People Are Betting Against Elon Musk's Tesla for All the Wrong Reasons.

Downward price pressure can create the most significant opportunities.

Today’s newsletter exists thanks to paying subscribers who support Carrot Lane for a small fee—you’re the real MVPs. If you found this article valuable, consider upgrading for even more.

Michael Lewis once said the best writers spot the gap between perception and reality.

I’ve always thought the same skill is a cheat code in investing.

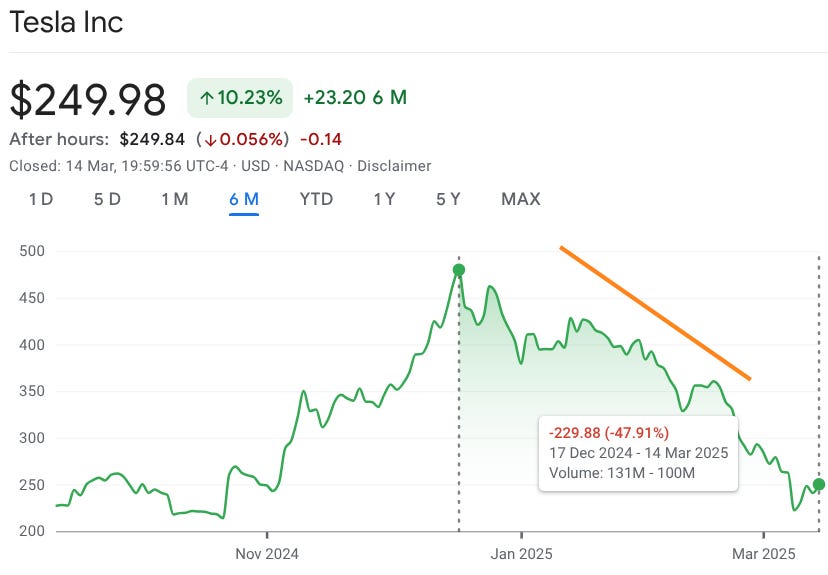

Take Ark Invest’s wild bet on Tesla — they’re calling for a $2,600 stock price by 2029, up from $249 today. That’s a 10x move.

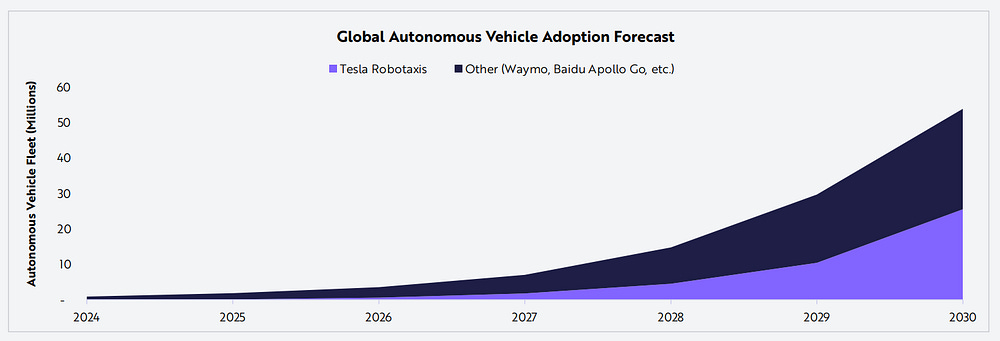

By 2030, they see 50 million robotaxis on the road, with Tesla owning half the market. Meanwhile, competitors like Waymo could struggle, stuck between China’s price wars and the usual legacy automaker mess.

If Tesla went all-in — turning every future car into a robotaxi instead of the expected 30–40% — they could hit Ark’s entire industry forecast solo.

Ark Invest CEO Cathie Woods calls autonomous driving a winner-take-all game. Tesla's aggressive development of an autonomous taxi network suggests it might be conducting the biggest AI experiment in history.

Tesla has a monopoly on people's data and can produce vehicles 30% to 40% cheaper than companies like Waymo.

“Autonomous electric travel should reduce costs, including fuel, insurance, and deadhead miles, thanks to higher utilization, increased safety and efficiency, and electric drivetrains. Deadhead miles are the number of miles driven without passengers, which account for 45% of ride-hail miles today. Autonomous vehicles could reduce deadhead miles by removing the human-in-the-loop and harnessing AI tools to predict demand and traffic patterns.”

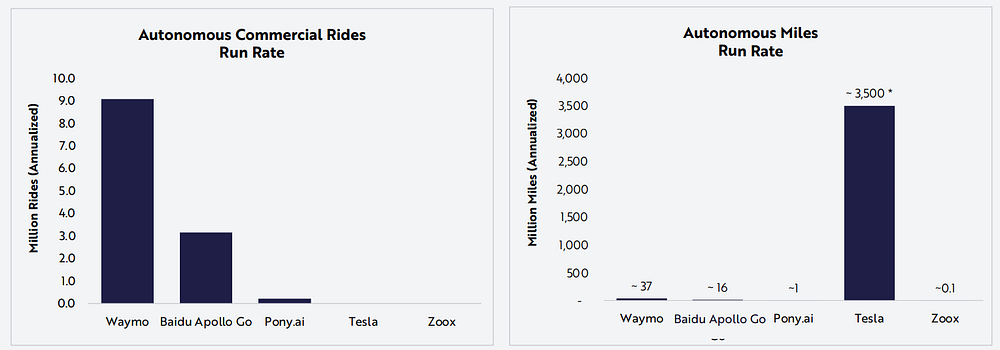

Waymo dominates autonomous rides in the U.S. and Baidu in China, as shown on the left below.

