You’re Being Reckless With Your Finances: Multi-Millionaire Patrick Bet-David Stunning Reaction to the Lowest Saving Rate in US History.

Some people got arrogant, bullying their employer for constant raises every 90 days and threatening to leave if they didn’t get a pay increase.

Source — Patrick Bet-David YouTube

Patrick Bet-David was born during the Iranian Revolution.

He couldn’t speak a word of English.

When his family eventually fled to Germany, he lived in a refugee camp before immigrating to the United States.

He was 12 years old. With no leg up. Or generational wealth. He’s now worth an estimated $200 million, the epitome of the American dream.

According to Patrick, Americans are spending most of what they’re earning, and the savings rate is the lowest since 2005, which is very concerning.

Despite being the wealthiest country in the world, higher prices and the return to everyday life have led to Americans spending more and saving less.

Patrick Bet-David — Source

“Americans are spending most of what they’re earning these days.

Okay, the savings rate in October was the lowest since 2005 and the second lowest on record ever.

One more time, folks, it’s very important for you to hear this. Americans are spending most of what they’re earning these days. Do you know how scary that is?

The savings rate in October was the lowest since 2005 and the second lowest on record ever.

This is America, the richest country in the world ever, right?”

We Saved, and Now We’re Spending Like Money Is Going Out of Fashion.

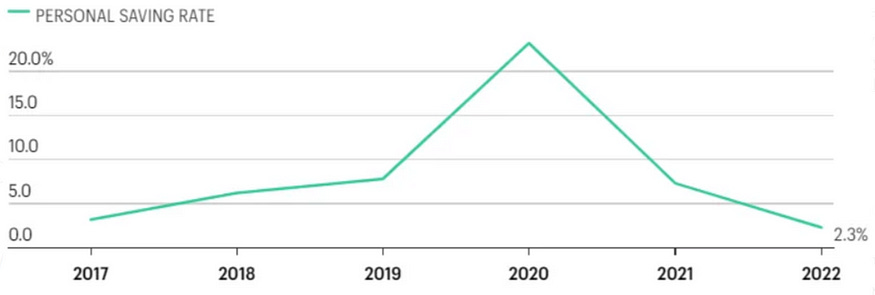

America’s year-over-year personal saving rate drastically increased between 2019 and 2020 but dropped significantly over the past year.

According to the Bureau of Economic Analysis, Americans spend most of what they earn eating into their savings.

Today’s savings rate is the second lowest on record Ever.

Patrick says people are sitting on cash, so they aren’t in a hurry to sell their houses and won’t get anywhere near what they were once worth.

He believes people are being reckless with their money and not saving, thinking that money will come regularly. Still, when times get tough, they’ll find themselves in a situation where they must sell personal items, collectables, cars and properties.

Many are not paying attention to different markers trending towards a bad event in their personal life and finances.

He stresses the importance of understanding wants versus needs, keeping up with the Joneses, and understanding lifestyle creep.

‘Lifestyle creep’ or ‘lifestyle inflation’ is when you start spending more money on things you used to consider luxuries, and now they seem like necessities because you’ve gotten used to them.

As your income increases, you spend more money on things that make you feel good, but these things become part of your regular expenses, and you don’t even realise that you’re spending more than you used to.

Patrick Bet-David—Source

“People are not selling a house for what it should be worth because they have some money.

Cash is still available to people.

They’re being reckless, not saving money, and thinking that money will come regularly.

People have yet to learn when unemployment goes up high next year, and eventually, in the next 6, 9, and 12 months, they’ll tell their partner we need to be realistic and sell the house.

Here’s what the conversation is going to be with the Realtor.

You think you have a million-dollar home when it’s a $790k home at best during a crash.

The Realtor has to sit there like a doctor in front of a patient and say the equivalent of, “if you don’t stop losing weight and eating sweets, you’re going to have a heart attack and die in the next 12 to 24 months.

Doctors have to have that conversation.

People will realise their financial situation is leading to a heart attack.”

Patrick is saying that people will become aware of their dire financial situation. Still, unfortunately, most prefer to avoid paying attention to warning signs that may indicate a problem in their personal life and finances. He believes that human nature often causes people to have blind spots and be overconfident.

We’ve been arrogant, and it’s time to level up.

Patrick Bet-David — Source

“Some people are going through really rough times right now.

People are experiencing pain, thinking about going to sleep every night, and worried that your company is about to announce layoffs, and if you’re on that list and have to clean up your resume, okay, that’s a scary place to be.

But I will also remind those same people if we can just be straight up with you, you were very arrogant a year and a half ago, bullying your employer for constant raises every 90 days and threatening to leave if they didn’t give you a raise.

You know who you are. If you’re listening to this, you did that. So both ways, if you did that, you’re paying a price today.”

Very few people like to pay attention to trending markers leading to terrible life events, whether with health, finance, or personal relationships.

He says people got very arrogant when times were good, but with no savings, they will go through rough times now, and some will experience pain because they’ll be on their company’s list for layoffs.

The current state of your life results from the decisions you made in the past five to ten years. If you made good decisions, your life could be significant.

If you made terrible decisions, it most likely turned out challenging. Therefore, it’s essential to improve your decision-making skills.

Patrick Bet-David — Source

“Let me simplify it for you.

Your current life today is a by-product of five decisions you made in the last five to ten years.

Who you married, what you bought, the job you took, why you quit, how you lost your emotions in a situation where you could have stayed calm.

You take those five decisions out. You’re in a different financial situation today.

And if your life is incredible today, you remove those five good decisions you made the last five years, and your life could be sh*tty today.

So we have to get better at our decision-making process. The better we get at making decisions, then life tends to give you a better lifestyle, friends, people, investments, and opportunities.

Things get better.

So if there’s one skill set we need to improve in 2023, it’s a system for making better decisions.”

Final Thoughts

There’s no fluff or sugar-coating with Patrick Bet-David regarding business and finances.

He’s a man who tells it like it is.

Don’t pee on my leg and tell me it’s raining.

To be clear, he aims his argument at Americans who are spending their savings and have never experienced what’s about to come.

Patrick knows the value of hard work and the importance of saving money. Having come from humble beginnings, he understands immigrants’ struggles when starting a new life in a foreign country.

Every dollar earned and saved is a step towards financial stability for him.

I completely agree with his assessment of the current state of peoples saving habits. Many will find themselves in a corner and won’t be able to sell their assets for what they were once worth.

People may have a cash surplus now, but things will change quickly.

Reckless behaviour can be dangerous in the long run. It’s crucial to save money, even if you don’t need it immediately.

You never know what life may throw your way.

Having a financial cushion can make all the difference.