You’re Making a Huge Mistake Investing in the Slow-Growing Stock Market When You Could Have a Digital Monopoly (Michael Saylor: Bitcoin)

You could have an asset free of labour, war, product and execution risks, giving you a unique and powerful monetary franchise like Mcdonald’s.

Source — CC0 Michael.com

Michael Saylor is a storytelling genius.

You’re either a fan or a critic; there’s little middle ground.

When you hear him speak, he mesmerises you like a moth flying headfirst into a blazing inferno. There’s no question about Bitcoin he can’t answer in detail, along with insightful anecdotes.

He must sit at home practising this stuff.

Cynics will say he’s a deluded tax evader trying to pump his 140,000 Bitcoin into space.

In 2000 his company MicroStrategy’s stock had tumbled 62% in a single day after the U.S. Securities and Exchange Commission (SEC) brought and settled accounting charges against Saylor and two other company executives.

As a result of republishing the correct financial figures, the company’s stock plummeted in value, and Saylor’s net worth fell by $6 billion.

Saylor paid the SEC $350,000 in penalties but never fessed up to wrongdoing. He had to pay a further disgorgement of $8.3 million from future business profits.

The Bitcoin believers who follow his message see him as a messiah taking on the establishment, so a bit of low-key criminality is acceptable, possibly even appealing.

He’s now vehemently said that you must consider protecting your wealth against value destruction. The only question you need to ask if you’re not a Bitcoin believer is, what are my alternatives?

Your property rights are inferior when you buy other assets.

There’s no guarantee over a long period that you can keep your house.

You won’t get high enough returns from stocks to outpace Inflation.

Heck, Inflation is outpacing Interest payments on savings.

Credit and Debt are dilutive instruments.

Anything in cash is value destruction because money printing turns the dollar into chicken feed, and anything in securities has execution risk.

Michael Saylor — Source

“The problem of securities lies in the many risks associated with traditional investments.

When you invest your hard-earned money in stocks like Apple, Amazon, Facebook, or Google, you expose yourself to various vulnerabilities that can undermine your wealth over time.

Firstly, management fees are involved, where a percentage of your investment is shaved off annually. It may seem insignificant, but considering the cumulative effect over a lifetime can deplete a substantial portion of your wealth. Take a look at ETFs that charge 90 basis points as an example (0.9%).

But that’s just the tip of the iceberg. Running a company comes with its own set of risks. Labour disputes can arise, leading to increased expenses and dwindling equity values.

Competitors can emerge with better products, leaving your company struggling to survive or even driving it to extinction.

Technological advancements pose another challenge, rendering certain industries obsolete and eroding the value of associated assets. And let’s remember the potential pitfalls in execution, where even a single misstep can have disastrous consequences for a company’s reputation and bottom line.

To make matters worse, external factors like geopolitical conflicts, trade wars, and tariffs can wreak havoc on investments, causing substantial losses and disruptions. Real wars are unfortunate and can result in confiscating assets or destroying entire factories.

It’s a volatile world out there.”

You’re Making a Huge Mistake if You’re Not Looking at Bitcoin as an Investment.

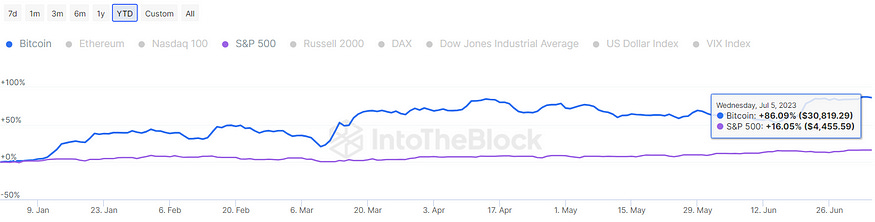

Bitcoin’s year-to-date performance has been exceptional compared to traditional stocks and commodities like gold.

During the cascade of banking failures, the leading digital currency emerged as a standout performer, surpassing the performance of nearly all the top publicly traded companies in the United States.

In 2023, Bitcoin’s price increased by 86.09% since the beginning of the year against a 16.05% increase from the S&P 500.

The S&P 500 is a stock market index representing the performance of 500 large publicly traded companies in the United States. It is considered a benchmark for the overall health and performance of the U.S. stock market.

According to data from the crypto education platform CryptoManiaks Bitcoin has outperformed 97.6% of S&P 500 companies in year-to-date returns.

It includes well-known companies like FedEx, Apple, and Amazon. Bitcoin’s YTD returns of over 86.09% surpassed the 27.2% of FedEx, 19.3% of Apple, and 17.8% of Amazon.

Among the S&P 500 companies, only 12 have achieved YTD returns exceeding Bitcoin.

Investors increasingly recognise Bitcoin as a valuable asset with significant returns, outperforming many established companies.

IntoTheBlock’s data shows the year-to-date growth disparity between the S&P500 (purple line) and a relatively new asset like Bitcoin (blue line).

Bitcoin Will Be the Key to a New Era of Financial Freedom.

Michael Saylor is adamant if you want an investment free from the shackles of traditional risks, one that promises enduring value and stands as a testament to the power of decentralisation, Bitcoin emerges as a beacon of hope and opportunity.

He suggests investing in Bitcoin can help free you from the execution risk associated with traditional investments because it operates independently.

If you embrace its potential, it might be the key to a new era of financial freedom.

Michael Saylor — Source

“You can liberate yourself from these risks by venturing into Bitcoin.

Bitcoin offers a unique proposition as an investment asset. It operates independently of labour disputes, competitor pressures, technological obsolescence, and geopolitical tensions.

It’s a truly global and borderless currency, immune to the whims of traditional markets.

Imagine a world where you can invest in an asset that defies obsolescence (becoming obsolete), remains secure against external threats, and remains untainted by management fees.

With its decentralised nature and limited supply, Bitcoin provides precisely that opportunity.

It’s a digital monument to anti-fragility, where risks taken by banks, miners, and individuals ultimately benefit those who hold Bitcoin, shielding them from the downsides associated with traditional securities.”

Final Thoughts.

Michael Saylor says Bitcoin is an anti-fragile asset.

I agree.

He insightfully says you should take McDonald’s as an example. They’re a successful business that has minimised their risks by transferring them to their franchises.

It’s how you should look at Bitcoin.

Each restaurant takes on the risk while the McDonald’s corporation still profits. It’s a smart strategy that allows them to thrive.

Bitcoin operates similarly.

It’s like a viral and innovative banking system where banks, miners and companies take risks. When those risks pay off, Bitcoin holders reap the benefits.

If the risks don’t work out, those who take the risks bear the consequences.

Not you and I.

Despite this, Bitcoin will continue to thrive and demonstrate its resilience, making it an anti-fragile asset in the financial landscape.

What you need to ask yourself is, what’s the alternative?