However, Tesla has the most significant data pool, which could give it a serious advantage if it launches ride-hailing with their existing network as planned in 2025.

During an earnings presentation, Musk explained how the real opportunity is to turn Tesla into more of a software business.

This becomes a recurring revenue model in which Tesla receives a slice of every mile driven on that autonomous taxi network, with very high margins.

Auto gross margins are around 16%, but in SaaS, they’re closer to 80%—a big difference.

“This’ll actually be a combination of Airbnb and Uber to some degree.

There’ll be some cars that Tesla owns itself, kind of like an Uber model. But for the fleet owned by our customers, it will be more like Airbnb. You can add or remove your car from the fleet whenever you want.

Say you’re going away for a week — with one tap on your Tesla app, your car gets added to the fleet and starts making money for you while you’re gone. You can add it for a few hours, a few days, or a few weeks. Whenever you want it back, you just say ‘come back,’ and your car will return.

I’m highly confident the revenue made by the owner will far exceed the monthly payment. Tesla will take a small share, but most of the money will go to the owner.

This is actually going to work. This is what will happen.”

Not everyone’s buying it.

What started as people trashing the idea of AI-powered vehicles — and Tesla as an investment — has spiralled into full-blown chaos.

Unless you’ve been off the grid, you’ve probably noticed Tesla has become a political talking point.

Now, homemade bombs are showing up at car dealerships. The anti-Musk movement has gone from internet outrage to full-on political warfare against Tesla.

Even JP Morgan’s head honcho Jamie Dimon, a lifelong Democrat, went on air calling Musk “America’s Einstein” — seemingly an attempt to ease tensions. But the attacks haven’t stopped.

Tesla dealerships are getting torched, Molotov cocktails are being thrown, and brand-new cars are going up in flames. Some protestors have even taken it further, showing up with AR-15s and shooting into cars, destroying charging stations across multiple shopping centres.

One suspect, 40-year-old Lucy Nelson — a biological male who identifies as a transgender woman — was arrested for planting explosives in Cybertrucks after spray-painting “Nazi” on several vehicles.

The anti-Tesla hysteria is everywhere.

After I did a deep dive into Tesla using Ark Invest’s research, some folks left explosive devices of their own in the comments section:

Anonymous:

“I wonder how much Elon paid Cathie Wood to pump Tesla stock? He bought a U.S. President for $270 million and made a 100x return overnight. He’s out there buying influencers too. But no amount of money will fix the damage he’s done to Tesla’s brand. Most of Europe has stopped buying Tesla, and I wouldn’t take one even if they paid me. Musk is a Nazi, plain and simple. You don’t ‘accidentally’ make a fascist salute at the end of a public speech — twice. Fascists have taken over the U.S. government. The world is a much darker place than it was before 2024.”

Musk has faced relentless scrutiny after his awkward, tone-deaf “my heart goes out to you” moment, which Piers Morgan gave his unfiltered view on.

“Elon Musk was very ill-advised to do this kind of salute to denote his clearly stated ‘my heart goes out to you’ sentiment… but he obviously didn’t mean it as a Nazi salute, and anyone who says he did is being a disingenuous idiot.”

Major stockholders have also had their say.

Ross Gerber, a well-known Tesla shareholder and CEO of Gerber Kawasaki Wealth Management, thinks that’s not the only problem for Tesla shareholders.

It’s more an issue of Musk’s divided focus.

“It’s become clear he’s now spending more time on DOGE than anything else. His 100% focus is on AI, and that’s really a detriment to Tesla more than it’s a plus for xAI and all the other businesses because he doesn’t work at Tesla anymore. From running several companies, including Tesla, SpaceX, and xAI, to posting prolifically on X, to spearheading government efficiency efforts at DOGE, to being the father to 14 kids, it’s safe to say there may not be enough time in the day for Musk.”

The one market signal that never lies.

It’s price.

That’s the purest form of truth, and it’s getting crushed right now.

Between the Molotov cocktails hurled at dealerships. Charging stations torched. Sheryl Crow putting on a whole production just to wave goodbye to her Tesla. It’s led to almost three months of straight losses.

I came across a comment online saying Elon Musk's net worth has dropped by $148 billion, captioned “The world is healing.” These kinds of comments always intrigue me.

Musk owns 20.5% of Tesla, so the real impact of their losses is felt mainly by everyday ‘mom-and-pop’ retail investors, who make up 45% of stockholders. The remaining 35% comes from pensions, wealth funds, and employee stock options.

