ends and goes to 0%.

In this case, we should be neutral.

50% x 1% + 50% x 0% = 0.5% = where we are today.

My view is that the chances that crypto doubles are significantly higher than it goes to zero, which means the expected value is positive.

Therefore, I would like to have an investment in Crypto, even today.

[I first did this analysis when Crypto was 0.005% of the global market cap]."

Final Thoughts.

PUNK6529 says— "My dumb expected value calculations answer the question just as well as your super-fancy distribution curve."

He's right.

I have gone from being the fool on the left all the way through to being that hair-splitting "Midwit" in the middle arguing over the semantics.

I'm no genius, but I've come full circle and am closer to being the person on the right.

Pal says: "Aim to be the person on the right, or if not, aim to be the person on the left because it's the money of crowds that moves things, so if the crowd believes it to be so, it is so."

Trying to be smart makes people sound dumb.

I've been there myself.

Keeping it simple is your superpower and competitive advantage.

Thanks Jayden for another brilliant article.

I love it.

Einstein once said: "keep it as simple as possible but not simpler than that"

Period. All said.