Tesla employs 125,000 US workers, so this politically charged self-destructive behaviour isn’t grounded in obvious logic.

Between Trump’s flip-flopping on tariff policies—seemingly to stir uncertainty and pressure the Fed into reversing interest rates—and activists venting their first-world frustrations on perfectly good cars, the stock price is falling faster than a broken elevator.

The 47.91% decline in the last three months has turned this tech juggernauts chart into something resembling a Memecoin.

Final Thoughts.

The claim that Elon Musk is raiding the government to enrich himself might hold some truth — but if that was the plan, it’s backfiring spectacularly.

He’s made massive financial sacrifices. In my view, he’s a force for good.

So, what’s driving him? It’s not money — he has plenty. Not power — he’s had it for years. Not fame — he’s already got that. Strip away the noise, and all I see is sacrifice.

Building multiple billion-dollar companies at one's own expense requires a moral virtue that inherently bad people are incapable of.

As an investor, the key is to separate Musk’s political views from Tesla. Regardless of your opinion of him, Tesla remains one of the world's most formidable companies and investment opportunities.

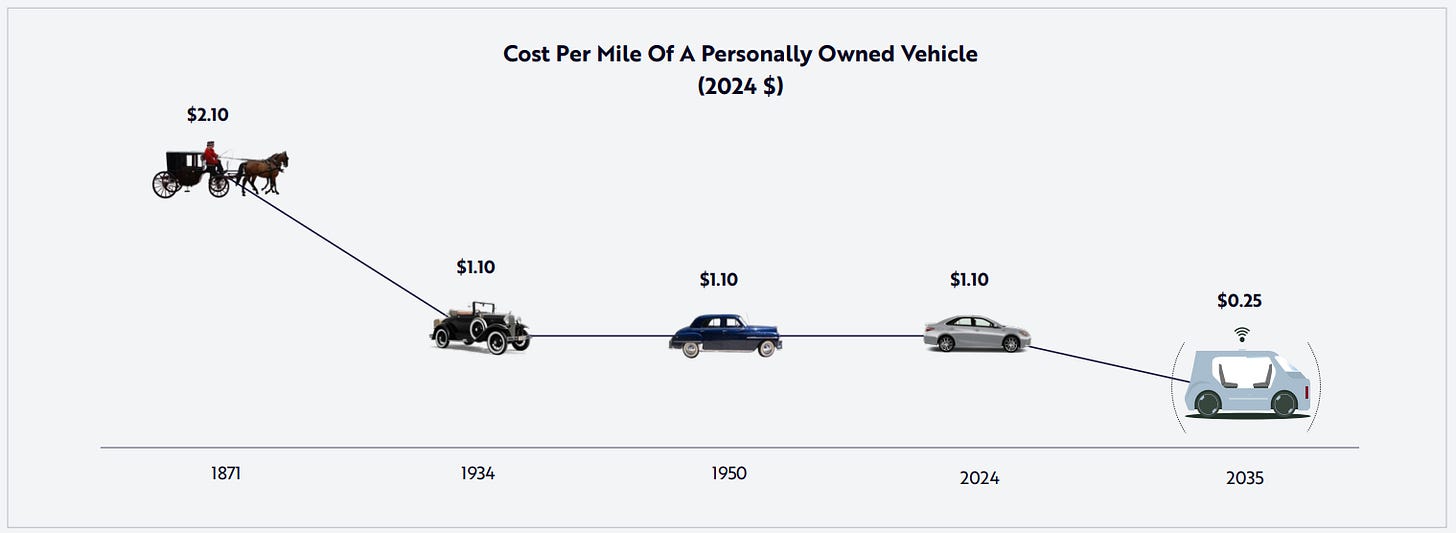

For the first time in a century, the cost of car travel (adjusted for inflation) is dropping —so there’s no reason this industry doesn’t explode.

ARK estimates that once autonomous taxis hit scale, they could cost as little as $0.25 per mile, almost 80% cheaper, making mass adoption inevitable.

The S&P 500 has dropped 34% in the past year — this isn’t just a Tesla problem.

There is broader market uncertainty under the new administration. Musk was pivotal in helping Republicans get re-elected, which is ironic.

Full self-driving cars and ride-hailing services will become more common because research shows they can be 16 times safer than having a human driver. Tesla already has the most significant data pool to capitalise on this shift.

Right now, in the middle of this downturn, while everyone is distracted by politics, I believe we’ll look back and see Tesla stock as a buying opportunity.

The gap between political perception and the reality of this generation's most innovative car company is what investors aren’t spotting.

Tesla will recover.

And many will regret betting against it.

LT Ark has done shit

Tesla's problems are bigger than politics.

- A distracted and unfocused CEO

- Competition from Chinese EV

- Poor quality control

- Too much time between new vehicle updates

There's more but that's enough to get the idea. Tesla's issues are remarkably similar to the complacency that affected Ford after the success of the model T and the model A. That also had nothing to do with politics, although I'm sure musk and ford would find common ground there as well.